Rates Spark: A Well-Oiled Mechanism

Any deterioration in the outlook would boost hopes of monetary easing, and fixed income markets at the same time. The BoE is next in line to validate this reasoning. In the Netherlands the details of the pension agreement have been worked out, though the immediate market impact appears limited.

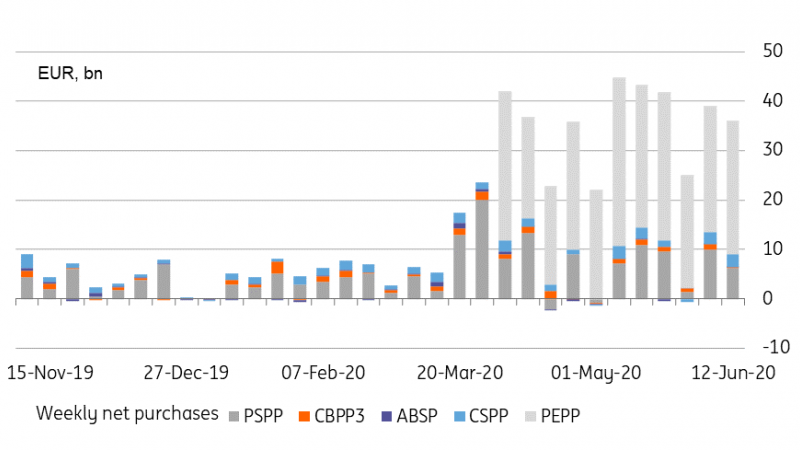

Source: ECB, ING

A well-oiled mechanism: central bank easing to help fixed income

The week has started on a relatively benign note for risk sentiment. Nevertheless, we suspect the magnitude of a reaction to any negative surprise on the covid front would be greatest, for instance if the resurgence of the epidemic in Beijing proves more serious. This skews rates risks lower for the rest of this week in our opinion. In an environment where sentiment is so volatile and hard to grasp , the ZEW index might gain in importance. Given the context of easing lockdown in Europe, we expect markets will go into the release expecting a marked improvement. This would make a disappointment, and associated drop in interest rates, more impactful in our view.

Eurozone (EZU) sovereign spreads have performed better than other risk markets so far this week. This is no surprise to us as we attributed last week’s underperformance to mostly technical factors, chiefly supply. More generally, we think rates markets have internalised the dynamic whereby central banks respond to a deterioration in the economic outlook with more balance sheet expansion. Given the strong pace of ECB purchases and tone of recent ECB communication, we see no reason to doubt this logic. The Fed's announcement that its SMCCF programme will start purchasing corporate bonds, although not surprising, also helped sentiment yesterday evening.

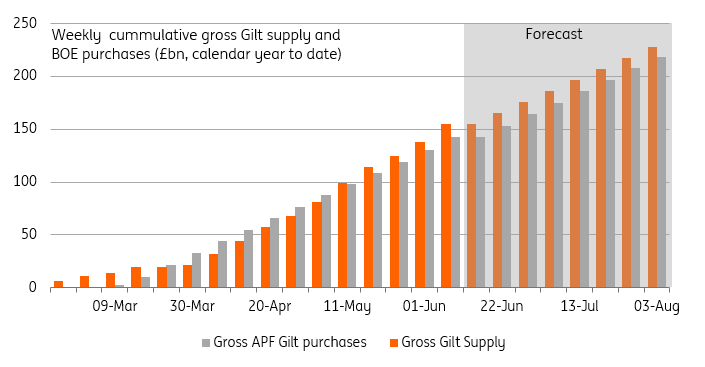

The next central bank in line to validate this reasoning should be the BoE. Dovish comments from MPC members, and the fact that the latest £200bn QE budget will be spent by early July leave little doubt about their intention to expand the program. Our economics team expects an above-consensus increase of £150bn which we think would buy the BoE until October before it decides to extend QE further. The debate around negative interest rates will be closely watched but we do not expect much by way of a clear signal this week.

Source: Bloomberg, ING

Dutch pension funds: Details for the new pension system have been agreed

Last Friday it was announced that the Dutch government and social partners have worked out the details of the new pension agreement in line with the goals set out last summer. The minister of social affairs will discuss the pension agreement in the cabinet this Friday and in the coming days the unions and employer organizations will also consult on the agreement with their members.

The aim is to have a bill ready to enter into force in 2022, pension funds would then have until 2026 to switch to the new system. There is a possibility for funds to opt out if they can show that pension participants are better off under the old system.

While little detail has been made public yet, the broad outline differs from what had been envisaged last year, though appear to be in line with what has been flagged in earlier months: The new system will be based on defined contributions meaning that the economic risk will shift towards the pension participants. Pension funds on the other hand will no longer be guided by coverage ratios, and the actuarial interest rate to discount liabilities is no longer necessary. Instead pension funds will use projected rate of investment returns to calculate expected pension levels for participants.

The largest probable impact for rates markets will arise from the move to a life cycle investment principle. While pension funds currently have one investment strategy for all its participants, pension funds can now cater to the younger participants’ desire for more aggressive investments and older participants’ need for more stability. Compared to the current situation that implies less interest rate hedging is needed for longer dated (and more risky) liabilities of the former and more hedging is needed for shorter dated liabilities of the latter.

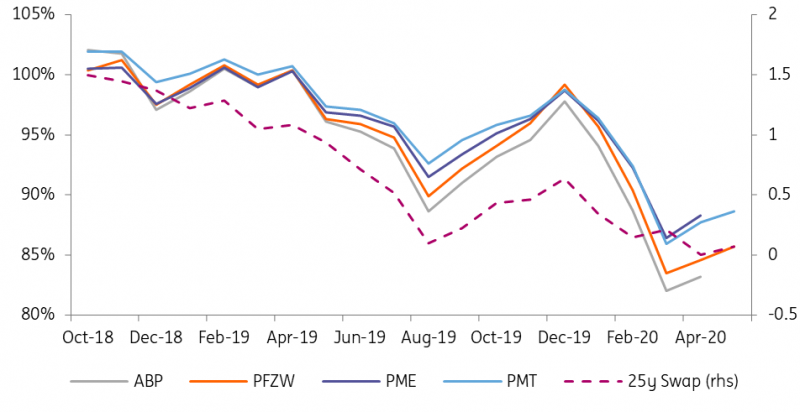

Pension funds will also receive more immediate regulatory relief given that current low interest rates make it hard to live up to their pension promises - the current framework still applies. The minister for social affairs announced that the reduced minimum coverage ratio of 90% will now apply until the end of 2021.

Pension fund coverage ratios remain under pressure

Source: Pension fund websites, ING

Events today: ZEW and US retail sales

Germany's ZEW survey result and the US retail sales should provide the main flash points of today's calendar. Interventions from Clarida and Powell should cement the dovish message sent by the FOMC last week. The most impactful outcome would be in case of hawkish soundbites but the chairman did not fall into that trap last week. If anything, fear of a second wave of covid infections will lend heft to his dovish argument. Talk of yield curve control at the front-end is prevalent at the moment so the chairman will likely be pressed on the topic. We doubt the policy of capping the front-end would be a potent one but at a push, it would increase the scope for curve steepening in a phase of rates normalisation.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more