Rare-Earth Stocks All Soar "Limit Up" After Xi's Threat

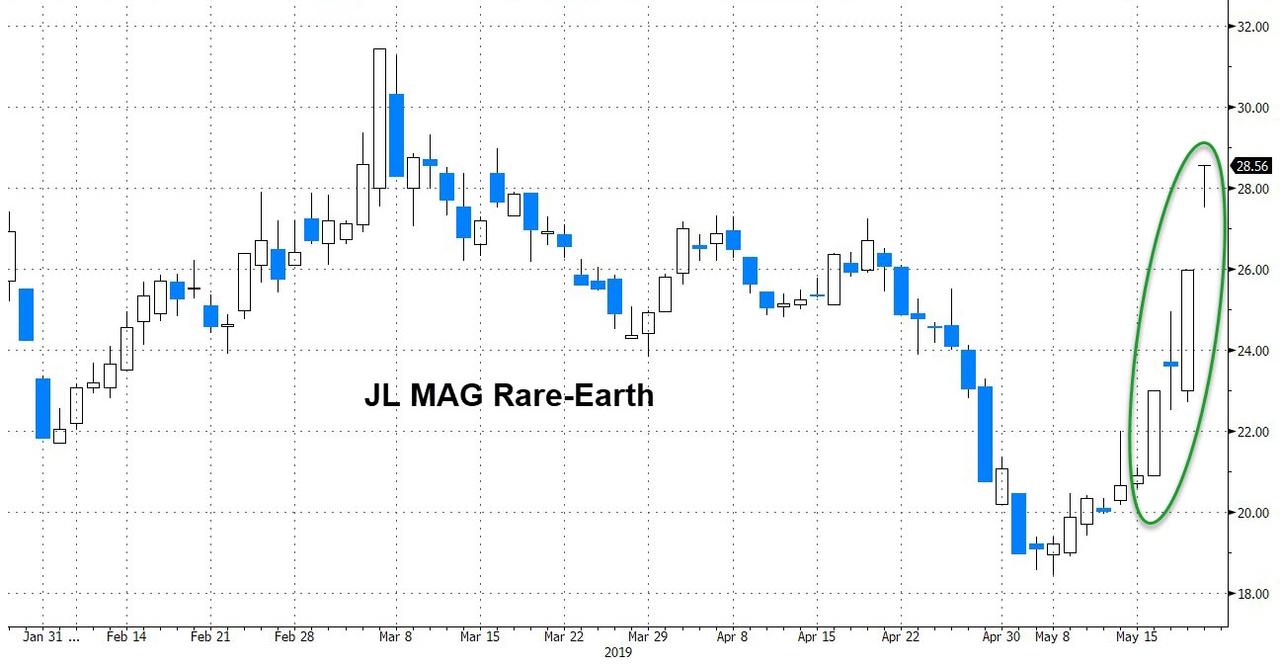

Chinese rare-earth stocks soared overnight for a second day following the implicit trade restrictions (export ban?) threat signaled by Xi Jinping's visit to JL Mag, a material producer in Jiangxi province.

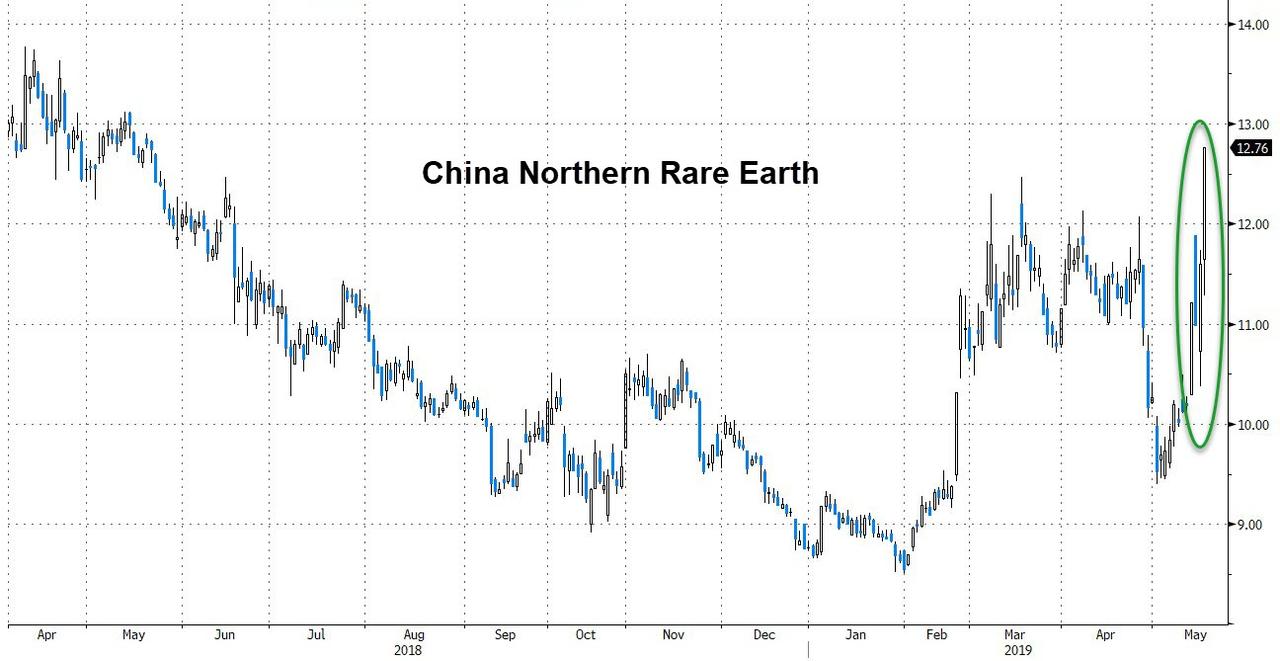

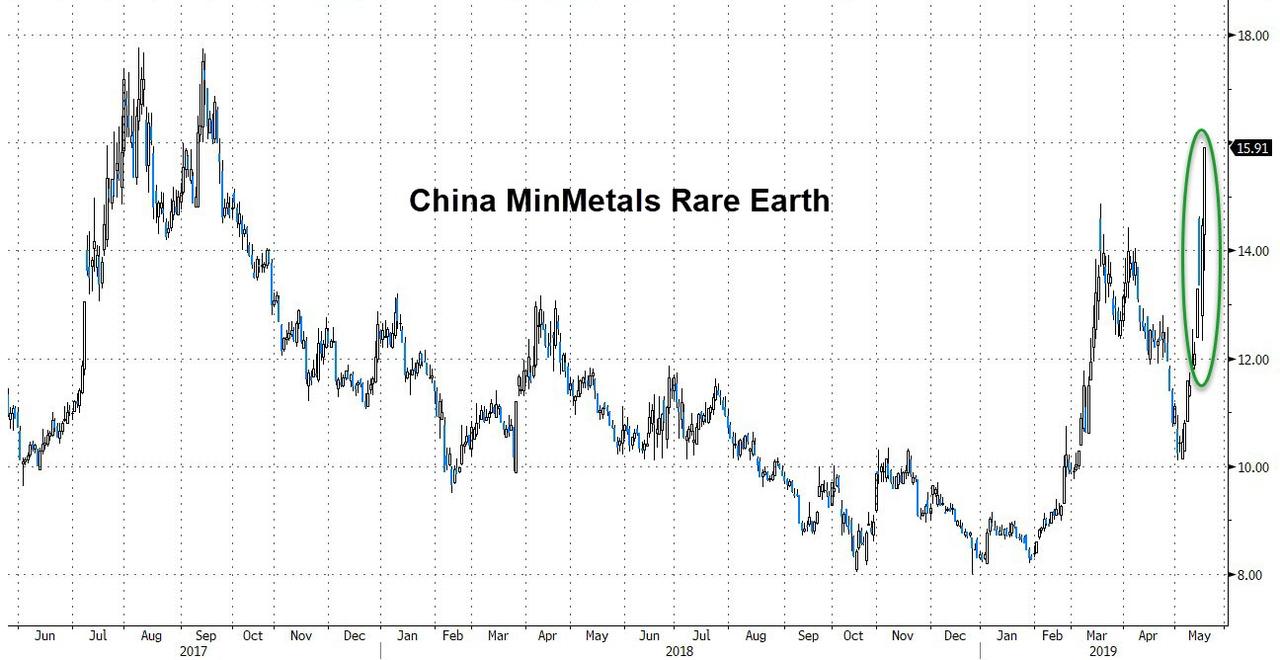

As Bloomberg notes, China Northern Rare Earth, Shenghe Resources, China Minmetals Rare Earth, and JL MAG Rare-Earth all spiked by the 10% daily limit in mainland trading, extending Monday's similar gains...

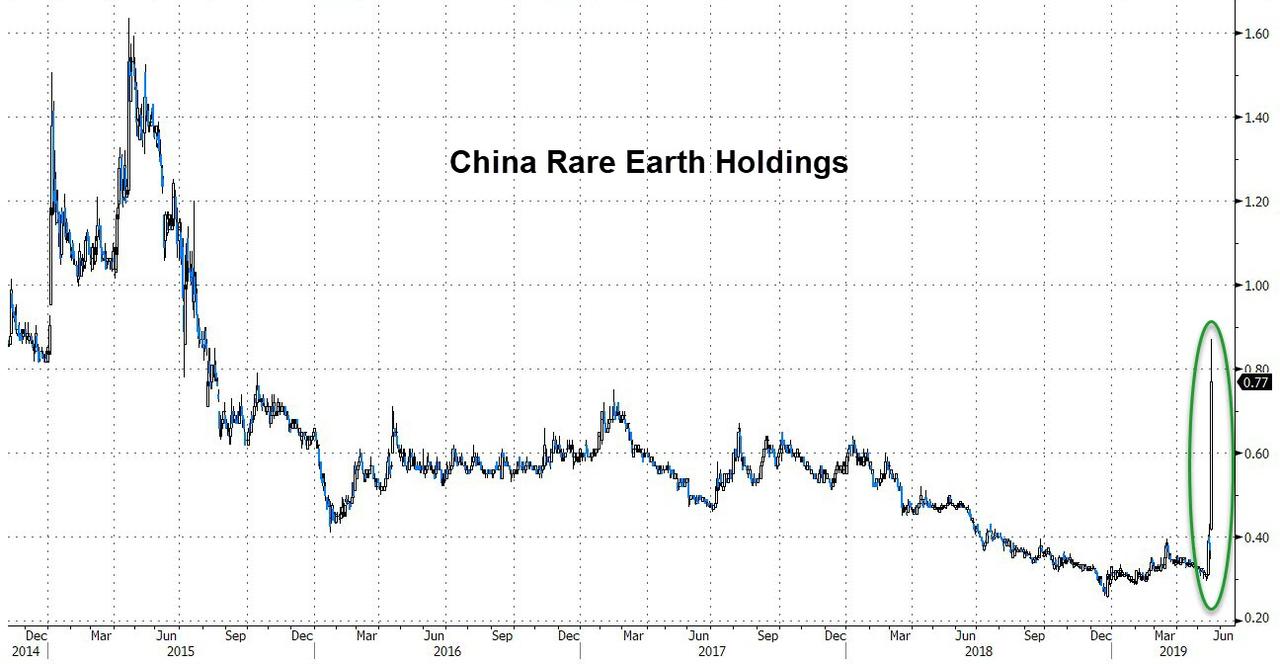

In Hong Kong, where there is no restrictive upside/downside limit, China Rare Earth Holdings surged as much as 132%...

As we noted previously, the reason for the dramatic market response is that the presidential visit flags policy priorities, and "rare earths have featured in the escalating trade spat between the U.S. and China."

Specifically, as Bloomberg notes, China raised tariffs to 25% from 10% on American imports, while the U.S. excluded rare earths from its own list of prospective tariffs on roughly $300 billion worth of Chinese goods to be targeted in the next wave of measures. And just in case the White House missed the message, Xi was accompanied on the trip to JL MAG by Liu He, the vice premier who has led the Chinese side in the trade negotiations.

Why does China have a clear advantage in this area? Simple: the U.S. relies on China, the dominant global supplier, for about 80% of its rare earths imports.

The visit “sends a warning signal to the U.S. that China may use rare earths as a retaliation measure as the trade war heats up,” said Pacific Securities analyst Yang Kunhe. That could include curbs on rare earth exports to the U.S., he said.

Xi's visit came just hours after the Trump administration on Friday blacklisted Huawei and threatened to cut it off from the U.S. software and semiconductors it needs to make its products. A spokesman for China’s foreign ministry told reporters Monday to “please wait and see” how the government and companies respond.

Finally, to those looking to trade a potential rare-earth export ban, one place would be to go long the REMX rare earth ETF, which after hitting an all-time high of $114 in 2011 during the first rare-earth "scare" during the China-Japan trade war, is trading some 90% lower as the market has all but discounted any possibility of a price spike...

...until the last two days...

Needless to say, should China lock out the US, the price of rare earths could soar orders of magnitude higher.

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more