Production Slowly Recovering In Japan

Japan's production for July continues the slow crawl back to pre-Covid levels, but as weak July retail sales indicate, the domestic economy is not going to provide much assistance, and this could be a slow march.

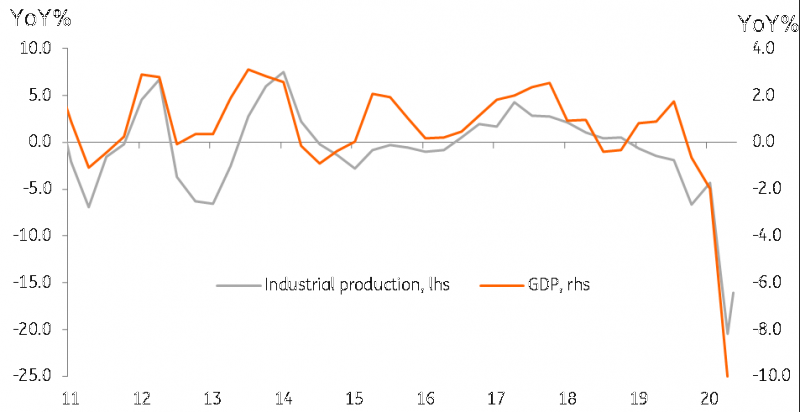

For developed market economies like Japan, the contribution of industry to GDP is typically lower than for emerging economies, though Japan still maintains a relatively solid industrial base, delivering just under 30% of GDP each year. Moreover, while the service side is much larger, some of that is also tied into the manufacturing cycle (insurance, freight, banking). As a result, we can still read a fair bit from monthly production data into the general trends of the economy.

So what of July's reading? Well, the 8%MoM gain looks encouraging, but choppy data like this is best viewed through the prism of the year-on-year figures. These showed the production slowdown moderating from -18.2% in June to -16.1% in July. The direction is good, but the rate of progress is still very slow after the initial bounce off the floor in May.

Japan production and GDP

Source: CEIC, ING Japan IP and GDP

Domestic sector remains weak

Domestic demand does not appear to be providing too much support for Japan's production sector. Retail sales figures, also for July, indicate no improvement from the previous month whether viewed against the prior month (-3.3%) or the prior year (-2.8%). This may well reflect the imposition of the highest states of emergency in the Metropolitan Tokyo area in July following some spikes in Covid-19 infections centred on nightlife and bars. Daily new cases in Japan have dropped since their July peak, and that should help lift spending in August and September. It may also provide a boost to production figures, though the biggest impediment to production will remain the weakness in overseas demand elsewhere in the world.

We are currently looking for full-year 2020 GDP growth of -6.1%. We will need to see stronger production and retail sales figures than these to warrant us nudging these forecasts higher.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more