Pounding The Pound

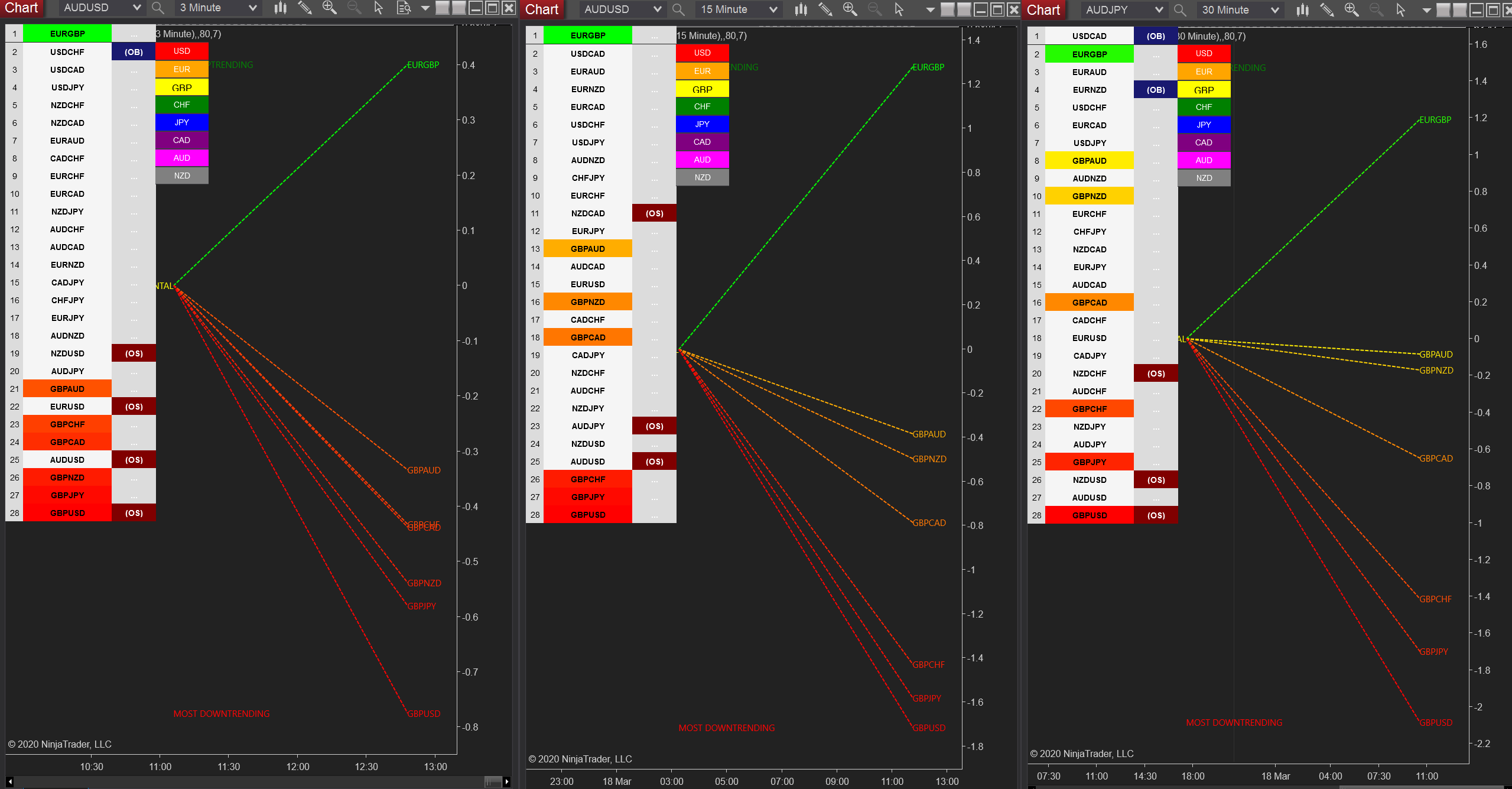

(Click on image to enlarge)

It’s been carnage for the British pound once again this morning across its complex. Cable has been suffering the most as continued heavy selling of the pound is balanced by equally strong buying of the US dollar as it rampages higher, and so creating the perfect combination for a sustained trend. Strength in one currency and weakness in the other driving the pair. And for volume traders, there was a standout signal of this sustained weakness delivered on Monday, with the effort to rally candle on high volume. This is a classic sign of weakness in a price waterfall such as this.

The pair attempts to rally on the day, only to close back near the open on ultra-high volume. Yesterday’s wide spread down candle confirmed the systemic weakness and on higher volume still. Price and volume in agreement, with the follow-through into today’s price action with the pair now moving to test the 1.1800 region. Note also the low volume node which is yet another reason the pair is moving so rapidly.

(Click on image to enlarge)

This bearish sentiment towards the pound is reflected across the complex on the currency array indicator, with the GBP/USD showing the strongest trend.

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more