Pound Jumps In Early Trading After Brexit Talks Extension

After tumbling on Friday amid speculation that a hard Brexit was inevitable, the British pound jumped in early Asian trading on Sunday following the earlier report that the U.K. and the EU said they will continue talking about a trade agreement, keeping hopes for a late deal alive.

Cable jumped as much as 1.2% higher at $1.3378 following UK PM Boris Johnson and European Commission President Ursula von der Leyen agreed to keep working on a post-Brexit accord, after earlier saying that negotiators had until Sunday to come up with a deal.

The positive Brexit news may also be one of the reasons why spreadbetting firm IG is showing US markets as modestly higher ahead of futures open.

As reported earlier, the extension follows German Chancellor Angela Merkel's exhortation urging that the two sides "should try everything to achieve a result." In a joint statement, the two sides acknowledged that "despite the fact that deadlines have been missed over and over, we think it is responsible at this point to go the extra mile."

"We had a useful phone call this morning. We discussed the major unresolved topics. Our negotiating teams have been working day and night over recent days. And despite the exhaustion after almost a year of negotiations, despite the fact that deadlines have been missed over and over we think it is responsible at this point to go the extra mile. We have accordingly mandated our negotiators to continue the talks and to see whether an agreement can even at this late stage be reached."

But in an indication of just how desperate both London and Brussels are to find something to feed markets and the public that might inspire optimism, the FT quoted an anonymous senior official in the Belgian capital, who said only that talks were "not going backwards."

As Bloomberg adds, "with less than three weeks until Dec. 31, the date when the transition period for the U.K.’s departure from the EU officially ends, many investors had hoped for a breakthrough by Sunday -- or alternatively clarity that Britain would indeed exit the bloc without a deal. Instead, they must prepare to parse yet more Brexit headlines amid choppy trading, with liquidity likely to get worse as the holiday season nears."

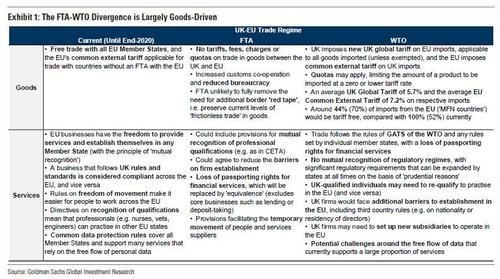

If there is no formal trade agreement by the end of the year, decades of free movement of goods, services, people, and capital will come to an abrupt end. British firms would revert to trading with the EU under rules established by the World Trade Organization in 1995. That means imports and exports to the EU would be subject to WTO-negotiated tariffs - essentially a tax on goods.

Such a scenario could push the Bank of England to cut interest rates below zero for the first time ever, BofA analysts said, while Bloomberg Economics estimates Britain’s economy would suffer a near-term shock of around 1.5% of output.

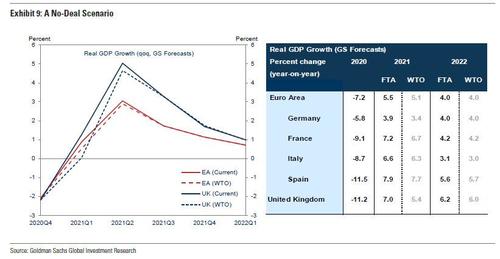

In a report published early on Sunday, Goldman economist Sven Jari Stehn laid out the "costs of a no deal Brexit" in which he finds that should there not be a deal, EU-UK trade would revert to World Trade Organization (WTO) rules from January 1, with significant tariffs and quotas on goods.

As a result, "for the Euro area, a WTO outcome would lower our Q1 forecast from +0.9% to +0.6%, and shave our Q2 projection from 3% to 2.9%, reducing the 2021 area-wide projection from 5.5% to 5.1%. Therefore, the implications for the ECB would likely be limited, unless the WTO outcome leads to a sharp deterioration in Euro area financing conditions." His main points are listed below:

- With less than three weeks to go until the end of the Brexit transition phase, significant sticking points remain in the EU-UK negotiations. Our base case remains that a “thin” free trade agreement (FTA) will be reached before the end of the year, which would ensure continued free trade in goods but entail barriers for trade in services. However, the risk of a no deal outcome persists, in which case EU-UK trade would revert to World Trade Organization (WTO) rules from January 1, with significant tariffs and quotas on goods.

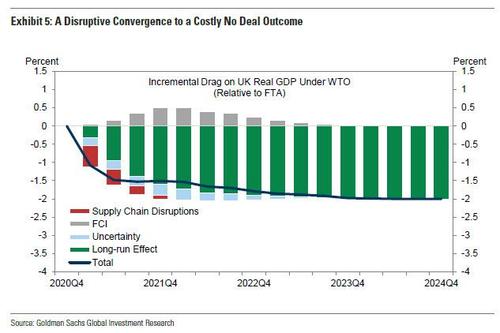

- Given the importance of the EU as an export destination for the UK — accounting for 45% of UK exports of goods — WTO rules would come with significant additional costs compared with an FTA. Our review of existing studies points to an incremental long-run drag of around 2% from a WTO outcome compared with an FTA, taking the total cost of leaving the EU to about 5½% of UK real GDP. Although these long-run effects are likely to build gradually, our analysis suggests that trade disruptions and uncertainty would lead to a significant near-term impact, resulting in a UK growth drag of 1¼pp in 2021 Q1 and 0.4pp in Q2 relative to an FTA outcome.

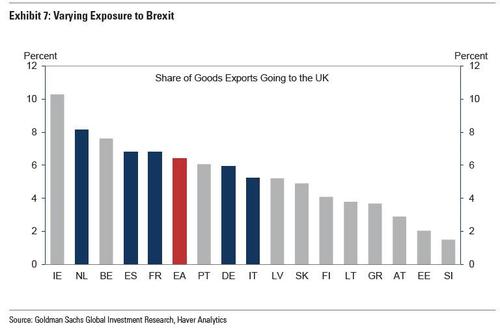

- The costs from a WTO outcome would be more limited for the Euro area, with goods exports to the UK accounting for only 6% of total area-wide exports. Although subject to significant uncertainty, our analysis points to an incremental area-wide cost of 0.4% of GDP under the WTO outcome relative to the FTA baseline. We find that these effects should be more pronounced in Germany and France (which have larger export exposure to the UK) than Italy and Spain (unless the failure to agree an FTA leads to sharp risk-off moves in financial markets).

- Using these estimates, we create a downside scenario to our baseline European forecasts, which assume an FTA agreement and a substantial vaccine-driven pickup in growth from the spring. Without a Brexit deal, we would expect no UK growth in Q1 (down from a non-annualised pace of 1.3%) and 4.6% in Q2 (down from 5%), pushing down our 2021 UK growth forecast by 1.6pp to 5.4%. Although a substantial hit to activity, the normalization in UK services activity should thus still clearly dominate the drag from a WTO outcome in 2021. We would expect the Bank of England to accelerate the pace of gilt purchases, ease the terms of the TFSME, and cut Bank Rate to zero at the February meeting in the event of a no-deal outcome.

- For the Euro area, a WTO outcome would lower our Q1 forecast from +0.9% to +0.6%, and shave our Q2 projection from 3% to 2.9%, reducing the 2021 area-wide projection from 5.5% to 5.1%. As a result, the implications for the ECB would likely be limited unless the WTO outcome leads to a sharp deterioration in Euro area financing conditions.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more