Polish GDP Still Below Pre-Pandemic Levels, But Resilience Is Rising

Poland's fourth-quarter GDP confirms what we have been saying for a while now. Despite the pandemic and contracting GDP, the economy seems to be adapting to the constraints and building resilience.

In 4Q20, Poland's GDP fell by 2.8% year-on-year versus the consensus at -3.0% and ING's forecast of -2.9%. Despite the deeper contraction than in 3Q20 (-1.5%YoY), the outcome shows increasing resilience to the pandemic.

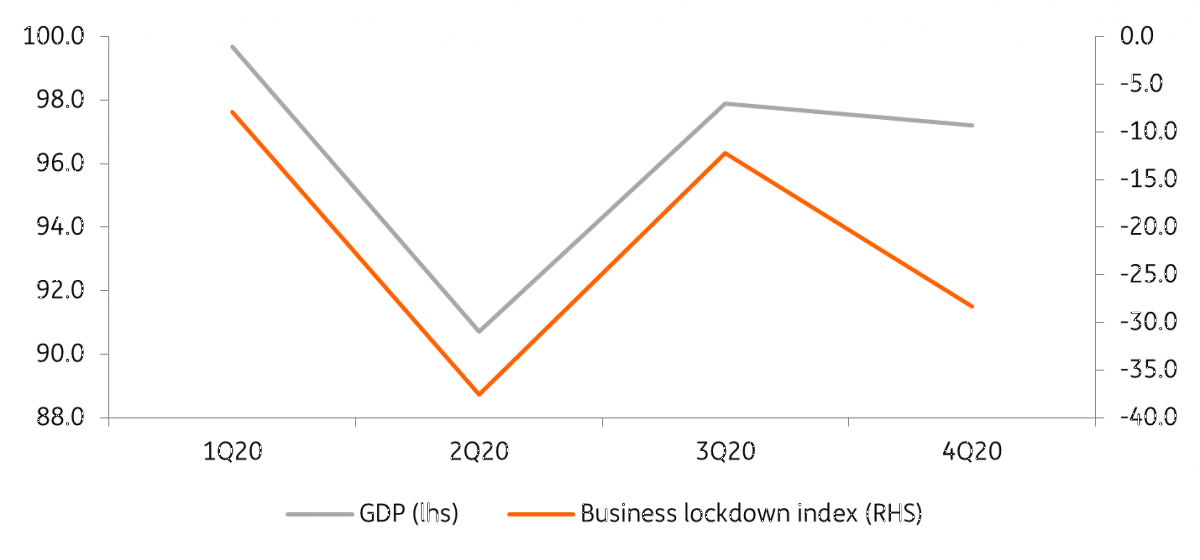

In the fourth quarter, the number of Covid-19 cases in Poland were several times higher than in the spring, and our index of the closing of the Polish economy indicated that restrictions were a quarter to a half times less onerous, the quarter-on-quarter contraction in GDP (-0.7%) was only about 1/13th of the drop in 2Q20 (-9% QoQ).

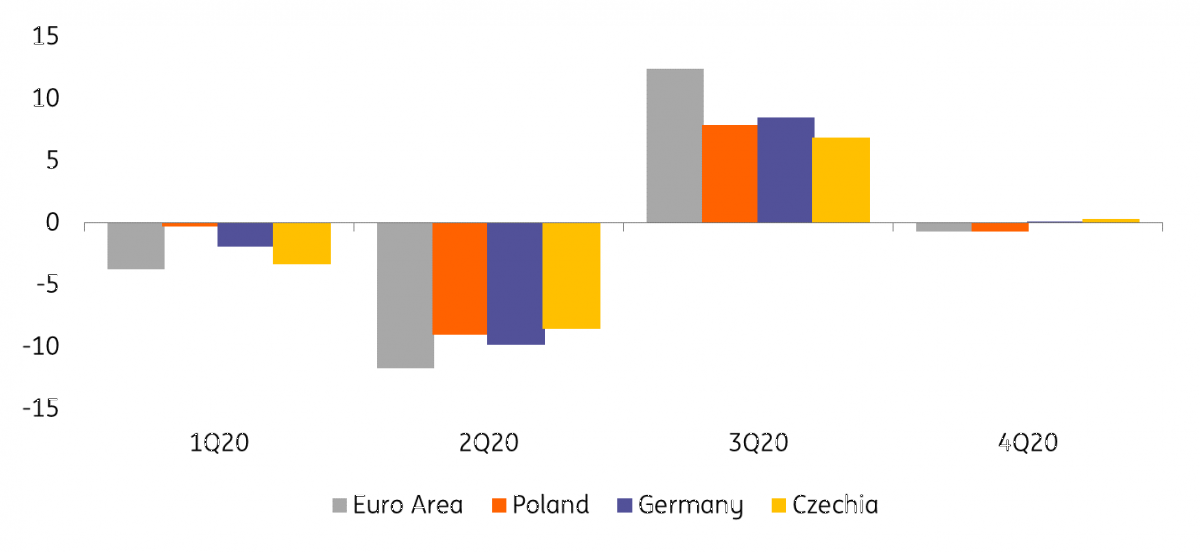

The picture is similar in other economies, including Poland's major trading partners.

GDP changes and business lockdown index in 2020

(Click on image to enlarge)

Source: CSO, ING

We do not know the structure of the growth in 4Q20, as that will be published on 26 February but we estimate that private consumption fell by around 3.0% YoY.

Currently, the growth in consumer spending seems to be limited by administrative barriers and to a lesser extend by households’ budget constraints. The labour market remains strong, which is supportive for household income. Due to administrative restrictions, this situation has resulted in increased involuntary savings. When restrictions are lifted, we expect consumers to go on a shopping spree.

In our view, the uncertainty regarding the pandemic's course was reflected in weaker investments. We estimate that in 4Q20, investments fell by 10% YoY, close to -9/-10.7%YoY in 2-3Q20. Net exports made a positive contribution of about 1.5pp. This is a result of a rebound in the global industry. Also in Poland, manufacturing looks much better than other sectors. For several months, manufacturers have been reporting an increase in new orders, and labour shortages due to employees in quarantine have resulted in higher demand for labour.

The increasing resilience of the economies to Covid-19 can also be seen in other countries, including the largest trading partners of Poland. Globally, we see a shift in the structure of growth towards industry from the services. This is a factor that adds to growth in Poland, where the economy, despite recent changes, is still more manufacturing-led.

Globally, while restrictions increased in the autumn and winter, the mobility of individuals didn't fall as much as in the spring, which in addition to a strong industry accounts for the resilience to the pandemic.

GDP – QoQ , Poland in comparison to selected economies.

(Click on image to enlarge)

Source: Eurostat

With lockdowns extended, the beginning of 2021 may be slightly worse in the Eurozone while Polish and German exports will no longer be supported by stock building in late 2020 amid concerns about the impact of Brexit.

Slow vaccination progress in Poland and Europe is also a negative factor but our daily indicator of the economic situation based on population mobility or industrial activity suggest that in the case of Poland, activity in January was close to December activity, and even increased slightly in early February.

Our forecasts assume near-zero QoQ GDP growth in 1Q21 but after that activity should rebound.

We reiterate our forecast for GDP growth in 2021 at 4.5% YoY.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more