Poland: Retail Trade Beats Expectations In December

Retail trade declined by 0.8% year-on-year, after a 5.3% drop in November. After seasonal adjustments, sales rose by 2.5% month-on-month, reflecting the loosening of restrictions in late November. Construction output has returned to growth in YoY terms.

Shoppers at the Poznan City mall in Poland

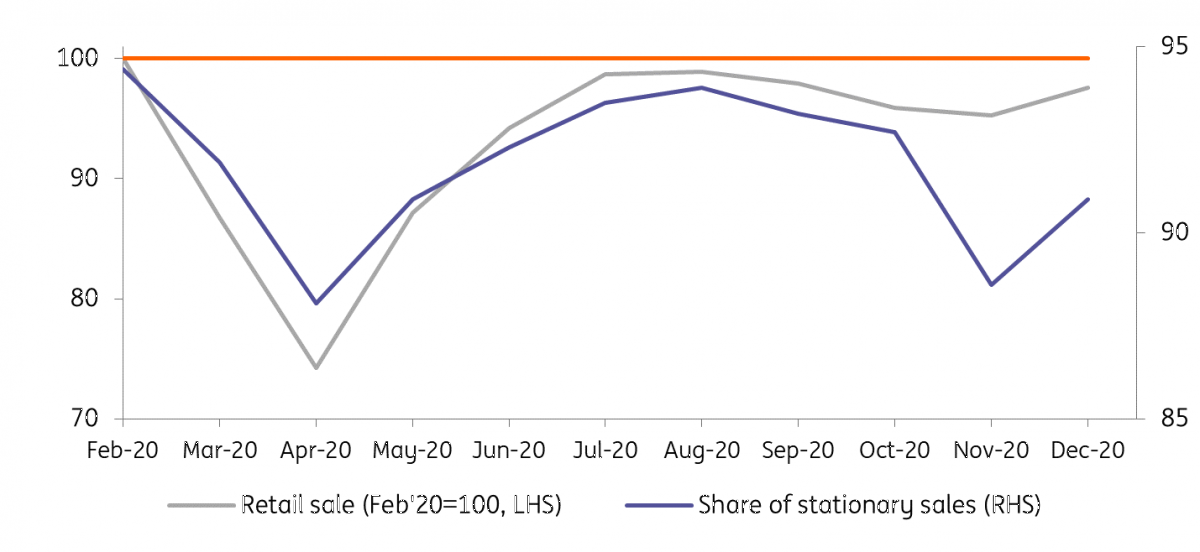

The reading came in above the consensus estimate (-2.3% YoY) and close to our call (-1.2% YoY). Retail trade is now only some 2.5% lower than in February 2020, after being 5% lower in November. The reopening of trade resulted in higher sales in brick and mortar stores vs the internet (90.9% vs 88.6% in November). This coincided with higher overall sales, as traditional stores remain key in Poland.

The YoY dynamics improved in all product groups, particularly for clothing (-10.9% vs -21.9% YoY in November). Sales of durable goods (furniture, radio, TV, and household appliances) remained strong, rising 3.5% YoY, after a temporary drop (-0.6%) in November.

Retail sales, the volume against the share of stationary sales

Construction output in December rose by 3.4% YoY, after a decline of 4.9% YoY a month prior. This is substantially better than the consensus (-2.2% YoY). Output has been improving for several months now and this trend only accelerated in December. After seasonal adjustments, construction grew by 1.9% MoM.

The details of the data point to an acceleration of infrastructure projects in the coming quarters. In 3Q20, growth in public investment slowed to 0.4%, from 14.2% in 2Q20 and 11.5% YoY in 1Q20. We hope to see an improvement in the coming months.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more