Philippines Posts Budget Surplus In May With Spending Held Back

The surplus helped cut the year-to-date deficit to -Php809 million, narrower than the Php138.7 billion deficit in the first five months of 2018.

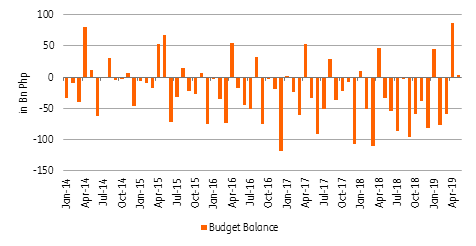

YTD Budget balance at -Php809mn

After holding back 1Q GDP growth, the ill effects of the budget delay appear to have seeped into 2Q, with the May budget surplus hitting Php2.6 billion. Revenue collection continued to rise, up 23% year-on-year while spending grew 7.8% largely due to the final tranche of the government pay bump. For the year so far, the Philippines has posted a deficit of Php809 million, much narrower than the Php138.7 billion deficit posted in the first five months of 2018, as government spending has been reined in.

Philippine budget balance in billion PHP

Source: Bloomberg

Government spending on hold could mean lackluster 2Q GDP

With government spending curtailed for most of the current quarter, the government is scrambling to implement “catch up” spending for the second half of the year. The month of May has been a deficit month for the last three years, with the economy getting a nice boost from the government to complement mainstay household consumption growth. With capital formation still likely to post lackluster numbers- as evidenced by anemic car sales and weaker imports of capital goods and raw materials, 2Q GDP will likely need to lean heavily on household consumption yet again.

Data dependent BSP watching

Bankgo Sentral ng Pilipinas (BSP) has vowed to remain data dependent and will likely be monitoring variables related to inflation and maybe even growth. Minutes of the May policy meeting show that members took the startlingly low 1Q GDP print into consideration when they cut policy rates by 25 basis points to reverse BSP’s ultra-aggressive rate hike in 2018. The next Monetary Board meeting coincides with the release of 2Q GDP and given the prospects for within-target inflation, and growth hampered by both relatively high borrowing costs and delayed spending, we could see the monetary authorities trimming borrowing costs further in 3Q.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more