Philippines: January Imports Rise While Exports Continue To Contract

Medium term view on current account deficit intact.

Source: Shutterstock

Same (trade) story, different month

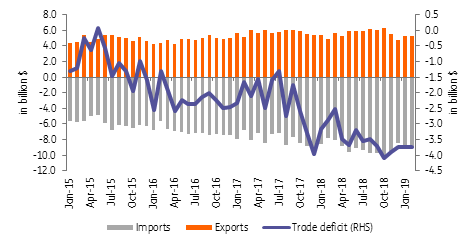

The Philippines posted a trade deficit of US$3.76 billion. Exports continued to contract while import growth was at 5.8%. As expected, the contraction in the fuel import bill weighed on the overall sector while capital goods and raw materials posted single-digit growth. Consumer goods saw a sizeable expansion, up 19.1%. Domestic consumption remains strong although the slowdown in the capital goods and raw materials numbers could show that capital formation may have reached its peak. Imports of raw materials related to construction - such as iron and steel and non-ferrous metals - posted contractions while raw material imports used for exports was up 5.1%.

Exports recorded a third month of contraction with the mainstay electronics subsector managing to eke out a 1.7% expansion. The rest of the export sector posted a 5.3% contraction despite the protracted weakness of the PHP. This might have cushioned the impact of the US-China trade war somewhat, given that it buys exports some time and helps preserve local currency earnings. With raw materials used for electronic exports growing by 5.1%, this could mean that exporters are building up on work in process and raw material inventory for a possible rebound in 2019, despite the US-China trade spat.

Philippine exports, imports, and trade gap (in billion $)

Source: Bloomberg

Some trends to monitor

Imports will likely continue to grow, albeit at a more subdued pace in 2019. The fuel import bill is expected to contract (given the $ price of oil versus 2018) and both the capital goods and raw materials accounts are likely at or past peak. Elevated borrowing costs may have be hampering some of the capital expansion although, given the prospects for the economy, corporates and the government remain bullish with capital outlay plans announced. Consumer import growth shows that household spending will likely regain prominence in 2019. Passenger car imports are up 14.6% with car dealers looking to rebound from the dismal performance in 2018 on TRAIN-related base effects.

On the export side, outbound shipments remain heavily dependent on the electronics trade. The rise in raw materials imports for electronic exports appears to be increasing in dollar terms, which should give hope for a turnaround in 2019. However, the ongoing trade war means that the Philippine export sector will need to continue to build on sector-changing reforms to help boost productivity, by enhancing supply chains and increasing standards. With the government’s "build build build" initiative seen to help boost efficiencies, perhaps the export sector can take advantage of this push and we can see the export renaissance that we’ve all been waiting for.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more