Pacific Safety Products’ Unknown Turnaround Offers Huge Upside

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

- Pacific Safety Products is a vastly undervalued micro-cap operating in the security equipment industry.

- Investors never heard of this stock. You won’t find any coverage on investment platforms like this one and no mentions on social media, Yahoo message boards or Investorshub.

- This company sports a sound balance sheet, makes a profit and is growing rapidly, yet trades at a ttm price/sales ratio of just 0.5.

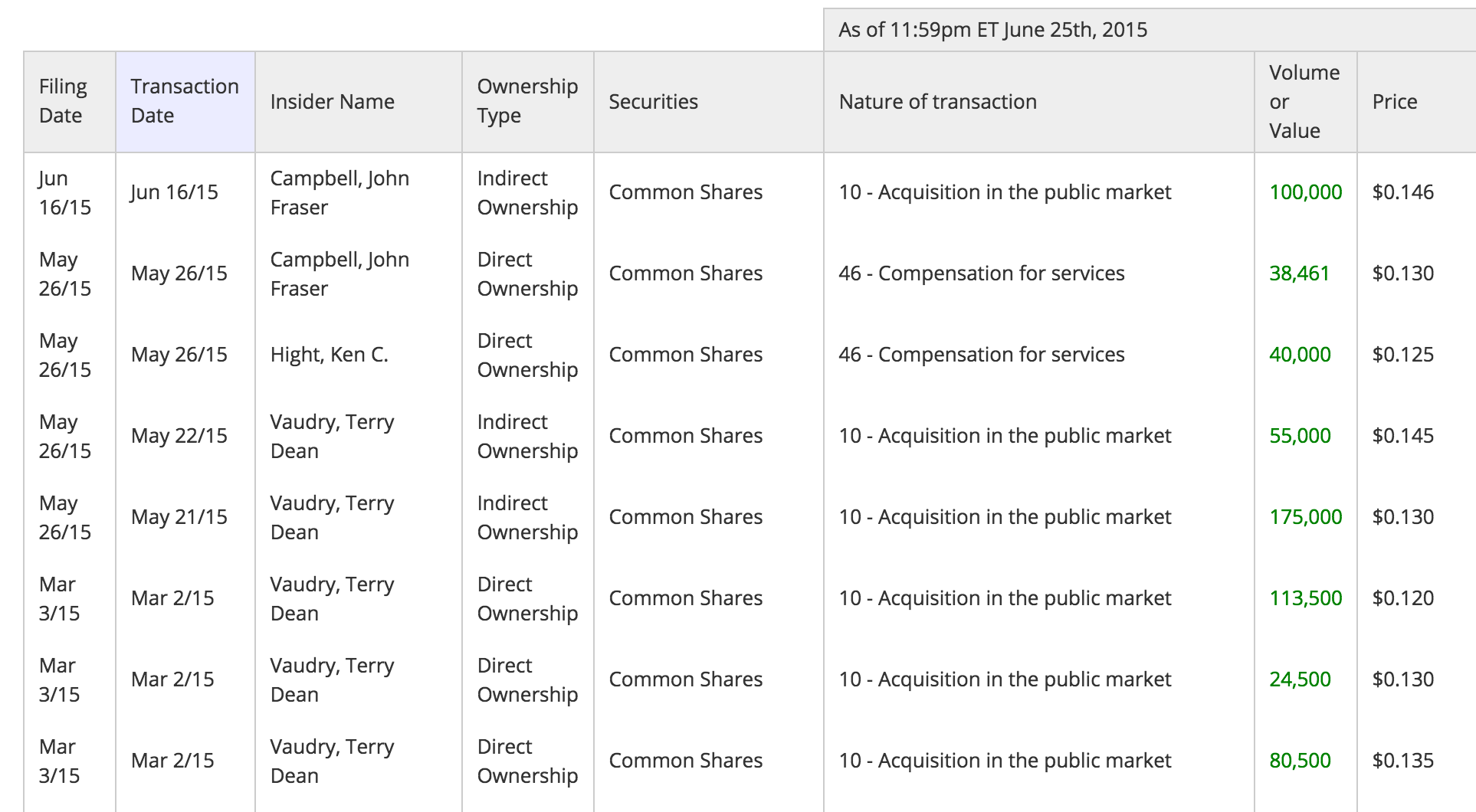

- The CEO recently bought 449k shares in the open market. Last week, the Chairman of the Board of Directors accumulated 100k.

- Short-term, investor awareness and a blow-out earnings report early August could drive shares up substantially.

Upfront note: the main listing is on the Toronto Venture Exchange, ticker = PSP.V. The company also lists on the US OTC Board under the ticker PCSFF, but without any trading volume. All dollar amounts mentioned in this article are Canadian.

I discovered a micro-cap stock trading on the Toronto Venture Exchange that doesn't appear on investor's radar, but actually presents a surprisingly compelling risk/reward opportunity: Pacific Safety Products (PCSFF). Just based on the tiny market cap - $10 million - you would assume this company isn't worth much. I don't blame you, but this case is different. Pacific Safety Products generates a ttm annual revenue of $20 million, is profitable and sports a sound balance sheet. A streak of contract wins with big customers like the US Navy makes up for strong revenue growth, and there's a clear trend the company's financials will continue to move in the right direction.

The more I looked into this stock, the more significant the mis-pricing became clear to me. When I found out that key insiders recently bought large amounts of shares in the open market, I decided to initiate a long position too.

About Pacific Safety Products

Pacific Safety Products is the largest body armor manufacturer in Canada, directly supplying to all kinds of Canadian and US law enforcement agencies. In Canada, the company is a market leader dominating 70% of the market. As for the US, management has initiated steps to increase its market share.

Interestingly, this is the only Canadian company that designs and manufactures soft body armor that is certified to the latest and most stringent NIJ-0101.06 standard. Their technology, connections in this space and their capabilities to manufacture and deliver the goods in time safeguards the company's competitive edge.

Historically, its former management has not done a good job creating shareholder value. As a matter of fact, several missteps led to an almost decade of losses and the stock price to collapse from over $1 to below $0.10. But 2 years ago a successful turn-around started to take place. A new management team refreshed the product line, cut expenses, signed up new customers and cleaned up the balance sheet. Despite a wide array of business improvements, the stock hasn't really moved from all-time lows, presenting investors a clear case of significant mis-pricing.

Nobody knows about this stock

I like uncovering undiscovered micro-caps, and Pacific Safety Products is a prime example of one. I searched for this company on several well-known investor platforms, but I could not find any coverage. Neither on Twitter, Stocktwits, Yahoo Message boards, etc. Only on stockhouse.com did I find some mentions, but nothing helpful. Also, management refrains from stock promotion of any kind.

I believe today's depressed stock price reflects the total absence of coverage. If nobody is paying attention, no one is buying.

Pacific Safety Products is growing

With years of decreasing revenue in its rear view, the new management team started a turn-around by putting the revenue shrinkage to a halt; 2014 till Q2 2015 turned out to be a transitional phase with a flat $3 to $4 million coming in per quarter. But the turn-around is now in the next inning. In fiscal Q3 2015 revenue grew to $5 million, an obvious trend break from previous quarters.

The business Pacific Safety Products is facing comes with long sales cycles, so there's a big lag between the actual recording of revenue and engaging potential customers for contract wins. Speaking of contract wins, I think management has done an amazing job:

April 3th 2014: Pacific Safety Products announces 2 contract wins

May 7th 2014: Pacific Safety Products again announces 2 contract wins

September 3th 2014: Pacific Safety Products awarded 2 client contract

November 24th 2014: Pacific Safety Products announces 2 big contract wins

May 6th 2015: Pacific Safety signs up the US Navy

In about a year, management landed 9 contracts. Especially the last one sounds promising, the US Navy as a customer! Earlier on, the CEO voiced the ambition to expand business in the US, a much bigger addressable market than Canada. The competition in the US is also more fierce, but signing up the US Navy is a strong validation of their product/pricing mix.

Bases on these accomplishments, I expect more contract wins coming up.

The latest press release also made public that the company now has a record back-log. They are also participating in large tenders this summer, so if you add things up, revenue should continue to grow nicely.

Pacific Safety Products has turned profitable

Despite a few one-time expenses and an increase in investments in R&D, the company managed to report a profit of $79k for Q3 2015. EBITDA was a positive $252k. If you cut out the one-time expenses EBITDA would come out at $440k. The previous few quarters were slightly profitable too.

Maybe you think these numbers aren't that impressive, but after near decade of losses, getting this small company profitable is an impressive feat by management.

This is only the beginning though. The profits seem to be lagging the revenue growth somewhat, but I think they eventually they will catch up given the new and much leaner company structure, so I expect the next earnings reports to reveal much higher profits.

Balance sheet

If we look at the balance sheet, we can see that working capital is improving over time:

Q1 2015: positive $0.7 million

Q2 2015: positive $1.6 million

Q3 2015: positive $2.4 million

Long-term debt stands at $723k, mostly compromised of a debt-based capital raise (private placement) last February. These debentures will mature on February 18, 2018 and are convertible at the holder's option into common shares at any time prior to the maturity date at a $0.15 conversion price. So there is a potential overhang above $0.15, but I don't know whether they will exercise that option, and if so at what level. If they do, it could provide a sizeable supply of cheap shares savvy individual investors might be willing to gobble up.

The company also has a big NOL asset and federal investment tax credits it can use to reduce taxes on future profits until 2026.

Overall, the balance sheet is pretty clean, and management has stressed not to dilute shareholders. They haven't done so in the past year, and given the ample financial improvements, I regard dilution risk as improbable.

Share structure

Currently outstanding are:

- 65 million common shares

- No warrants

- 5 million convertible debentures with strike price at $0.15, mostly held by insiders

- 4.76 million options with an average strike price of $0.11 and expiry date in 2018

This share structure stands out among many micro-caps; the total shares outstanding did not increase, and it's completely warrant-free.

The options holders could theoretically exercise at current levels causing selling pressure to occur, but when the share price hit $0.20 a few months back only 50k options got exercised, so I only expect them exercising in the near future if shares really take off.

As stated in the previous paragraph, the debentures also could potentially cap the stock price >$0.15 for the time being. Most of them are held by insiders, so I assume they won't readily act as arbitrageurs.

Significant insider buys

Both the CEO and the Chairman of the Board of Directors bought sizeable blocks of shares in the open market:

The CEO was recently interviewed, I recommend watching the video. He clearly put his money where his mouth is, which unfortunately is an uncommon phenomenon among micro-cap CEO's.

Safety products for law enforcement is a hot market

Due to unfortunate civil unrest in some cities, law enforcement agencies have decided to upgrade their equipment. Both federal as municipal governments are funneling more of their budgets to defense and police departments. Visiongain, a business intelligence provider, envisions the market to expand globally, with specifically strong growth in the Northern American territories. MarketsandMarkets has voiced the same opinion. This is a very hot sector to be invested in.

Body armor is a vital part of a police officer or soldier his or her protective gear. In my opinion, Pacific Safety Products offers an ideal and unique product portfolio to those agencies seeking the best protective gear for their employees.

Currently, the addressable market in Canada totals about $15 million and in the US about $200 million on an annual basis. This is a conservative estimate though, if you add the military in the mix, the figures go much higher. But you can see why the company is focused on the US. This market is simply much bigger, and the company's 3% market share is poised to only increase (whilst in Canada it already is 70%).

For a biased but nevertheless good overview of their products and market opportunities go check out their investor presentation by clicking here.

Valuation going forward

Revenue for the calendar year of 2015 should come out at $20 to $25 million roughly, and EBITDA of about $2 to $3 million. For 2016, I conservatively expect revenue to grow about 20% to 30% to around $30 - $35 million. EBITDA should top $4 million.

The company's current valuation is a tiny $10 million. This is in relative terms equivalent to an EV/Ebitda ratio of 5 and a price/sales ratio of 0.5. These are deeply discounted multiples.

What's fair? A company proving to be able to consistently grow its revenue and profits, I think a price/sales multiple of 1 or EV/Ebitda of 10 is fair at minimum during the first innings of this turn-around. Keep in mind that well-known competitors like Taser (TASR) and Digital Alley (DGLY) are valued at much, much higher multiples. Eventually, investor awareness and strong execution should lead to higher multiple valuations. In terms of share price, this means it should double quickly, and could double again somewhere next year.

In sum, based on the deep discount to fair valuation, ample business improvements and upbeat guidance, I think Pacific Safety Products' stock price offers 100% ~ 250% upside within 12 months from current low levels, while the downside risk is limited.

Risks

- The debentures and/or option holders deciding to convert. If they do, the stock price will be temporarily be capped at a certain level.

- A new capital raise. Management has stressed not to dilute shareholders, but if big orders are coming in (which would be highly welcomed of course), they might need extra cash to able to manufacture and deliver the goods. They have a positive working capital, but not a lot of pure cash available at hand.

- Losing market share to competition. In Canada the company has a near-monopoly status, but in the US there a lot of competitors, and Pacific Safety Products is the new kid on the block. Getting the US Navy on board was a great start, but the competition isn't exactly sitting still either.

But overall, I hardly see any downside risk based on the deep undervaluation, streak of contract wins and financials moving in the right direction.

Conclusion

By my analysis, Pacific Safety Products' successful turnaround is overlooked by all, presenting investors a case of limited downside risk vs. multi-bagger upside potential. Its new management team is doing a great job transforming this company into a steady growing and cash-generating enterprise. You probably never heard of this company, but it's these undervalued and undiscovered micro-caps that can significantly boost your portfolio's return. I added Pacific Safety Products to mine, and I expect to benefit handsomely.

Disclosure: The author is long PSP.V.

Click more