Oil Volatility Cost Producers Hundreds Of Millions In Bad/Unusual Hedges

I’m about to open a small window into the arcane world of oil producers’ hedging. There are lots of industry terms you’ve never heard of…but the bottom line is this: Oil producers routinely write way out-of-the-money hedges and pocket a small premium on a situation they know will never happen – like oil under $20/b or $10/b.

But in March 2020 it did happen. And that has cost several producers tens or even hundreds of millions of dollars – being forced to sell their product at very low prices when a different kind of hedge could have saved them.

It’s the epitome of the saying–picking up pennies in front of a steamroller. Though to be fair, who saw this steamroller coming?

Until recently I never gave much thought to the type of hedge that an oil producer put on. Swaps, collars, puts, calls. Whatever. There was a fixed price, or a floor – and ceiling. That is all I needed to know.

But when oil started going way down – way, way, way down – I discovered that all hedges are not created equal. The problem child is something called a 3-way collar. This can best be termed as the fair-weather hedge.

A 3-way option is a hedge – as long as things don’t get too bad. If the bottom falls out, the 3-way option is really no hedge at all.

Trying to Pick Up Pennies In Front of a Steamroller

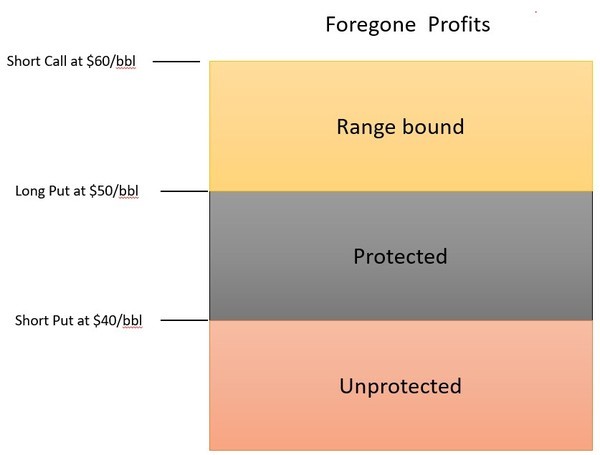

The first two parts of a 3-way option are the basic elements of any collar. The company buys a put – or an option to sell oil – at a price less than the price is on the day of the hedge. Then the company sells a call – or an option to buy oil – at a price above that the day of the hedge.

From this put/call spread the company is guaranteed a minimum price – that of the put they bought – and capped at a maximum price – that of the call.

Unfortunately, many oil companies wanted to squeeze some extra pennies out of their hedges – to bring the net premiums down. They realized that they were hedging a scenario that was extremely unlikely. That put they bought protected them again $40 and $50 oil, which made sense, but it also protected them again $30, $20 and $10 oil.

What were the chances oil would get that low?

So they layered on a third put, one that they sold, at a lower price then their spread. They received the cash for the put (ie. lowered the cost) in return for taking on that tail risk of an unlikely event that brought oil prices down to the $30’s or below. In the example below, this would leave the company unprotected (ie. exposed to lower oil prices) at anything below $40/bbl.

It was a great penny picking strategy – until they found themselves in front of a bulldozer (ie. a price < $30).

Ovintiv – Peeling off the 3-way Collars

Take Ovintiv (OVV – TSX) as an example. This is not because they are the only company that does this, or because they are the worst perpetrator. But they have been transparent and their disclosures and they have actually have changed their hedging in the last month – that makes them an interesting case.

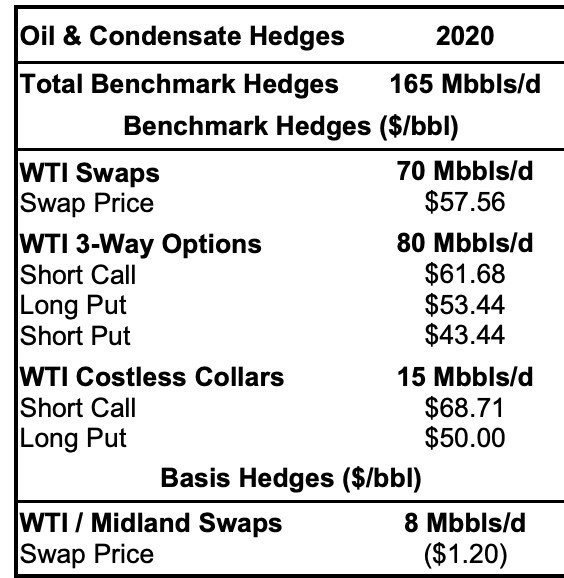

Ovintiv at the beginning of March – so right before the Saudis waged war on the world and took the price down – had hedges on 165,000 bbl/d of oil for 2020.

Works out to about 70% of their liquids production.Sounds great right? Well… the devil is in the details.

Source: Ovintiv March 12th Press Release

Ironically, Ovintiv had been pretty vocal about being 70% hedged. And before the Saudis decided to flood the market, no one really cared about the details. The stock had likely held up as a relative bastion of safety.

But then came Black Monday and the Saudi flood of oil to the market. If there had been expectation that Ovintiv could rely on its hedges to steer through the rough patch, that quickly disappeared.

Of the 165,000 barrels per day hedged, 85,000 were straightforward swaps and put/call collars. Swaps meant that Ovintiv got a specific price – in this case $57.56.

So not bad.

The problem was that another 80,000 barrels per day were 3-way collars. Ovintiv had sold that third put at $43.44. They were fully exposed to downward price movement below that price.

Let’s sketch out how that would impact cash flow if oil averaged $23 for the year – or $20 less than their $43 put. All else being equal, those 80,000 barrels a day would have resulted in roughly $584 million less revenue than if those hedges were a straight up costless collar.

Not small potatoes.

Now I did say “would have resulted”. That’s because Ovintiv realized they were on the wrong side of this trade and did something about it.

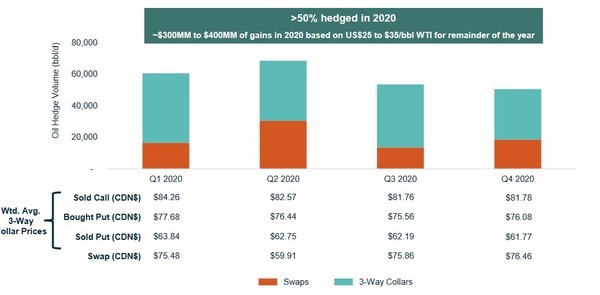

From their April presentation:

Source: Ovintiv April Presentation

Some time between March and April Ovintiv realized they were offside on these collars and made some changes. Their 3-way collars were reduced from 80,000 barrels per day to only 27,000 barrels per day.

Smart move. Probably not a cheap one, but smart nevertheless.

Canadian E&Ps – Hedged, to a Point

Skimming through the disclosures of public E&Ps in Canada, it is often hard to discern whether a company has a 3-way collar or a more typical costless collar.

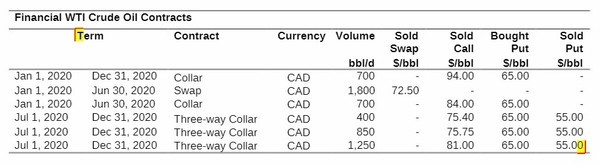

At the far (good) end of transparency is Crescent Point (CPG – TSX). They not only break out 3-way collars, but even give them their own slide:

Source: Crescent Point April Presentation

The presentation this comes from is CPG’s April one, so I must assume these hedges are still held.

Those 3-way collars are going to hurt CPG’s results in the short run – the puts they sold at $62.75 for Q2 2020 exposes them to the long drop to what is now close to $0. I don’t doubt that the underperformance of the stock compared to the rest of the sector has something to do with this.

Many companies are vague in their disclosures.I found lots of references to costless collars without much detail.

A costless collar means that the amount of premium received for the call sold is offset by the cost of the put premium. That could mean a single put/call spread, but (with opaque disclosure) also could mean a 3-way collar.

Often the reason a 3-way option is done is to reduce the cost of the overall hedge. I am a little wary of companies that reference costless collars and where I don’t see the numbers behind them.

There are a couple names that have clear disclosure and straight up hedges for the first half of this year. One is Gear Energy (GXE – TSX).

Gear is nicely hedged (~56% of oil production) with simple swaps and collars until the end of June.

Unfortunately beginning in July, Gear replaced those simple hedges with 3-way options, so they are exposed at prices below $55 per barrel beginning in July.

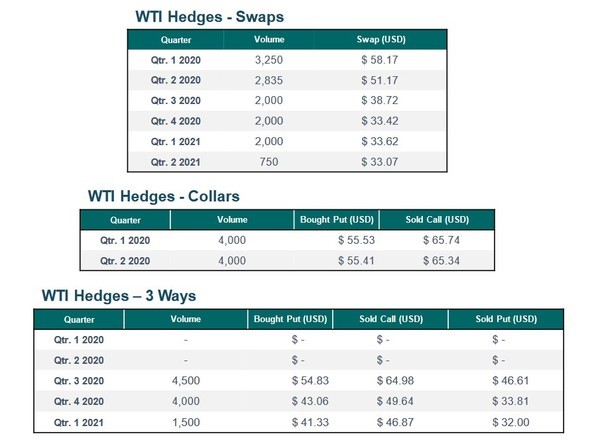

It is a similar story for the second name, Surge Energy (SGY – TSX). Surge has collars on 4,000 barrels a day in the second quarter, which protects them below $55.In addition they have 2,835 barrels a day in swaps.

Source: Surge Energy Investor Presentation

But like Gear, Surge has 3-way options beginning the second half.

The conclusion is that both Gear and Surge, and much of the rest of the Canadian E&P universe, need oil prices to at least begin to recover in the second half of this year.

That may happen. In which case companies like Gear, and many others, have positioned themselves well.

But if oil prices continue to stay at these incredibly low levels through the summer, there aren’t too many producers here in Canada that have the hedge book to handle it.

Disclaimer: Under no circumstances should any material

Comments

No Thumbs up yet!

No Thumbs up yet!