Norges Bank Preview: Time For A Breather

Having hiked three times so far in 2019, the Norwegian central bank looks set for a prolonged pause amid global uncertainty. We continue to see downside risks to NOK and expect EUR/NOK to test the 10.25 level in the coming weeks.

The Norwegian central bank has gone firmly against the tide over recent months, having hiked rates three times so far in 2019.

Oil investment/activity has been a key factor behind this hawkish stance. The recovery in global oil prices has seen both energy services, as well as investment in equipment, increase - especially given that break-even production costs are considered to be quite a bit below current market pricing for oil, according to the central bank.

But with global risks mounting, the Norges Bank signaled a prolonged pause at its September meeting. It’s latest projections have interest rates flatlining for the next couple of years.

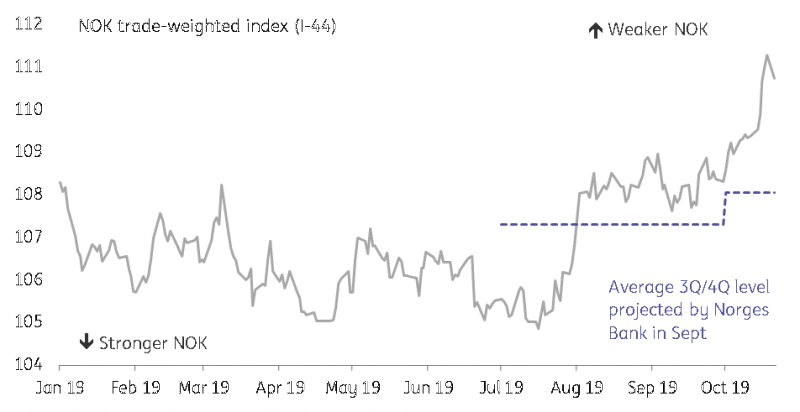

We expect a similar signal at the next meeting on Thursday. While the Norwegian krone is noticeably weaker than the fourth-quarter average the central bank was projecting back in September, oil prices are a tad lower. All else equal, a weaker currency means a higher interest rate projection, while lower oil prices are assumed to reduce economic growth and therefore pull down on the rate forecast.

Putting the two together still suggests that there will be no more tightening this year (and we'd note we won't get a new set of forecasts this week). However, we wouldn’t totally rule out a further hike in 2020.

There is some scope for a global trade “truce” next year ahead of the US election, which coupled with added clarity on Brexit, could conceivably see some modest Norges Bank tightening come back onto the radar next year - particularly if NOK is still perceived to be relatively weak.

NOK has been weaker than the Norges Bank had anticipated

(Click on image to enlarge)

Source: Macrobond, ING, Norges Bank September forecasts

Further downside risks to NOK

The Norges Bank's policy stance has had a fairly limited effect on the currency so far this year. In fact, the currency has totally failed to benefit from monetary policy tightening delivered over recent months.

This week's fairly uneventful meeting should be no exception. With global growth slowing, the low-liquidity NOK remains vulnerable. As we wrote in our GBP update on Monday, we find that NOK benefits less from the positive Brexit newsflow than SEK, which is why we've seen the NOK/SEK cross decline over the past few days.

We continue to see downside risks to NOK and expect EUR/NOK to test the 10.25 level in the coming weeks.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more