New Zealand Employment Preview: Jobless Rate To Hit The Highest Since 2015

Although the New Zealand economy fared relatively well against the Western world in combating the coronavirus crisis, the dour virus situation overseas is seen weighing on the South Pacific nation and its labor.

New Zealand’s unemployment rate is expected to have climbed north in the fourth quarter despite a mild improvement in other employment indicators, the NZ Statistics will show this Wednesday.

NZ labor market recovery falters

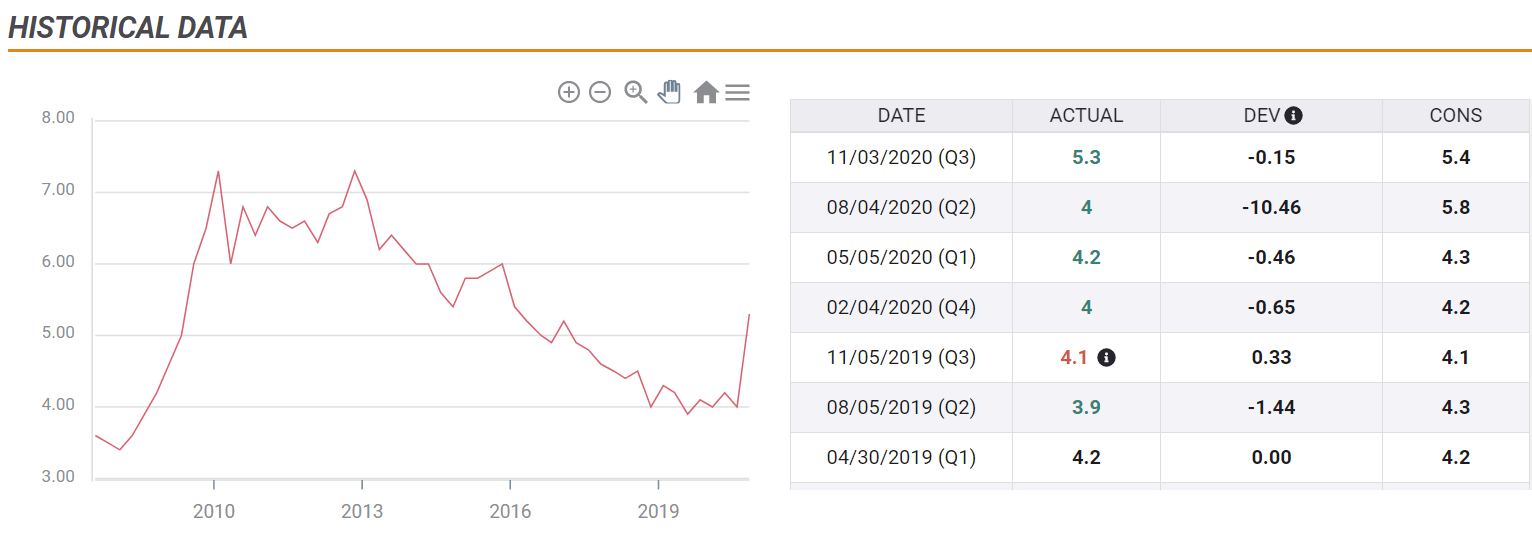

The NZ Unemployment Rate is foreseen at 5.6% in Q4 2020, up from 5.3% recorded in the July-September quarter. The jobless rate is likely to hit the highest since Q2 2015. The economy did not see any jobs growth in the reported period, with the figure likely to arrive at 0% vs. -0.8% seen in Q3. The Participation Rate is seen a tad higher at 70.2% in the final quarter of 2020 vs. Q3’s 70.1%.

Jobs deterioration and RBNZ policy action

New labor market data on Wednesday is predicted to show the worst of the job situation is not yet behind us.

Despite the economy unlikely to see job losses in the December quarter, the increase in the unemployment rate and underutilization rate could call for additional support from the Reserve Bank of New Zealand (RBNZ) to revive the jobs growth.

Further, markets are expecting the unemployment rate to extend its upward trend in the first quarter of 2021 amid worsening trading conditions for tourist operators, as most major Western economies are battling fresh lockdowns due to the spread of the new covid strain, found in the UK and South Africa. Meanwhile, the wage growth is also likely to remain muted in the final part of 2020.

In such a scenario, the RBNZ could be compelled to bring back negative rate discussions on the table while almost sealing in an expansion to its newly-launched Funding for Lending Programme (FLP).

At its November monetary policy meeting, the RBNZ Governor Adrian Orr said that the Official Cash Rate (OCR) will remain at 0.25% until March 2021.

NZD/USD probable scenarios

However, a disappointment in the jobs report could prompt the RBNZ to consider negative rates as a policy option, in a bid to revive the post-pandemic labor market recovery.

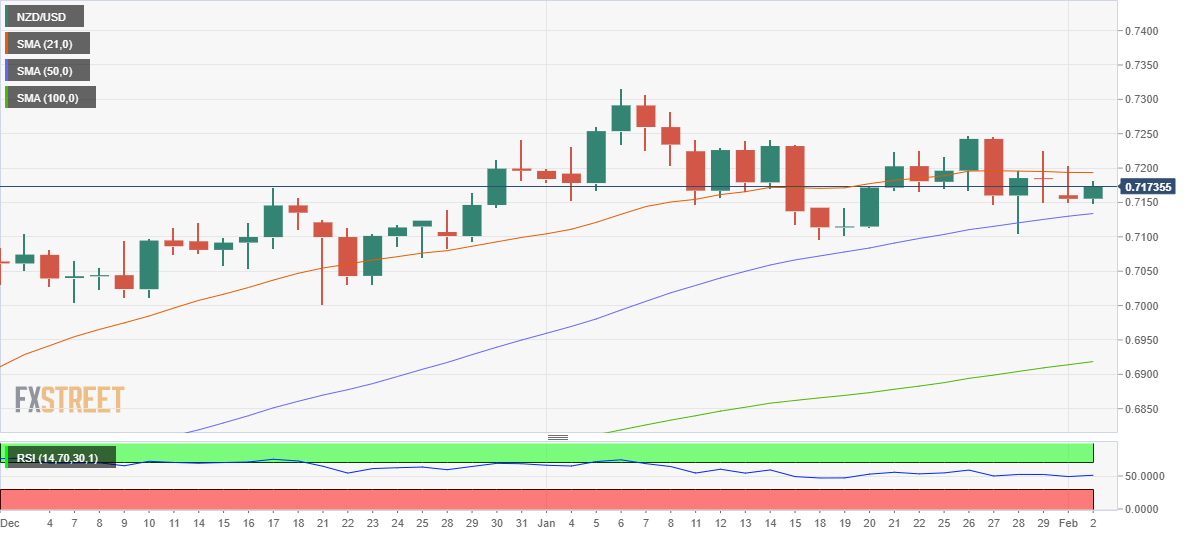

Any upside surprises in the employment report could join the recent market's optimism over the US fiscal stimulus, supporting Tuesday’s rebound in NZD/USD. Broad market sentiment and the US dollar dynamics could also have a significant impact on the kiwi at the time of the data release.

Looking at the daily chart, the price is locked in a range between the 21-Simple Moving Average (DMA) and 50-DMA. Therefore, the outcome of the jobs data could yield a range breakout in either direction for the kiwi. Acceptance above the 21-DMA at 0.7193 is critical to extending the recovery. Meanwhile, a breach of the critical 50-DMA support at 0.7134 could trigger a sharp decline towards the 0.7100 level, below which the December 25 low at 0.7070 could be challenged.

Daily chart

(Click on image to enlarge)

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more