New Zealand: August Rate Cut In View

Hawkesby says rates to stay "broadly" as they are

Although Hawkesby's use of the word "broadly" in his 30 May speech is clearly a get-out-of-jail-free card, to be drawn and played if conditions merit it, the assistant governor's recent remarks set quite a high bar for a rate cut at this meeting.

The question is, has anything changed since he delivered this speech in Tokyo?

The biggest change, of course, is what's happened at the Federal Reserve. While the US central bank hasn't taken any decisive action yet and has only hinted at a small amount of easing, markets have frothed at the mouth at even the suggestion of a rate cut, pushing the US dollar lower, and virtually everything else higher, including the New Zealand dollar.

At just a shade over 0.66, this is a decent bounce back from the 0.65 support level seen only a short while ago. This makes any additional rate cuts by the RBNZ easier, as the bank doesn't need to consider the impact on the currency as much as it would otherwise.

Most of the data has been weak

Furthermore, with the exception of backward-looking 1Q GDP data, which delivered a better-than-expected 2.5% year-on-year result, the run of data since 30 May has been universally poor. In a long list of weak data, we can name April building permits (-7.9%YoY), May consumer confidence (-3.2%) May House Prices (2.3% down from 2.7%), May credit card retail spending (-0.5%) and the Manufacturing PMI (50.2 down from 52.7).

About the only good news was another 1Q release (manufacturing activity) and the May service sector PMI.

In short, if Hawkesby or Governor Adrian Orr want to play the "broadly" card and cut rates at this meeting, it would not be too surprising, although, like the consensus, we're not expecting a move at this meeting. Still, we will be on the lookout for signs that another cut is coming soon.

August looks like a good shout for the next cut

Assuming no action this week, the 7 August RBNZ meeting looks to be the first good opportunity for some further easing. By then, we will have more information on key variables such as CPI (2Q figure due on 16 July) and the labor market (2Q data due on 6 August, the day before the Official Cash Rate meeting). Home price data for July will be released the same day as the meeting. Weakness in one or more of these indices could provide the nudge needed for a further 25 basis point cut, taking the Official Cash Rate down to 1.25%. We think that is more than likely.

NZD: beware of short-lived rallies

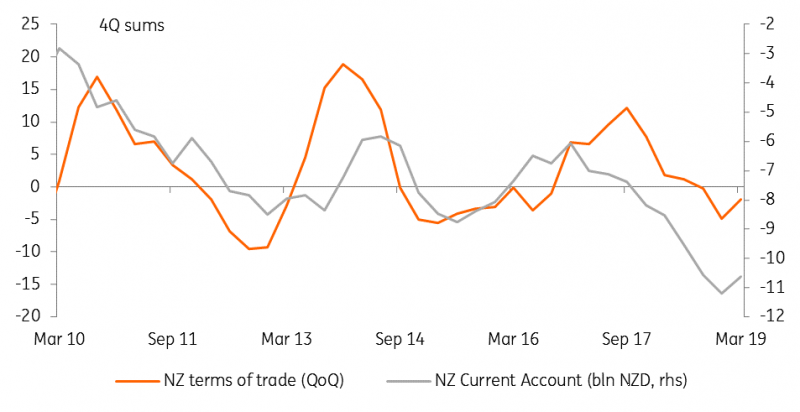

As the dollar fell across the board in the aftermath of Wednesday’s Fed meeting, NZD (and AUD) performance was somewhat muted compared to its G10 peers. This is probably because a number of factors are keeping the balance of risks for NZD heavily tilted to the downside. Although markets have recently become more optimistic about a de-escalation of trade tensions following this week’s G20 meeting, our trade team still expects the US to launch another round of tariffs this year. In addition, broadly weak data, along with a widening current account deficit and faltering terms of trade, continue to shed some doubt on the economic outlook.

(Click on image to enlarge)

Source: Statistics New Zealand, ING

Ahead of the RBNZ meeting, rates and FX markets are attaching a 20% probability to a rate cut. As we expect the central bank to keep rates on hold but to leave the door open for further stimulus, the short-term impact on the NZD may prove broadly limited. In the longer-term, OIS pricing shows 27bp of easing priced in for end-2019 and 35bp by June 2020, signaling market uncertainty about whether the RBNZ will push rates below 1.25% in the coming quarters. All in all, the current dovish stance suggests that any NZD gains are likely to be fleeting, at least until the trade conflict is definitively resolved. We still expect NZD/USD to trade around 0.63 towards the end of 3Q, before gradually recovering throughout 2020.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more