NEO Lithium: Next In Line

Safety in the Leader

The junior mining or junior natural resource extraction sector is extremely risky. There should be warning labels like, “Do not touch unless you can handle a 50% decline in a month” or “Do not touch unless you can stand being down by 75% for 3 years” and so on. Case in point, Northern Dynasty (NAK) fell 50% the day I am writing this. One thing I learned from my experience as the Industrial Minefinder is that the junior with the very best undeveloped project for each metal is not only the safest way to invest in a junior but the most likely vehicle to capture excellent returns without having to wait too long.

For several years I have been of the view that Lithium Americas (LAC) and NEO Lithium (NLC.V; NTTHF) had the two best junior development projects. Lithium America’s Cauchari-Olaroz has now been funded, is under construction, and is expected to begin producing in 2022. NEO Lithium’s Tres Quebradas (“3Q”) project currently has a definitive feasibility study underway which is expected to be completed in Q2 2021. Both of these projects are brine projects in Argentina, located within the Lithium Triangle which overlaps Chile, Argentina, and Bolivia. 3Q is in Catamarca which is a better province to operate in than Jujuy where Cauchari-Olaroz is located.

Something lit a stick of dynamite in the lithium stocks earlier this year. Albemarle (ALB) has nearly doubled while both LAC and NEO have both roughly tripled.

Photo by Danilo Alvesd on Unsplash

Lithium at a High Level

At a high level, lithium mainly comes from two major sources: South American brines and spodumene (“hard rock”) deposits that are located around the world with Western Australia currently the prominent location. Liquid from brines is pumped into pools where evaporation does some of the processing work. Brine production typically goes into lithium carbonate which is mainly used in lower nickel content lithium-ion batteries. Livent (LTHM) is the exception. Its brine production in Argentina mainly goes into lithium hydroxide. Hard rock is mined and the concentrate is primarily used to make lithium hydroxide. Lithium hydroxide is a “must-have” to produce the highest nickel content lithium-ion batteries. South American brines tend to have a bit lower production costs than hard rock.

Most of the world’s lithium production comes from South American brines (the Atacama in Chile and Hombre Muerto in Argentina) and Western Australian hard rock (Greenbushes, Mt. Marion, Pilgangoora). The major producers are Albemarle, SQM, Ganfeng Lithium, Tianqi Lithium, and Livent. Most of the lithium-ion battery production is in Korea, China, Japan, and the United States by LG Chem, CATL, BYD, Panasonic, Samsung, and Tesla.

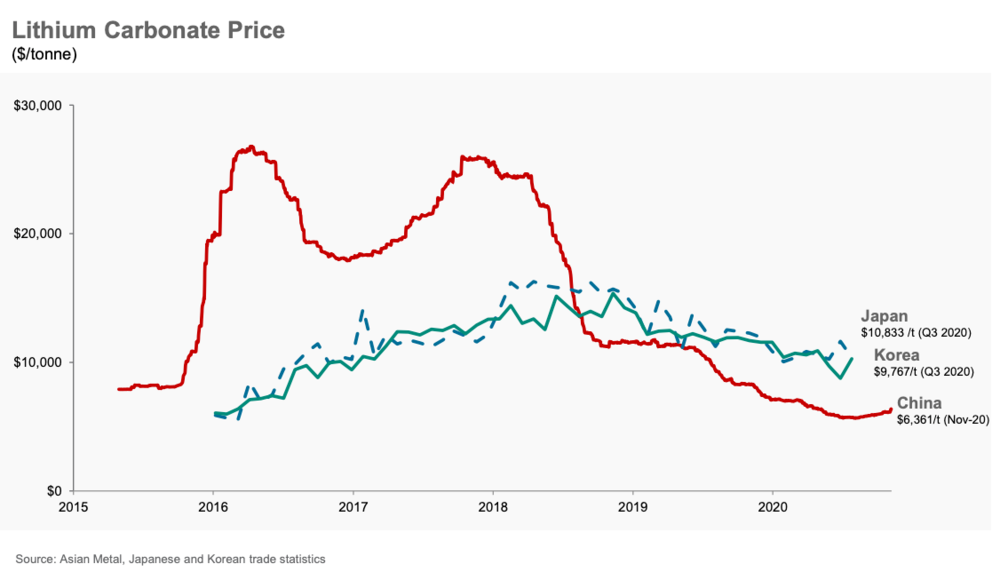

Lithium is priced through multi-year contracts and spot pricing. There are generally two types of pricing—the Korea / Japan price and the China price—as shown on the following historical chart:

(Click on image to enlarge)

source: Lithium Americas Investor Presentation; Asian Metal, Japanese & Korean trade statistics

The average pricing for Japan/Korea and China varies depending upon the battery quality of material, the supply and demand, and contract versus spot pricing. Higher quality battery-grade material continues to price above $10,000 per tonne. A good band for future price assumptions is between $10,000 to $14,000 per tonne. Hydroxide has historically traded at about an average premium of $2,000 per tonne to carbonate but this could change in the future depending upon battery type demand characteristics.

Although lithium tends to fall into the purview of mining, lithium carbonate production from brine and spodumene conversion to hydroxide is truly a chemicals business. Every resource is different and the processing nuances are different for every single resource. The most critical thing to understand about lithium is that even though there is an abundance of resources around the world, it is still difficult for the industry to scale high-quality battery-grade material. Lithium is also still a small industry and there is not an abundance of know-how and talent to go around. Lithium is not like gold or copper where there is a large industry in existence with an abundance of technical know-how. Nothing like this. As an investor, you want to focus on companies with the highest quality resources, top talent, and proven extraction processes. If you can embed this into your mind and stick with it, you will already be ahead of 75% of the investors in this space.

7 Things to Know about NEO Lithium

NEO Lithium’s 3Q project was discovered by CEO Dr. Waldo Perez exploring with his son. Perez also discovered the Cauchari project and founded Lithium Americas. Under his leadership, they took the 3rd largest brine deposit from discovery to definitive feasibility study (the final study) in only 5 years. Perez has assembled an experienced team of technical people at NEO Lithium that includes engineers that previously worked at SQM, Lithium Americas, and Orocobre.

Here are the 7 things you need to know about NEO Lithium:

1. NEO Lithium controls 100% of the 3Q project.

2. 3Q has very low impurities. As the following investor presentation slide notes, the 3Q project has very low impurities which can lead to production issues and higher costs.

(Click on image to enlarge)

Again, remember that this is a chemical business at heart. The chemical composition of the brine is very important.

3. 3Q is projected to have very low costs. The low impurities is a factor here. The following slide compares the project to its peers when it comes to pure processing costs:

(Click on image to enlarge)

source: NEO Lithium Investor Presentation

All the high-quality South American brines tend to have operating costs around $4,000 per tonne level. NEO Lithium’s pre-feasibility study is projecting that it will be the lowest cost producer with cash operating costs at $2,914 per tonne of lithium carbonate equivalent (LCE). LAC is currently projecting $3,759 per tonne LCE for its Cauchari-Olaroz which would make it the lowest cost producer until 3Q is in production (if successful). At one point, LAC was projecting $2,500 per tonne LCE operating costs for Cauchari-Olaroz at an earlier study stage and this has continued to rise. I expect we will see some cost creep for 3Q as well when it releases its definitive feasibility study (DFS) next year. I am more conservative in my financial model for the company and use $3,750 for total operating costs and royalties.

The low impurities at 3Q means the production process does not require the use of reagents for additional treatment and this lowers cost. Nevertheless, the key is that lithium carbonate product is very high quality. That is more important than having the lowest costs by a few hundred $dollars per tonne.

4. NEO Lithium’s pilot plant has been able to produce very high purity battery grade material. Apparently, this was good enough for the world’s largest automotive battery manufacturer, China’s Contemporary Amperex Technology Limited (CATL), to take an 8% equity stake in the company. NEO Lithium has formed a “strategic partnership” with CATL but continues to maintain 100% of the off-take rights. CATL is clearly looking to 3Q as a lithium source. The company is working with NEO Lithium as they complete the definitive feasibility study to iron out final product specifications. Battery manufacturers have to “qualify” carbonate from lithium producers to make sure there is the consistent quality they need and that their processes can accommodate the material.

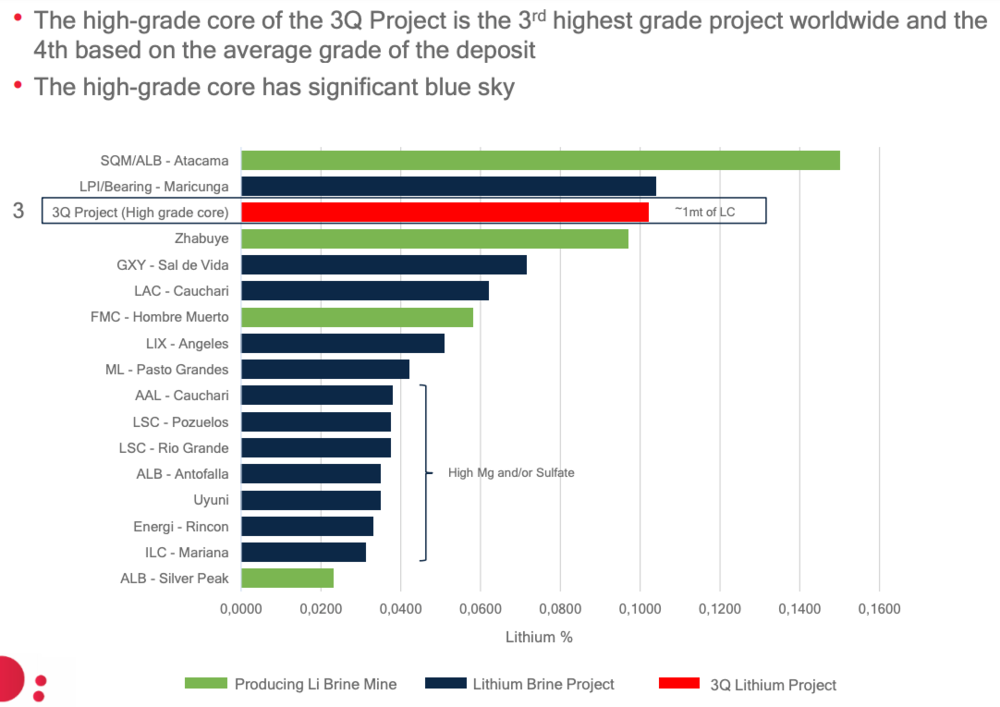

5. 3Q is very high grade. Most brine resources are huge so having enough of my life is not really a concern. 3Q’s total Measured, Indicated, and Inferred resource is large enough to produce 40,000 tonnes of LCE for 175 years with a 400 mg/L tonne cut-off grade. It could theoretically supply current world demand for 23 years. What matters is the grade and the impurities. 3Q is very high grade as the following slide shows:

(Click on image to enlarge)

source: NEO Lithium Investor Presentation

Some analysts downplay the investment potential of lithium because the brines are so abundant. By this they mean that the ample supply will drive down costs to the point that only a handful of the large, lowest cost producers will remain. Nothing could be further from the truth because, again, this is a unique chemicals business where every resource is different. These brine resources take years to ramp production and are fraught with delays and technical setbacks.

6. Decent Jurisdiction. 3Q is in the Catamarca province of Argentina which ranks highly for its desire to attract investment. I once listened to a podcast with the Secretary and Undersecretary of Mining of the province where this message came across loud and clear. This has been reflected by the fact that NEO Lithium has not had any issues progressing the project. Their final environmental permit for the construction of 3Q is in the approval process and they have an agreement in place with the nearby municipality of Fiambala to build the processing plant. Argentina as a whole is a basket case with their perpetual debt defaults and currency devaluations but this has not hindered lithium development. Livent (formerly FMC) has been operating successfully in Argentina for a long time.

7. 3Q has superior economic potential. 3Q is projected to have the lowest capital intensity of any lithium brine project in development. The upfront capital expenditures (CAPEX) for the project are estimated to be $319 million in the pre-feasibility study (PFS). I am using $375 million in my financial model. Once this project gets up and running at full capacity, free cash flow margins are likely to exceed 40% with LCE at only $10,000 per tonne. This project will throw off a lot of cash that will enable the company to execute a phase 2 expansion to at least 40,000 tonnes per annum. This high margin potential means that investors should continue to be rewarded by strong share price increases as long as the project continues to be de-risked and successful production becomes increasingly likely.

My Valuation

The PFS for the 3Q project boasts a $1.144 billion net present value (NPV) assuming an 8% discount rate and a $11,882 per tonne LCE price. If CATL provides financing the 8% might be realistic. The lithium price used is reasonable.

In my financial model, I assume higher upfront CAPEX, higher operating expenses, and a lower $11,000 per tonne LCE price. I could say that I am being conservative, but in practice, the actual economics for mining projects are almost always less robust than the estimates of feasibility studies so one is just asking to be let down by not doing so.

My approach for valuing juniors is to estimate what an acquirer may be willing to pay, keeping in mind that an acquirer has to commit capital to buy the company and finance the project. I am not saying that NEO Lithium will be acquired but I believe it is management’s preference. However, if they do not get a good enough offer they will continue to own the development of the project. They own 10% of the company and we should expect them to follow the best route for shareholders.

Assuming an acquirer would want a 15% return on invested capital, I currently value NEO Lithium at $302 million assuming $11,000 per tonne LCE. At full capacity of 20,000 per tonnes of LCE per annum, the project will have average annual free cash flow of $101.5 million. An acquirer paying $302 million for the company and then $375 million to develop the project may thus be able to generate a 15% annual return on invested capital (ROIC) [$101.5 / ($375 + $302)]. $302 million divided by the number of shares outstanding after the project is financed, perhaps with 60% equity, puts the value per share about 25% below where the stock currently trades.

If lithium demand materializes over the next several years like many are expecting, then we are likely to see an extended spike in lithium prices to incentivize the development of existing project expansion and new projects. Thus, I think it is likely that NEO Lithium could trade materially higher. A Chinese or Japanese acquirer would likely have a lower capital return threshold, such as 10% to 12%, which would boost my valuation from between $471 million to $640 million, assuming $11,000 per tonne LCE. Taking this further and assuming a $14,000 per tonne LCE price, my valuation climbs to as much as $1.1 billion assuming a 10% ROIC for an acquirer.

Under my base case scenario and assuming 60% equity / 40% debt financing, the project could be at full production capacity in 2026. The free cash flow is likely to be very strong so the stock price would likely accelerate higher if and when production materializes according to plan.

Overall, I think the stock is a fair value but investors could receive up to 2 to 3 times more within a few years under a lithium bull market acquisition scenario or 3 to 5 times more by the end of the decade under a scenario where the company is not acquired and becomes a stand-alone producer.

Sentiment Driven

What can we learn from this chart of the NEO Lithium share price (in CAD $dollars)?

(Click on image to enlarge)

courtesy of Barchart.com

Despite actual lithium demand growth continuing to grow at a relatively steady state, we see 2 periods—Q4 2017 and Q4 2020—where shares of NEO Lithium suddenly went vertical on a narrative shift. Part of this has to do with the fact that almost half (~47%) of NEO Lithium shares are owned by retail investors which appear to be manic-depressive over lithium. It definitely seems like a new bull market has started.

There are several takeaways or lessons here:

-

Do not buy the stock unless you are prepared to possibly ride out a 50%+ decline.

-

If you are going to invest in the company, do so in tranches, such as 1/3 now, 1/3 later, and 1/3 further out or 1/4 now, 1/4 later, 1/4 even later, and 1/4 even further out. You get the idea. Be strategic and have scope for the manic depressives to give you an opportunity to buy the shares at potentially a much lower price.

-

Remember, it takes years to develop these brine projects and lots of things can happen to delay or derail them. It may likely be 4 to 7 years before 3Q begins to have a material amount of production. This gives you lots of time to evaluate the progress of the company and slowly accumulate in tranches. If you buy the stock now and it doubles. Consider selling half to remove your initial investment and just let the rest ride long-term.

-

We could very easily have a global economic slowdown in 2021 that sends stocks like this into a tailspin for no material reason. It happens all the time.

Conclusion

I would say NEO Lithium is a fair value right now but longer-term there is considerable upside due to the inherent strengths of the 3Q project, strong technical team, and investment interest of CATL. If the current lithium mania continues and the lithium price spikes in 2021, then investors could still make a lot quickly but this is very high risk.

If we classify LAC as a producer, then I think NEO Lithium is the top junior on the block and this comes back to my introductory theme about the safest way to invest in a junior natural resource developer. NEO is likely in the acceleration phase now that will take the 3Q project into production and unlock value for shareholders. The involvement of CATL confirms this. CATL does only have an 8% stake though so it is possible that some other major player could still come in and acquire the company or take a larger stake.

I built conservative assumptions into my valuation for the company. The share price is still reasonable for an investor looking to take an initial stake. NEO Lithium is definitely my top junior pick in lithium right now. If things go according to plan, the company will be very successful long-term because their production costs may ultimately be the lowest in the industry. The lowest cost producer never goes out of business and typically generates the most free cash.

This article was originally published as Premium content on November 27, 2020. I am publishing it here as a sample of what Premium offers. I strive to write not about everything there is to know but ...

more