Mexico: Muted Policy Reaction To Recession

The growing slack in economic activity and the stellar MXN performance should tip the balance in favor of another rate cut by Banxico this week. Concerns over core inflation and, especially, rising wages suggest however that monetary policy guidance should remain cautious, but our bias is for a deeper cycle than currently expected.

Economic recession calls for a longer rate-cutting cycle

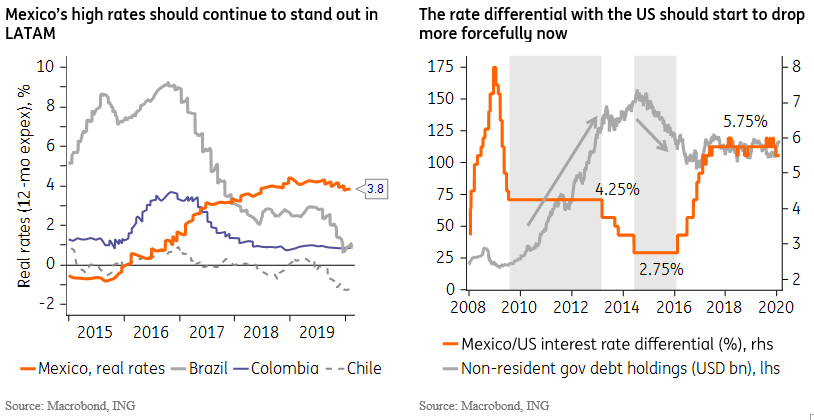

The growing slack in economic activity together with the impressive outperformance of the Mexican peso should tip the balance in favor of another rate cut at Thursday’s monetary policy meeting. A 25bp cut would bring the policy rate to 7.0%, down from the 8.25% peak that prevailed during 1H19.

This would also mark the second consecutive rate decision in which Mexico's central bank (Banxico) does not follow the US Fed, which kept its policy rate stable two weeks ago, marking a more decisive decoupling and another reduction in the US-Mexico rate differential (see chart).

Still, considering the growing output gap and the limited prospects for a recovery, in the absence of fiscal policy stimulus, Mexico’s monetary policy stance remains unusually restrictive. The contrast with the monetary policy stance adopted elsewhere in LATAM is especially noteworthy, indicative of the more substantial scope for monetary policy stimulus, when compared to its regional peers.

(Click on image to enlarge)

Local market surveys suggest that the cycle should pause when the policy rate reaches 6.5%, ie, there would be only two additional cuts after this week. This scenario suggests that monetary policy would remain slightly restrictive in the foreseeable future.

Policy catalyst for growth is still lacking

The Lopez Obrador administration continues to emphasize its conservative fiscal policy credentials and, as a result, continues to signal a broadly neutral fiscal policy guidance, with reduced scope for fiscal expansion.

This suggests that the overall policy mix should remain, on balance, slightly restrictive, further reducing prospects for an economic recovery in 2020.

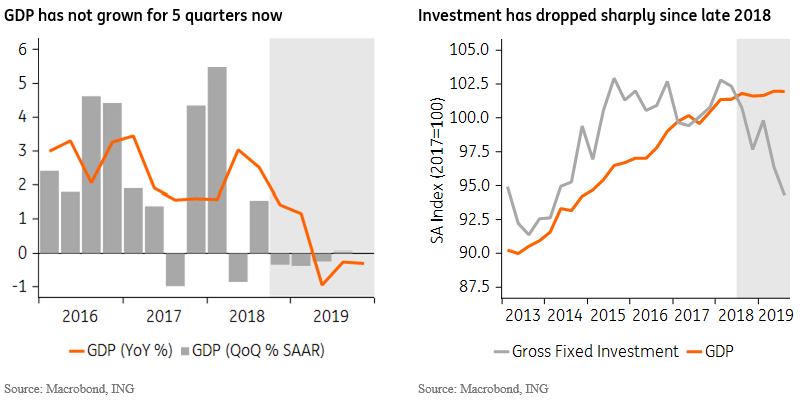

4Q19 GDP data (preliminary) confirmed that the Mexican economy registered a slight recession last year, ending the year at -0.1%, down from 2.1% in 2018. Capital investment, which has dropped sharply since AMLO took office, as seen in the chart below, remains the biggest drag to economic activity. Consumption and net-exports have, meanwhile, become the main drivers for GDP growth (more on this below).

(Click on image to enlarge)

With the GDP growth carry over into 2020 now standing at 0%, we have entered the new year with a balance of risks for economic activity biased towards the downside. Our new forecast is for a 0.7% GDP expansion this year, which compares with a higher, but also declining, market consensus of 1.0%.

Despite the recession, some inflation concerns remain, as wage pressures rise

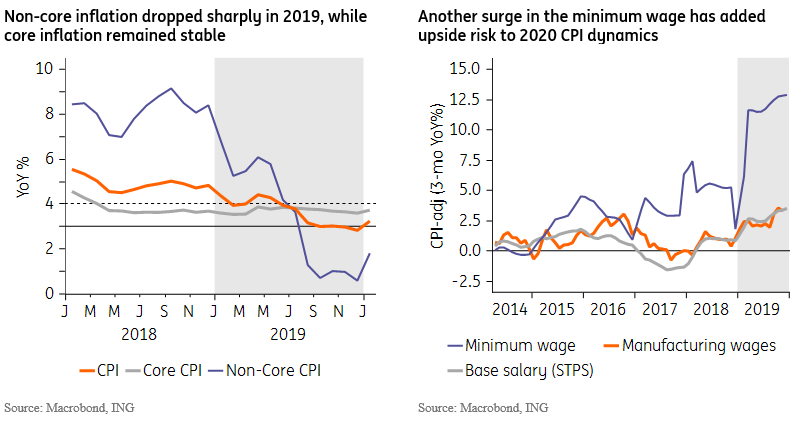

Headline inflation ended 2019 slightly below the target, at 2.8% year on year. That is a good result when compared to 2018’s 4.8%, but the improvement is relatively narrow-based, as it reflected the collapse in the more volatile and less predictable components of the CPI, ie, its non-core components. Non-core inflation fell from 8.4% to 0.6% in the same period, driven by food and energy.

Core inflation has, meanwhile, stayed remarkably steady, if somewhat higher than the 3% target, trending within a narrow 3.5-3.9% range for almost 2 years. These levels are also largely in line with the evolution of inflation expectations, as seen in local market surveys.

(Click on image to enlarge)

Lingering concerns over the persistence of core inflation and above-target inflation expectations should remain the primary arguments for central bankers to proceed with caution, as they extend the easing cycle. In fact, these concerns have gained special resonance now that the federal government has opted to implement another large-scale (20%) increase in the minimum wage.

Even though the impact of the minimum wage over broad labor market dynamics is seen as relatively narrow, when compared to Brazil that has a history of widespread labor market indexation to the minimum wage, for instance, the large increase could influence wage negotiations throughout the year.

Wage increases seen throughout 2019 already suggested that an upward momentum was underway (see chart above). Strong wage gains would be consistent with the fact that the local job market remains around full-employment, ending 2019 near 3.4% (SA 3m-MA). But the fact that that upswing also coincided with last year’s 16% increase in the minimum wage may have been an additional factor strengthening workers’ wage increase demands.

Treading softly to avert FX volatility

Overall, wage pressure risks should remain a persuasive near-term argument for central bank officials to maintain a cautious monetary policy guidance, despite the rising slack in economic activity. That guidance should not prevent the board from gradually reducing the policy rate towards 6.5% by 2Q.

Market consensus is that the bank should pause after that. Our view is that Banxico should extend the easing cycle a bit further, towards 6%, but that remains a low-conviction call and highly dependent on FX and GDP dynamics in the coming months. Mexico’s robust labor market indicators and the focus on FX stability by both the administration and the central bank, also suggests that, despite the dovish dissentions seen in recent central bank decisions, policymakers should be under little pressure to ease more forcefully.

The change in the board’s composition expected for December may also figure in the board’s voting pattern this year. In particular, expectations that the new appointment may alter materially the policy inclinations of the median-vote at the board may increase the likelihood of a shorter easing cycle in 2020, followed by a deeper cycle next year.

The MXN's outperformance could last longer

Banxico’s resistance to follow the lead of other central banks in the region and embark on a deeper monetary easing cycle should continue to support the MXN throughout 2020. But the peso’s outperformance is also justified by the significant improvement in Mexico’s external accounts seen in recent quarters.

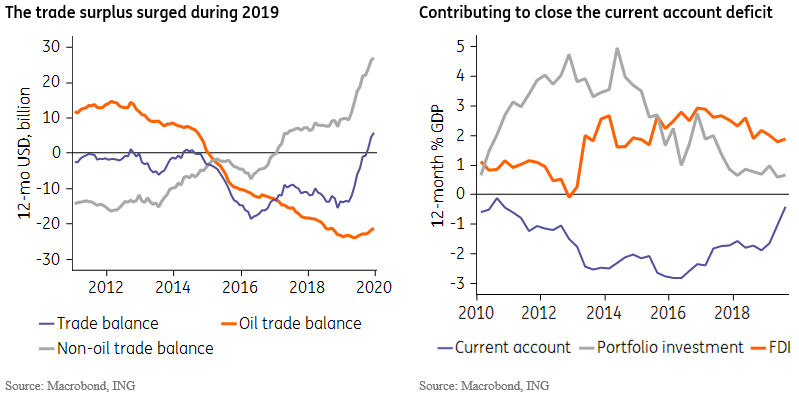

After a near USD 20bn surge during 2019, Mexico’s trade balance registered a surplus for the first time in 5 years, the largest surplus since the 1990s. This surge was the result of a combination of 2% drop in imports and 2% increase in exports in the period.

The bulk of the change occurred in the non-oil trade surplus, which increased by almost USD 18bn in the year. The oil-sector trade balance also improved for the first time in years, with the deficit dropping USD 2bn in the year, but remaining large at USD 21bn.

The sharp drop in capital and intermediate goods imports, consistent with the poor results seen in investment and industrial production, helped drive this result. Exports were, meanwhile, largely a function of US manufacturing trends, which performed relatively well early in 2019 but ended the year with a negative momentum.

(Click on image to enlarge)

In any case, thanks to this surge in the trade balance, Mexico’s current account deficit dropped from nearly 2% of GDP in 2018 to close to 0% now.

But, arguably, the chief anchor for the MXN remains Mexico’s highly attractive carry. And, as discussed above, given that Mexico’s local rates should remain far higher than the levels seen elsewhere among its regional peers in the coming months, the MXN’s outperformance could persist a while longer.

In our view, the risk to the MXN this year stems from eventual decisions by rating agencies to downgrade Mexico (eg, due to poor GDP growth dynamics) or market reaction to eventual policy controversies that threaten Mexico’s macro fundamentals.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more