Markets Wait For Lagarde And The European Central Bank

During today's session, the market's attention will no doubt be focused on the words of European Central Bank President Christine Lagarde, following the ECB’s meeting.

In principle, the ECB is not expected to depart from the US Federal Reserve's script, so no changes are expected to be made to interest policy or its asset purchase program, but during the subsequent round Lagarde could leave between seeing future actions by the European Central Bank in terms of interest rates and inflation control.

Recently, we learned that the European Central Bank approved an historic change in its monetary policy strategy by raising its inflation tolerance level to 2% allowing this figure to be exceeded on a temporary basis. This is in a clear move to dispel doubts about its current monetary stimuli in the face of rising inflation produced by the economic recovery.

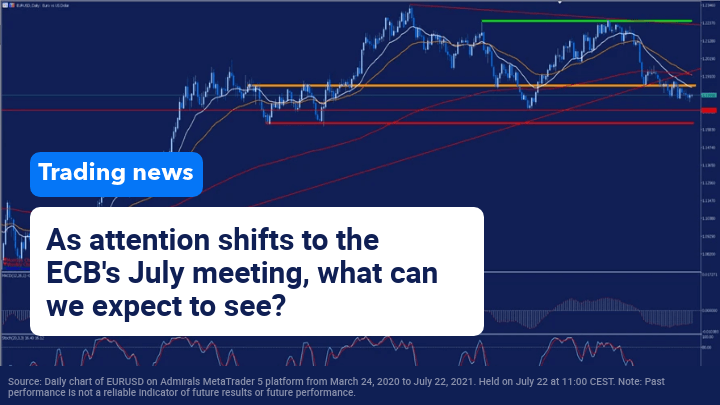

As we commented in our analysis of the Forex market two weeks ago, during the first half of the year EURUSD has lost 2.93% and for the moment this downtrend continues during this month of July with a decline of 0.51%, which has led EURUSD to lose several support levels including the important support levels of its average of 200 sessions in the red, its long-term uptrend line and its important support/resistance level in the orange band.

This bearish move has also caused a triple cross of bearish moving averages thus confirming the change from uptrend to bearish that could lead the price to seek its next level of support around the level of $1.17, despite the accumulated oversold in its stochastic indicator.

This oversold, in turn, may cause a upstic bounce in search of its current resistance levels in the coincident zone of its 18-session moving average and the orange fringe. If the pullback is finally confirmed the price could generate strong bearish momentum to its next support levels.

On the contrary, as long as EURUSD does not break its 200-session moving average higher and manages to maintain levels close to $1.19, we cannot expect a new upward momentum.

(Click on image to enlarge)

Source: Daily chart of EURUSD on Admirals MetaTrader 5 platform from March 24, 2020 to July 22, 2021. Held on July 22 at 11:00 CEST. Note: Past performance is not a reliable indicator of future results or future performance.

Evolution of the last 5 years:

- 2020 = +8.93%

- 2019 = -2.21%

- 2018 = -4.47%

- 2017 = +14.09%

- 2016 = -3.21%

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter ...

more