Markets To Shift Focus To The Fed? What’s Next For USD Index?

Macron victory in the second round of the French elections is being greeted with a lukewarm response as it was mostly priced-in.

Mr. Macron lacks a political base and is likely to have a hard time winning seats in parliamentary elections next month. Without a majority in the 577-seat National Assembly, Macron will be reduced to being a paper tiger. However, markets are not concerned about this right now.

French election risk is out of the way and things appear to have calmed down on the geopolitical front as well. UK PM May’s Conservative party maintains a healthy lead in the poll, while Chancellor Merkel’s comeback continues... Her CDU party won regional elections in the northern state of Schleswig-Holstein, defeating their social democratic rivals for the second time this year just five months ahead of the general election.

So it’s time for the Fed to retake the centre stage after being sidelined for almost two months. The March Fed minutes had talked about the balance sheet normalization... This is perhaps the biggest story in the last six years. However, the story was overshadowed first by the geopolitical tensions and later by the surge in inflows into the European stocks on expectations that centrist Macron would defeat anti-EU Le Pen in the elections.

The talk of Fed balance sheet normalization is gathering pace. St. Louis Fed President James Bullard said on Friday that he is in favor of shrinking the $4.5 trillion balance sheet to $2 trillion. That amounts to a 56% reduction in the balance sheet size. San Francisco Fed President John Williams echoed similar sentiments.

Also worth noting is that the probability of a 25 basis point rate hike in June now stands at 87.7% (as per CME fed funds futures). The fact that the anti-EU right wing sentiments are fading fast across the Eurozone also opens doors for a potential ECB rate hike. History shows Bank of England (BOE) and Bank of Canada (BOC) that have usually followed the Fed when it comes to the rate hike. This time it could be different... As Marc Ostwald, Strategist at ADMISI said while talking to Tip TV, “The ECB could shock the markets with a sooner than expected rate rise and may become the first central bank to follow the Fed”.

Fed seeks wiggle room

With everything looking hunky dory, the Fed may resort to faster rate hikes or balance sheet normalization. We believe the central bank aims to create wiggle room i.e. push rates sufficiently higher so that they could be reduced during the next bout of recession. On similar lines, the central bank intends to offload its bond purchases/reduce bond purchases so there is room for fresh purchases if and when required in the future.

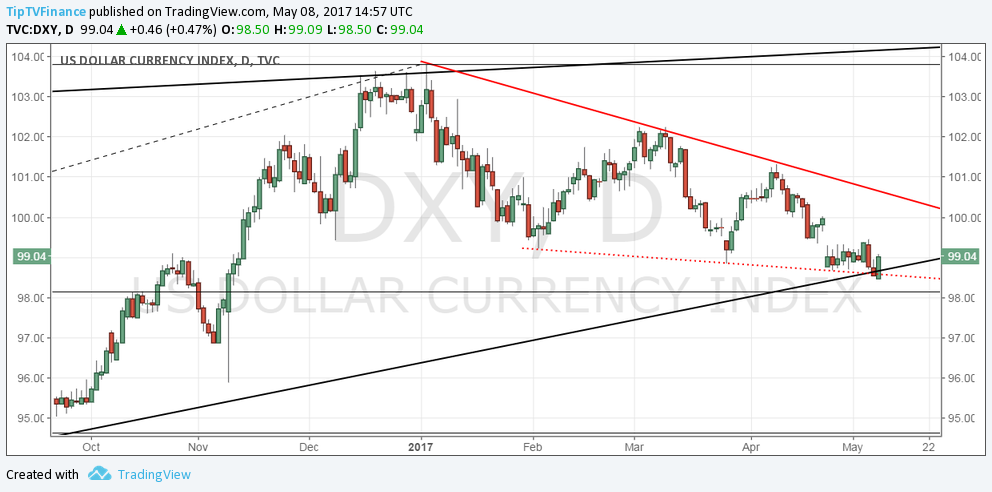

Dollar Index – Fake breakdown

Daily Chart

- The index closed below the rising trend line (sloping upwards from July 2014 low and May 2016 low), marking a major long-term trend reversal.

- However, the macro environment could tilt in dollar’s failure as markets are likely to shift their focus to the rapidly changing Fed policy.

- In fact, today’s candle is likely to end up being a bullish engulfing/bullish outside day candle.

- Two consecutive daily close back above the rising trend trendline signal a short-term bottom has been made. However, only a daily close above 100.00 would revive the bullish view.

Weekly Chart

- The sell-off would gather pace once the index breaks below 98.14 (23.6% fib retracement of 79.74-103.82).

Disclosure: None.