Markets: Fruit Flies

Markets are going bananas again. The syntactic ambiguity of the moment shouldn’t be lost as computer algorithms mix badly with geopolitical news. Volatility has rebounded despite the modest hope from US markets yesterday. The main story overnight happened just at the close yesterday – Apple cut its sales forecasts for 1Q due to slowing iPhone sales in China – there are other fruits to consider overnight that matter. Stocks had an immediately negative reaction with a “flash crash” in USD/JPY and other safe-havens bid up accordingly. China economic fears remain central to trading so far with Danish shipper Maersk shutting its container factory there. The Chinese countered some of the gloom over their economy by landing a probe on the darkside of the moon– moving up the race for space dominance in 2019. The threats yesterday from North Korea on changing the approach to denuclearization matter to China/US relations as well – and the disappearance of a North Korean diplomat in Italy makes it a European affair as well. The problem with using USD/JPY as the guide to trading other markets is liquidity. Japan is on holiday, the BOJ isn’t going to act on FX unless asked and the debt situation of Japan make safe-haven status less meaningful.

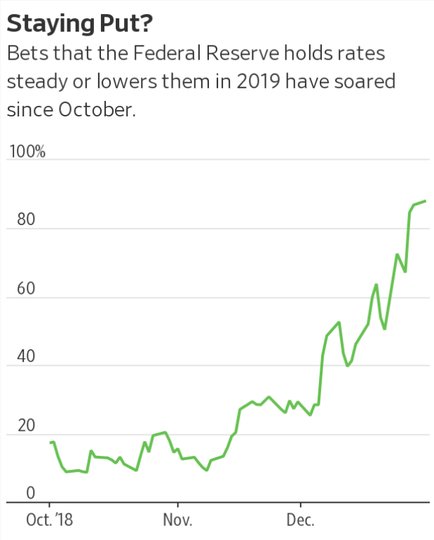

The USD maybe the other side of the trade to consider today with the US government shutdown far from over, with Fed hikes for 2019 all but priced out and with the rest of the world looking like a value play, the USD is the barometer with 95.90 opening up the risk for 91.50 again. A weaker USD is the Trump and perhaps Powell dream as it will help bring some punch back to the US economy.

Question for the Day: Is it USD/JPY or CNY/JPY that matters the most for trading? Economic weakness globally is the fear driving markets and the data overnight doesn’t do much to alleviate this emotion even as the Swiss and Spanish news is better, the ECB M3 and UK construction PMI generally support those stories and even Turkish inflation eases to 20%. So if economic fundamentals don’t work, what really is driving markets? US/China relations –with trade talks, geopolitical pressures from Taiwan to North Korea, the ongoing Canadian detainment and G5 technology issues, and the militarization of the South China Sea – all that matters in the fruit punch for investors. The role of Japan in this mess is important to consider as they are the spice from BOJ policy with QE and ZIRP as far as any analyst can predict.

The ability to balance a stronger JPY with a weaker CNY to help counter the US/China trade war is in play today. The flash crash of USD/JPY puts in a new USD low to watch and that will become the bellwether risk level for bears. The105 barrier break opened a stop-fest that will only be back in play today. On the other hand, the markets are focused on ways out of the present mess with China and that is where the CNY/JPY comes into play. The April 2017 lows for 15.622 broke down last night and we are not yet back like the JPY to a safe-zone. Global trade disruption shows up first in Asia with the Korea/Japan/Taiwan to China flows all key and all in play over the next week.

What Happened?

- Spain December unemployment off 1.55% or -50,570 to 3.20mn after -1,840 – as expected. Unemployment increased in industry, up 3,967, construction 9,998 but fell in agriculture -10,392 and services -43,874. Youth unemployment >25 fell 17,378. For 2018 overall, unemployment fell 6.17% or 210,484.

- Swiss December manufacturing PMI 57.8 from 57.7 – better than 57.2 expected. Production rose 2.2 to 60.5 while new orders fell 2.3 to 55. Input prices fell 1.6 to 60.3. Employment slowed -1.3 to 56.6. Overall, 2018 average PMI was 61.5 – best since 2010.

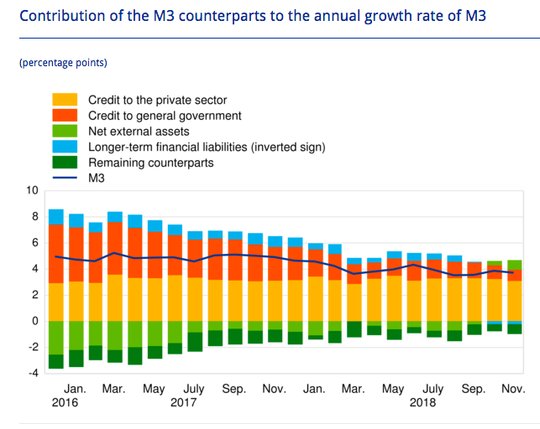

- Eurozone November M3 slows to 3.7% from 3.9% - less than the 3.8% expected. The private loans to households increased to 3.3% from 3.2%. The loans to business (ex financials) rose to 4% from 3.9%. The narrower M1 currency in circulation and O/N deposits shrank to 6.7% from 6.8%.

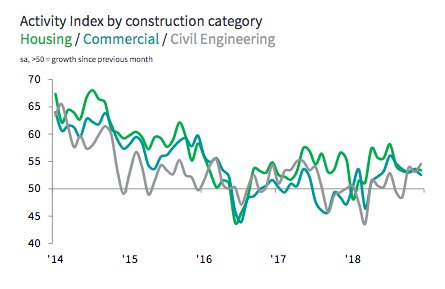

- UK December construction PMI 52.8 from 53.4 – slightly weaker than 52.9 expected – weakest in 3-months. Civil engineering rose at the best pace since May 2017 and business optimism rose to April 2018 highs with focus on energy and big-transport work. The slowdown was linked to commercial and housing activity. Employment rose across the sector but eased back from November 3-year highs.

Market Recap:

Equities: The US S&P500 futures are off 1.4% after a 0.13% gain yesterday. The Stoxx Europe 600 is off 0.7% after opening -0.9% and trading off over 1% with technology the focus. The MSCI Asia Pacific fell 0.3% with Australia gaining on weaker A$.

- Japan Nikkei closed for holiday

- Korea Kospi off 0.81% to 1,993.70

- Hong Kong Hang Seng off 0.26% to 25,064.36

- China Shanghai Composite off 0.04% to 2,464.36

- Australia ASX up 1.23% to 5,694.60

- India NSE50 off 1.11% to 10,672.25

- UK FTSE so far off 0.3% to 6,713

- German DAX so far off 1.25% to 10,445

- French CAC40 so far off 1.15% to 4,634

- Italian FTSE so far off 0.65% to 18,216

Fixed Income: Bonds are mixed with periphery hit in Europe as bank fears and growth doubts return – 10-year Bund yields up 2bps to 0.18%, France OATs up 2bps to 0.67%, UK Gilts up 2bps to 1.24% while Italy BTP s up 14bps to 2.84%, Spain up 3bps to 1.44%, Portugal up 5bps to 1.77% and Greece up 1bps to 4.41%.

- Spain Tesoro sold E1.195bn of 3Y Oct 2021 0.05% Bonos at -0.028% with 2.26 cover– previously +0.027% - also sold E1.345bn of 5Y July 2023 0.35% Bono at 0.337% with 1.75 cover– previously 0.421%. The Tesoro also sold E1.997bn of 10Y 1.4% Jul 2028 oblig at 1.402% with 1.465 cover – previously 1.456%.

- US Bonds are mixed despite equity fears– 2Y up 1bps to 2.49%, 5Y up 1bps to 2.48%, 10Y up 2bps to 2.65%, 30Y up 1bps to 2.96%.

- Japan JGBs closed for holiday.

- Australian bonds are lower with profit taking, focus on US/China– 3Y up 5bps to 1.75%, 10Y up 8bps to 2.23%

- China bonds are bid– 2Y off 13bps to 2.77%, 5Y off 2bps to 2.95% and 10Y off 1bps to 3.19%.

Foreign Exchange: The US dollar index 96.71 off 0.2%. All about JPY – with EM mixed – RUB up 0.15% to 68.919, ZAR up 0.1% to 14.448, INR off 0.3% to 70.19, KRW off 0.7% to 1127.

- EUR: 1.1350 off 0.8%. Range 1.1325-1.1497 with JPY driving first, USD second – 1.13-1.15 wide range holding.

- JPY: 107.60 off 1.9% .Range 104.74-109.46. Focus is on 106.50 against 108 now.

- GBP: 1.2560 off 1.4% .Range 1.2561-1.2773 with focus on JPY cross and Brexit no deal scenario repricing. EUR/GBP .9035 up 0.55%.

- AUD: .6960 off 1.1%. Range .6960-.7045 with JPY and .68 now key. NZD .6635 off 1%.

- CAD: 1.3585 off 0.45%. Range 1.3569-1.3663 with oil and US rates and JPY cross in play.

- CHF: .9890 up 0.5%. Range .9792-.9920 with EUR/CHF 1.1225 off 0.3%. Still less of a safe-haven than JPY?

- CNY: 6.8875 up 0.15%. Range 6.8828-6.8877 – focus is on JPY and rest of regional FX.

Commodities: Oil up, Gold up, Copper off 0.15% to $2.6520.

- Oil: $46.66 up 0.25%.Range $45.35-$46.67. Brent up 1% to $55.47 – rebounding on December oil production from OPEC and with recovery in equities in Europe. $45-$48 key for WTI still.

- Gold: $1290.20 up 0.45%.Range $1286.80-$1294.30 with $1295 and $1300 still in play with JPY focus along with equities now. Silver off 0.1% to $15.63, Platinum off 1% to $796.20 and Palladium off 0.2% to $1196.30.

Conclusions: No Hikes in 2019? China easing and spending to restart is growth engine for 2019 is just one side of the coin – the other is the US. Markets have been busy countering the bear market move in equities with the hope for a Powell Put – ie the Fed holding rates in 2019 rather than hiking them. The WSJ chart and article are worth reading as you enter the 2nd day of equity pain for 2019 with fear and loathing.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.