Market Briefing For Wednesday, June 12

A 'moat' is seemingly needed given the range of S&P possibilities that most pundits are now debating; depending on everything from 'technology' investigations (and potential antitrust actions); political noise (some of which is self-inflicted by the politicians); and of course the primary focus; which is whether or not a 'China Trade Deal' moves forward (with a focus on whether President Xi shows up at Osaka, some say; although doing so doesn't imply Chinese acquiescence to all terms of the nearly-completed former 'deal').

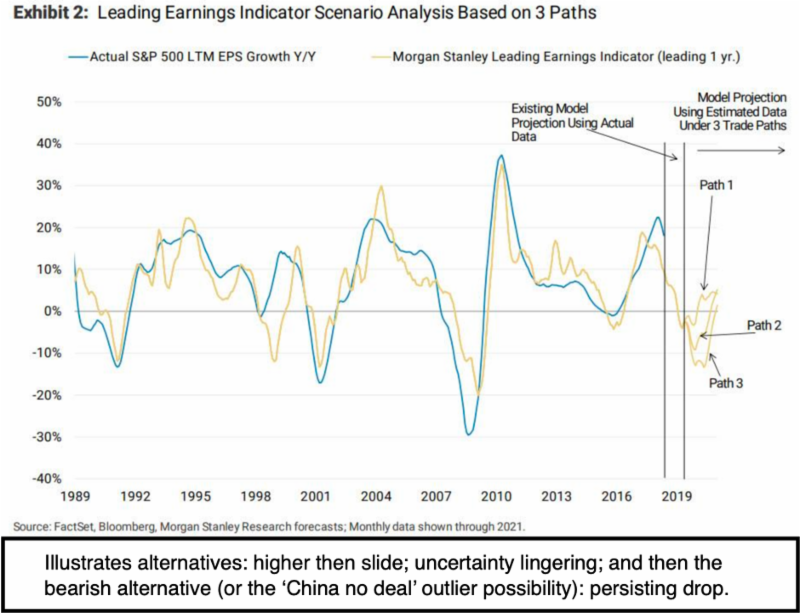

With the S&P back up to (and rolling on either side) of 2900; definitely heard are extreme views, ranging to 'moonshots in technology if a deals' made' (I actually think that would be brief and sold-into on a trading basis at least); to collapse and crashes of the market if President Xi fails to show and we don't at least get an outline of a 'path forward' between the U.S. and China (well I've said if there's 'no deal' the market would tank; but it a process, which included a forecast June bump-up, that we've now seen).

For a trader, the response 'might' be to 'hedge' both directions or protection such as in options (especially if that trader is heavily involved in expensive technology stocks which would have significant risk if the plug is pulled). Of course for most (including big tech stocks) the investors who are in far-lower from a good while back (no later than the December forecast trading bottom for the S&P and a lot of other areas at least temporarily), either do that for a bit of insurance; or they lighten to the sleeping point (which varies of course) or they just wait and should there 'be' a deal, and a moonshot; only then try considering taking more money 'off the table' into likely unsustainable gains.

However, the elements of the rally at 'this' point won't reveal the outcome; a reference to why 'moat building' (or mental preparation) may be reasonable. I believed investors/traders got too pessimistic after May's expected decline, and that the market now is running into certain resistance ceilings; but they can be overcome 'if' there is a satisfactory outcome from G20.

In sum: the market's positioning itself for meaningful S&P moves either way by virtue of this thrust higher; and whether it's an appropriate repricing isn't known. What is known is that the daily overbought status is reestablished to a degree; but if you get a 'deal', you can move stocks even higher; briefly.

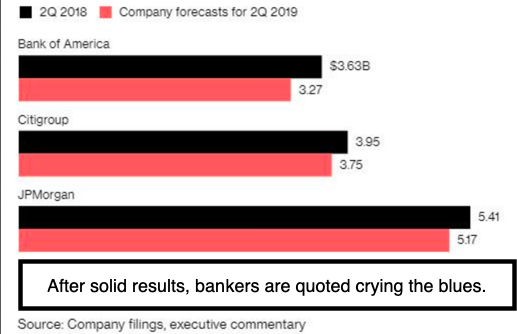

Presuming you don't get a 'perfect deal', the market will be mixed and they'll focus again on the Fed, which incidentally isn't a rock-solid assumption. The crowd presumes a strong earnings season (better than might be thought in a tariff-era, which however hasn't had much real-world impact on pricing as of yet); and there is greater embrace (and evidence) of our view that a great many companies are resourcing their supply-chains (for some time now); so it raises the bar for China to make a deal to plug the leakage to countries of course with low production costs, or in some cases back to the USA.

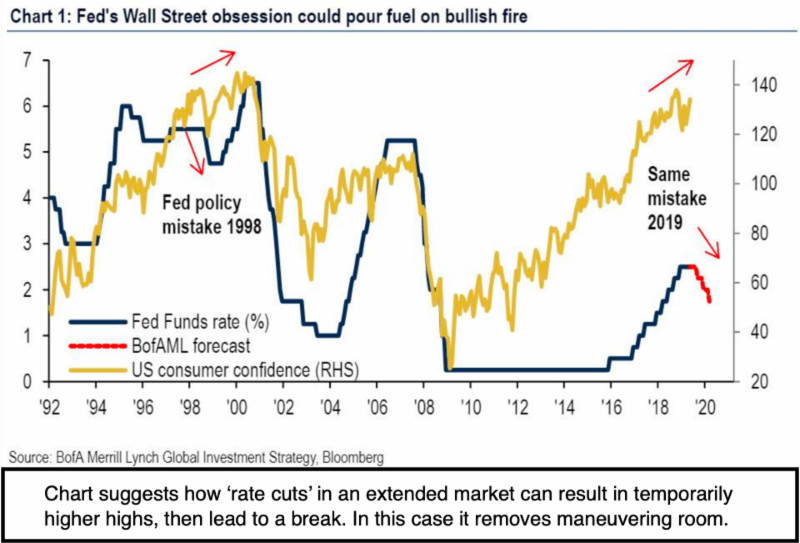

The Fed (if they cut as an 'insurance' and politically expedient move they're fond of saying they won't do) while they're in a rock-and-hard place. Given a sluggish economy, but one that's not falling off-a-cliff, we're looking primarily at foreign rates low (globally really); attracting funds to the U.S. (we want to keep that going, and Washington may not widely grasp that); while it relates to 'relativity' compared to yields overseas.

Now the G20 still is key; and maybe we'll hear about coordinated stimulus (I am not taking sides, but in a way disdain essentially negative rates, while it is fairly clear that central banks are nervous as heck about trying to restrain decline from becoming outright deflation; a word they all hate to use). There is a squeeze, and the U.S. cutting might emphasize both concern and even recognition of the excess of that last rate hike.

Bottom line: progress at G20; a Fed rate cut; and/or a China deal... all are capable of thrusting S&P higher, but unlikely sustainably. None occurring iseither going to provoke a significant declining phase or (perhaps likely) we'll get some but not all of that; resulting in a sort of rotating swing we've gotten accustomed too (and was actually our forecast during parts of this year and much of last year until the 2nd 'crash alert' call in early September). Not very exciting; but it was valid analysis of the situation.

Here we have uncertainty about fundamental factors that will impact market behavior. Markets dislike vague prospects, so you get the roller-coaster. It's a backdrop that invites hedging or just fading (inverse) initial reactions to all the news (or lack) that's evolving over the two weeks just ahead. The worst case would be a lack of eye-to-eye thinking with China (though we concur it won't be the actual outcome, even if we have a deal); and then the US leans on the EU (particularly German automobiles). Markets wouldn't be pleased.

All of this does enhance companies likely increasing US centric production; and we think that's already an ongoing trend. You don't need tariffs to close down anything; just the awareness they're in the armamentarium works well enough for Washington. Even some staunch Trump haters recognize there are attributes of trade (if not migration) policies that have merit. That's why a lot of Congressional leaders are saying it's the 'style and threat approach' so disdained. Well they say we don't negotiate that way. But the U.S. did, and so far, to a degree, it's working (if indelicate at times). The people take note and realize the bar is set for the future (more focus on growing the U.S.). It's a trend that may to some degree prevail even after this Administration.

Conclusion: stay nimble; realize we've basically had our expected rebound in June; and that whether or not it extends further depends on news. This is likely to be a more significant influence on the technical picture ahead, than the swings we've seen over the last few months; which were largely focused on technicals, with the news being the backdrop; not so much instigator (of course aside the knee-jerk responses to tweets and so on). S&P resistance and support levels and again resistance appeared about where they should; but now that can be variable (influenced) due to crucial trade news.

Trade's a more important factor than the Fed focus here. History shows that Fed cuts can sometimes stimulate a market temporarily; but not sustainably, when cuts come at such low level that a 'trend' of reduction isn't feasible.