Managing The Canadian Federal Debt In The Coming Years

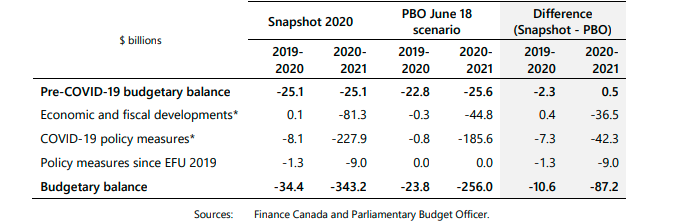

When the Canadian Government presents its next fiscal statement, the deficit and the outstanding debt will be the hot topic of debate. The Parliamentary Budget Office (PBO), in April, using federal measures already in place, estimated that the budget deficit would increase from C$24.9 billion in 2019‑20 to C$252.1 billion in 2020-21. ( https://www.pbo-dpb.gc.ca/en/covid-19) . According to PBO estimates, the deficit would be 1.1 % of GDP in 2019-20 rising to 12.7% of GDP in 2020-2. A combination of rising deficits and slower nominal GDP will result in a federal debt-to-GDP ratio of 48% in 2020-21. Large as this ratio is, this level is well below the peak of 67% of GDP reached in 1995-96.

Nonetheless, the sudden explosion in deficits is now taking on a life of its own and will likely draw greater attention in the face of so much economic uncertainty. Government spending to combat the deep recession caused by the pandemic is far from over. Early indications are that additional spending will be needed. Since the release of the PBO report in April, the federal government has announced larger budgetary deficits, primarily due to the inclusion of additional stimulus measures. Possibly, we can expect new stimulus measures over the course of the fall and winter as we learn more about the economic fallout from COVID-19. The PBO anticipates that the budgetary conditions will deteriorate further by an additional C$ 87 billion in 2020-21 (Figure 1).

(Click on image to enlarge)

Figure 1 Canadian Federal Budgetary Balances

Forecasts of rising deficits have sounded alarm bells. The fear is that levels are too high and are “unsustainable” in the face of such great uncertainty. Economists have struggled to define what are manageable debt limits. Recently, the most famous attempt was by Kenneth Rogoff and Carmen Reinhart. They argued that when debt reaches 90% of GDP the result is a serious slow down in economic growth. Although Canada is nowhere near that ratio, the sudden surge in the federal deficit has and will likely be topic number one when Parliament returns later in the fall.

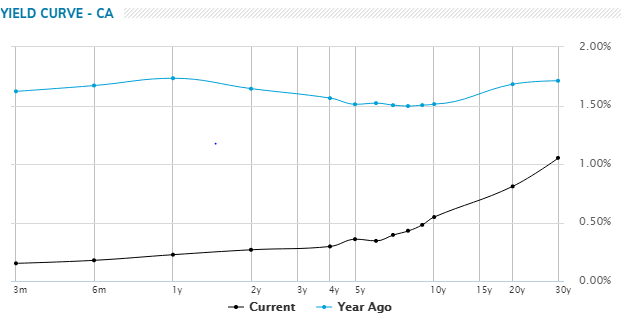

One of the prime reasons governments have managed to service their debts is that interest rates, on average, have been below economic growth rates which lessens the burden of carrying debt. Figure 2 shows the dramatic drop in Canadian Government bond yields in just 12 months. Even going out further along the curve to 10 -30 years range, yields are down more than 50 bps. The Government has indicated that it intends to increase its issuance of bonds with maturities of 10- and 30-years from 14 % of total issuance to 26 %. Although the costs of issuing long-date debt is slightly higher, it provides predictability and certainty regarding future interest expenses. The PBO estimates “that the Government’s planned 2020-21 gross debt issuance of $713 billion will cost $2.2 billion in annual interest expense; by comparison, the same amount of debt issued using the 2019-20 maturity structure would cost $1.9 billion.”

(Click on image to enlarge)

Figure 2 Canadian Yield Curve

Servicing the debt is one thing, but the issue of reducing the debt load, debt/GDP, is another matter. Economic growth can cure many ills. Eventually economic growth will return and will be greater than the rate of the interest charged on the debt, further reducing the debt burden.

As the economy recovers, both the servicing of the debt and the debt/GDP will fall reducing the overall debt burden.