Malaysia’s Central Bank Surprises With 25 Basis Point Rate Cut

Bank Negara Malaysia’s (BNM) rate cut today is yet another insurance move to support growth, while inflation remains benign. We believe BNM's brief easing cycle has run its course.

A pre-emptive easing

Contrary to the near-unanimous consensus of stable monetary policy, the Bank Negara Malaysia’s Monetary Policy Committee decided to cut the Overnight Policy Rate by 25 basis points to 2.75% at their meeting today.

The BNM statement painted a cautiously optimistic economic outlook, noting a gradual improvement in consumption, investment and exports amid persistent external risks from global policy uncertainty and geopolitics. It also pointed to another year of modest inflation, with risks mainly stemming from commodity prices. However, it concluded by describing today’s move as “a pre-emptive measure to secure the improving growth trajectory amid price stability”, which indeed is a loud and clear message given the consensus of no change in policy at this meeting.

We believe the BNM’s brief easing cycle with only two rate cuts (the last 25bp cut was in May 2019) has now run its course. We expect no more cuts this year.

Stable inflation outlook

Also released today, the consumer price data for December revealed inflation ticking up in line with consensus to 1.0% year-on-year from 0.9% in the previous month. The seasonal rise in food prices explains most of the increase in the headline inflation rate - a 1.7% yearly rise in this component was up from 1.5% in November. Among other key CPI components, inflation in housing was unchanged at 1.7%, while the transport component posted a smaller decline (-1.9% vs. -2.4% in December) which was mostly due to a favourable base effects rather than underlying price recovery.

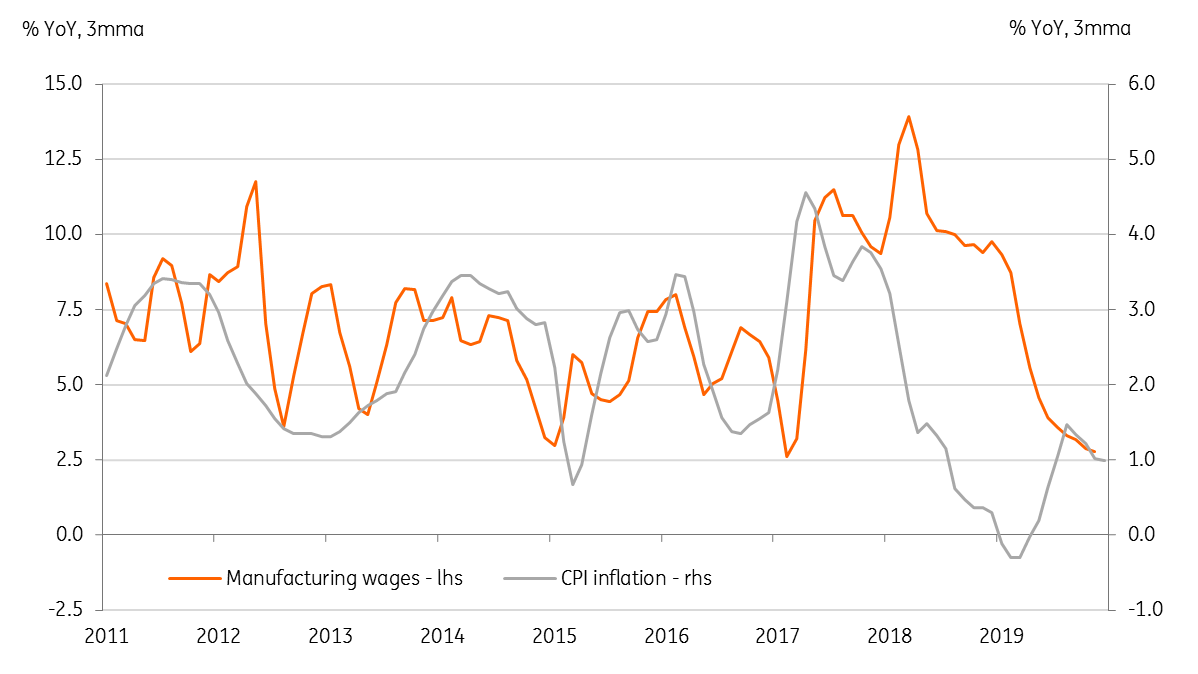

The annual inflation rate of 0.7% in 2019 was the lowest in a decade and down from 1.0% in 2018. We share the central bank's view that inflation won’t be a problem this year as demand-side price pressures should remain muted, especially as wage growth has been on a downward trend. Our 2020 inflation forecast is 1.2% (Bloomberg consensus 1.9%).

Manufacturing wage growth and CPI inflation

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more