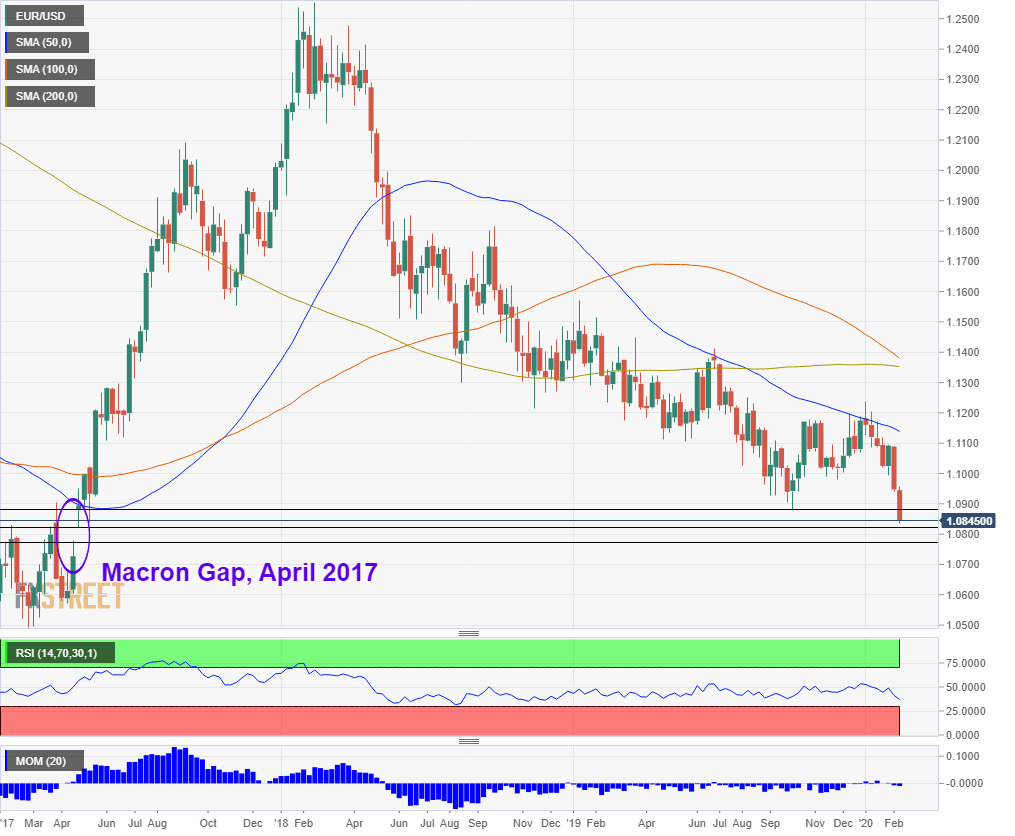

Macron Gap May Result In 50-100 Pip Fall In EUR/USD

- EUR/USD has been extending its slide amid economic divergence and other factors.

- It is nearing the chart gap created by French President Macron’s victory in April 2017.

- The slow grind lower may turn into an avalanche.

Is EUR/USD moving too slowly? The world’s most popular currency pair has been stuck for months and even when it hints multi-year lows – the move is somewhat frustrating.

That may change soon.

Euro/dollar is suffering from worsening economic conditions in Germany, whose manufacturing sector’s output continues squeezing. The locomotive of the eurozone had already been struggling with shrinking output, and the coronavirus outbreak risks its exports to China.

On the other side of the Atlantic, the US economy continues growing at a solid pace, with jobs aplenty – as the recent Non-Farm Payrolls report showed. Moreover, the world’s largest economy is benefiting from consumer spending and its industrial sector has also picked up.

Politics have also been playing a role. President Trump’s approval ratings have been improving – thanks to the economy and to his opponents’ chaos in the Iowa caucuses. In Germany, Chancellor Angela Merkel has been left without an heir after a political scandal involving the extreme right hit the party.

Macron Gap – Bounce or total collapse?

(Click on image to enlarge)

EUR/USD has already dropped below 2019 low and is trading at levels last seen in the spring of 2017. Back then, the common currency kicked off its rally in response to politics in Germany’s neighbor, France. Emmanuel Macron, unknown to many not long before the elections, won the first round of the presidential elections with far-right leader Marine Le Pen coming second. His centrist position placed him as the clear favorite to win the second round – in which he triumphed by receiving two-thirds of the votes.

On the eve of the elections, EUR/USD hit a high at around 1.0770 and closed at around 1.0725. Markets opened as the results were pouring in. The pair started the new week at 1.0820 and only began correcting after surpassing 1.20. It eventually peaked at 1.2550 in early 2019 before turning south.

This “Macron Gap” makes 1.0820 a critical spot for EUR/USD. Will it serve as a point of correction with the pair rebounding? Or will it fall down the rabbit hole?

In the case of an upswing, recent short-term resistance lines such as 1.0879, 1.0905, and 1.0940 could be the upside targets.

In case it falls through the gap, EUR/USD may plunge rapidly to 1.0770 – a 50 pip drop – to close the high price before the elections. The downfall could double with a 100-pip plunge to 1.0720 if investors eye the closing price on the eve of the critical vote.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and ...

more