Lira Slides After Turkey Imposes FX Transaction Tax, Rebuffs US Over S-400 Purchase

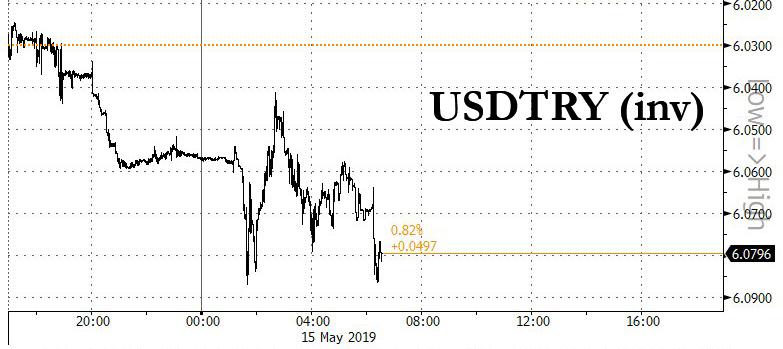

After rebounding briefly back over 6.00 against the dollar earlier this week, the Turkish lira has been drifting lower again in the past few days, with the slump accelerating overnight even as most EM currencies rebounded on China stimulus hopes, after Turkey announced it would reintroduce a 0.1% tax on some foreign-currency transactions in the latest desperation move to increase budget revenue for the fiscally challenged nation, but risks further raising investor angst that the government is taking on a larger role in managing the market.

The tax, which had been kept at zero for over a decade, will be introduced on foreign-currency sellers in hopes of limiting the decline in the currency but will accelerate it instead as what little faith is left in the Turkish lira is extinguished. The tax won’t apply to the interbank market and credit transactions, as it is designed "more to discourage FX buying” than to raise funds, according to Erkin Isik, chief economist at QNB Finansbank in Istanbul.

How much revenue will the tax generate? Well, the average trading volume in the local foreign-exchange spot market was $3.6 billion in April, according to central bank data, and according to Isik, the government could add an estimated 200 million liras ($33 million) in monthly revenue to the budget, or about 1.5 billion liras for the remainder of the year. The 12-month rolling budget deficit was 88.4 billion liras as of March, according to Bloomberg calculations using data from the Treasury and Finance Ministry.

In recent months as the lira has resumed its plunge to the record lows hit last summer, Turkey resorted to increasingly aggressive interventions to steady the lira, even engineering a currency crunch before March elections by pressuring local lenders not to provide liquidity to foreign investors. Ironically, officials have repeatedly denied any plans to impose capital controls.

“It sends the wrong signal to the markets,” Guillaume Tresca, a senior emerging-market strategist at Credit Agricole CIB, said by email. “The risk is it could deter further appetite from foreigners to invest in Turkey.”

Not helping the lira this morning, was the latest denial by Turkey that it would cancel its purchase of the S-400 Russian missile system, refuting a Bloomberg report from Monday. Speaking to reporters in Ankara on Wednesday, Foreign Minister Mevlut Cavusoglu said Turkey will press ahead with its plan to buy the S-400 air-defense missile system from Russia, ruling out a delay requested by the U.S.

“There is no delay or halt at this point,” Cavusoglu told reporters, defying the US demands for Turkey to cancel the Russian missile order.

Turkey’s plan to import Russian advanced weapons has added strains between the two NATO allies. The Trump administration last week asked Ankara to postpone receiving the advanced S-400 missile-defense system which was set for July, according to the people familiar with the proposal.

Following the FX tax news and the S-400 denial, the lira extended its losses against the dollar, trading 0.9% down at 1:25 p.m. in Istanbul.

The lira has weakened almost 13% versus the dollar this year, the worst performer in emerging markets after the Argentine peso. It was 0.7% weaker at 6.0546 per dollar as of 12:56 p.m. in Istanbul.

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more