Libor Transition: Bank Of England Cranks Up The Pressure

The Bank of England is expediting the transition away from Libor. We review the implications for sterling rate markets and take stock of the transition.

Source: Shutterstock

Libor-linked collateral beware

The Bank of England has taken additional steps that should ensure the transition away from Libor interest rate benchmark.

In a market notice, the central bank said it will gradually increase the haircut imposed on Libor-linked collateral used in liquidity operations. This will result in counterparties pledging Libor-linked collateral, primarily loans and securities, to the central bank receiving less cash in return. The additional haircuts will come into force in October 2020 and will increase gradually all the way through to December 2021. In addition, securities referencing Libor issued after 1 October 2020 will not be eligible for these operations. Helpfully, a distinction could be made for collateral including robust fall-back language.

If the changes make sense to reflect the greater operational risk posed by Libor-linked securities after the possible discontinuation of Libor, it will also act as an additional incentive for market participants to transition away from Libor. It is also consistent with the Working Group on Sterling Risk-Free Reference Rates’ (RFRWG) aim of ceasing issuance of cash products linked to Libor by 3Q20.

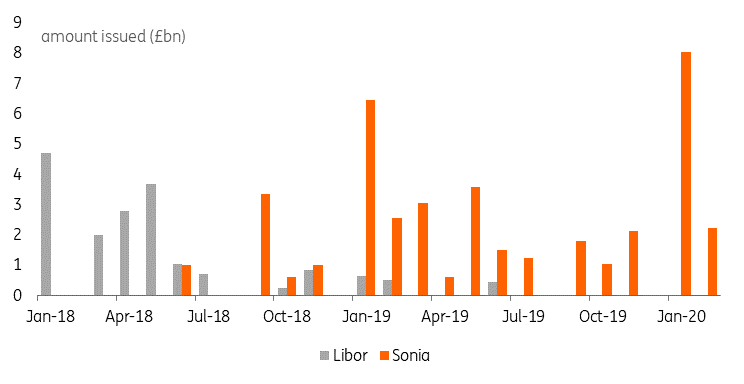

Sonia-linked bonds has overtaken Libor ones...

(Click on image to enlarge)

Source: Bond Radar, ING

Progress report: Near-term deadlines

For securities, there is ground for optimism. Issuance of Sonia-linked bonds, the preferred Sterling Risk-Free Rate (RFR) replacement to Libor, has all but overtaken Libor-linked ones.

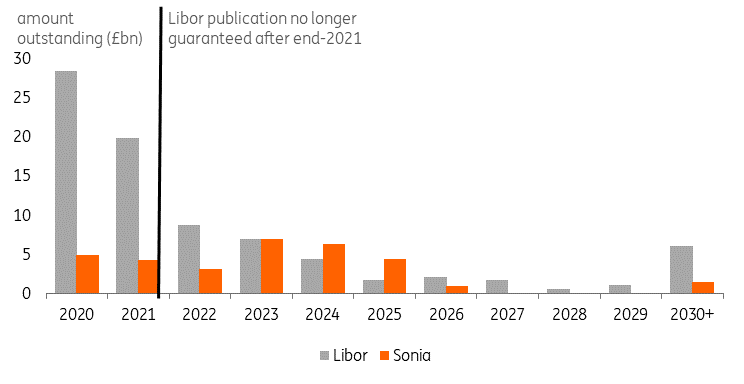

A significant amount of Libor-based bonds are still outstanding with a maturity past 2021, however, the transition for other cash products, in particular loans, is progressing albeit at a slower pace due to the sheer number of contracts to amend, and of counterparties to inform. The RFRWG thinks 90% of loans could be referencing Sonia in the future.

But there remains Libor-linked bonds maturing post-2021

(Click on image to enlarge)

Source: Bloomberg, ING

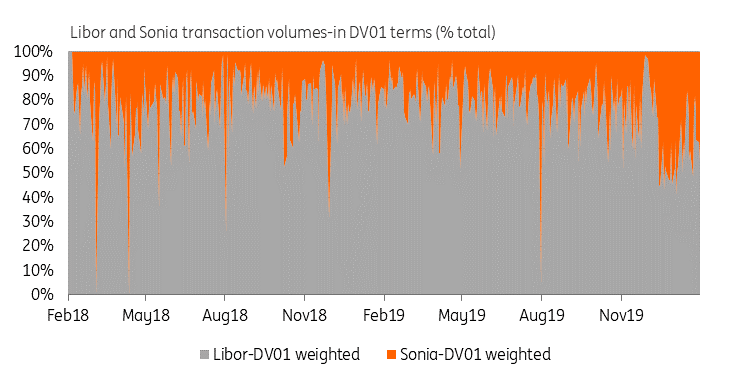

Hedging flow around the launch of Sonia-securities and loans is also helpful in building up liquidity and familiarity with Sonia swaps ahead of the RFRWG’s aim of switching the convention from Libor to Sonia on 2 March 2020.

More broadly, the fact that the reformed Sonia, rather than a new benchmark, was selected as replacement to Libor is helpful for the Sonia swap market to quickly reach critical mass.

Sonia swaps volumes market share has increased

(Click on image to enlarge)

Source: Bloomberg, ING

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more