Let's Talk Turkey

The manipulation of those who play with the dollar will explode in their hands and their hands will be burned

- Turkish Economy Minister Nihat Zeybekci

He's repeatedly threatened that "speculators will be burned" in reaction to the collapse of his country's currency. It is always a bad sign when politicians scapegoat us speculators, but is perhaps even more ominous in a part of the world where it is never entirely clear how rhetorical the plans are for said speculator burning.

Central bank independence is somewhat in question this year as Recep Tayyip Erdoğan threatens bankers with jail if they do not cut rates. Turkish prisons are nothing like US-style "Club Fed" where nice banker types can play tennis and golf and work on their hobbies. So, this type of threat probably will get their attention.

In any event the foreign exchange markets are in no mood for waiting to find out.

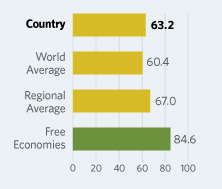

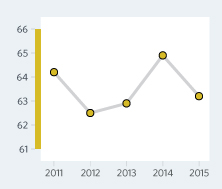

Despite a collapsing currency, Turkey has been improving in a number of other areas, including improvements in bank capital ratios, public debt levels, current account balance and tourism. As far as tourism, it is a beautiful country worth visiting anytime between April and October. It is more affordable with the currency decline. If you want to visit, there are walking tours that can make planning easy. Its market cap to GDP is currently around 39%. In terms of economic freedom, it is slightly better than the world average.

For your consideration, Turkish Investment Fund (TKF) trades at a discount of over 10% to NAV, which is beneath its 10-year average. It is broadly diversified between financials, consumer goods, and telecommunications. It offers a modest distribution yield of 2.65%. So far, it is off to a rough start in 2015.

With a little time, stability, and mean reversion, things could improve significantly by the end of the year. One partial hedge to consider would be to write August 21 2015 $46 calls on iShares MSCI Turkey ETF (TUR), which last traded for $3.00, with a bid of $2.55 and ask of $3.10. If you are able to write such contracts roughly twice per year against a TKF position, you can capture some premium while partially offsetting any future widening of TKF's discount to NAV.

Disclosure: The author is long TKF.

Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep ...

more