Lagarde Channels Past Self As To Japan Going Global

As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar.

The neighbor everyone though most likely to be sponged off of was Europe. The day after the Fed’s second launch, Lagarde loudly complained, “the euro bears the brunt of the move.”

The euro is clearly the variable of adjustment. On the one hand, the dollar is going down with a monetary policy designed to that effect; on the other hand, the Chinese yuan is not floating freely, which means another currency has to rise.

What was needed, according to Lagarde, was “to rethink the international monetary system and cooperation mechanisms.” Couldn’t have said it better myself, so long as Christine Lagarde and everyone like her was kept far, far away from the investigation. They really have no idea what’s going on.

The euro, of course, didn’t rise because the dollar didn’t weaken. Quite “unexpectedly” for all the Economists and policymakers, the opposite ended up happening in 2011 and beyond. The dollar is still up to this day, and the very idea of “currency wars” quietly retired by results that still haven’t been explained in the policy circles Christine Lagarde too easily blends in with.

This was not a small miss. Neither is the one Lagarde now as President of the ECB just teed up for every single one of her critics. At her first press conference heading up Europe’s central bank, she was asked about Europe becoming Japan. She replied:

I don’t think Japanification is on the cards at all.

Huh? If we characterize such a thing properly, as a prolonged period of slow growth, no inflation, an overactive central bank, and zombie depository institutions who refuse every prod to lend, Europe’s been Japan for quite too many years already.

Every single one of Europe’s economic cards has a picture of the Japanese islands stamped right on them.

Japanification is a river in Egypt.

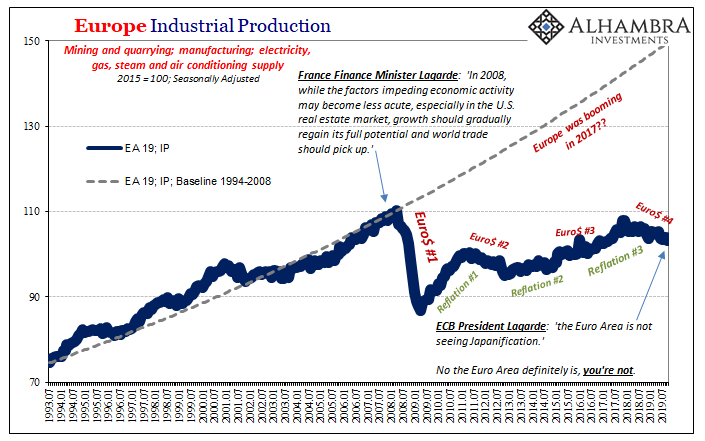

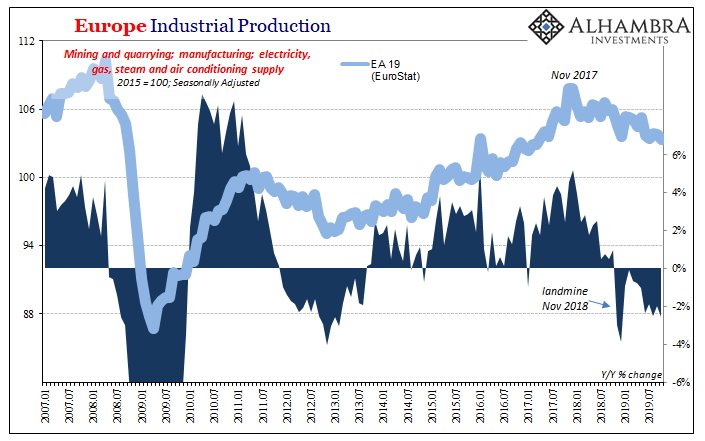

She can get away with this kind of statement because of how it all comes about – not all at once and certainly not in a straight line. In other words, like Japan in the nineties, Europe in the tens didn’t just fall down after ’08 and stay that way. It has ebbed and flowed like everyone else. Rather than a straight decline, Japan’s “lost decade” was actually a series of false dawns. Only false dawns.

The problem, for public purposes, has been how they are always characterized. Every minor upturn is described as gigantic booming of epic proportions, the skilled result of so much monetary genius, when, in fact, each one has actually turned out to be a false dawn. Every single time. Japan as well as Europe.

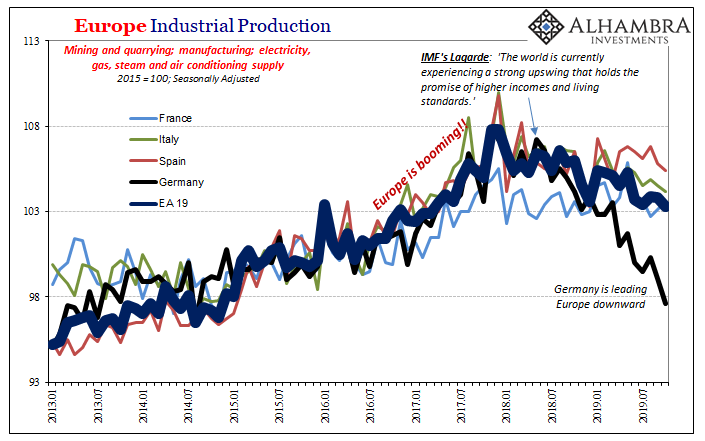

As if to make a further mockery of Lagarde’s arrogance, Eurostat reports today European industrial conditions. I’m having a lot of trouble, as you probably are, figuring out which part of the last decade was booming.

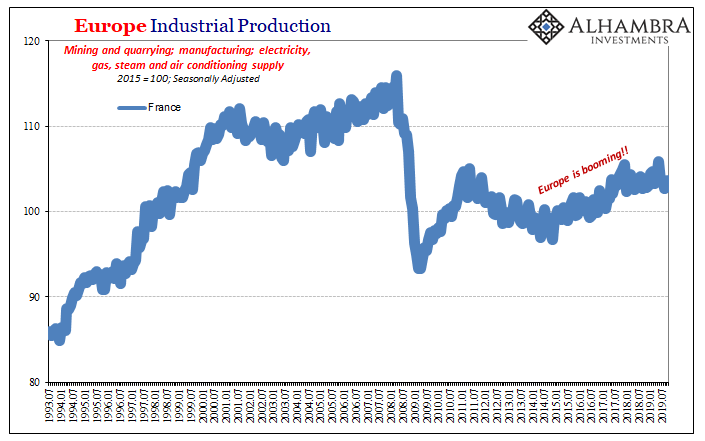

In some places, Japanification is more obvious than others. Take, for instance, Lagarde’s home country of France:

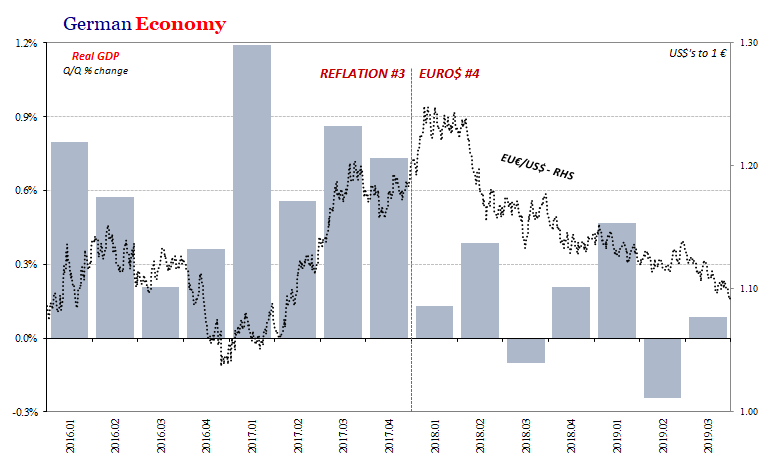

French industrial output, according to Eurostat, is stuck at levels of production the French economy managed in 1999. And now even that much is falling, too, along with the rest of Europe “somehow” being pulled downward starting in Germany.

If Lagarde like any of the others, including her predecessor Mario Draghi, was serious about Japanification they might begin by examining how it would come about. Perhaps looking more closely at the early global “recovery” period and what they all got so wrong.

Maybe something to do with rising not falling dollars.

When the dollar falls, for reasons that have nothing to do with QE, the world grows the tiniest bit while central banker confidence in that tiny bit grows enormously. The mainstream narrative somehow follows the hyperbole rather than the dollar’s obvious context. The currency wars were never what they said.

When the dollar rises again, as it always does, everything goes in reverse. When you realize how each time it does it was preceded by a false dawn rather than a boom things begin to make a whole lot more sense. From politics in Europe to the social consequences of a decade in utter stagnation.

You know, Japanification.

Lagarde in 2010 was pleading for a falling euro and she got her wish. And now that she’s in charge of the ECB, she has it again. Boy does she.

If only the dollar had gone up in a straight line, maybe then Japanification would be a simple issue acknowledged in broad and unquestionable fashion. It actually is in terms of data and performance, but no one ever bothers with that stuff. Lagarde says Japanification isn’t possible, for most that’s the end of the story right there.

Except it really isn’t. Just like the currency war that never happened. And to this day, practically no one wonders why it didn’t. Least of all, it appears, Christine Lagarde.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more