Key Events In The Coming Week: All About Earnings And The ECB

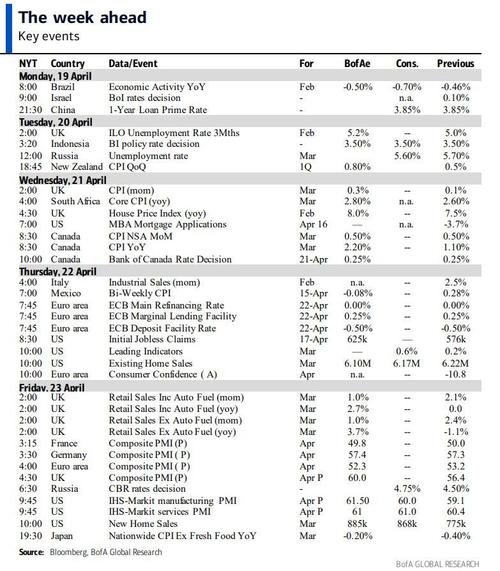

As Jim Reid summarizes events over the next five days, there’s a reasonably eventful calendar for markets this week, with the highlights including Thursday’s ECB meeting and Friday’s release of the April flash PMIs from around the world. Investors will also be paying attention to the latest earnings releases, with a further 80 S&P 500 companies reporting, as well as the continued path of the pandemic as a number of places such as India have faced a big surge in cases. There have been around 5.1mn cases reported across the globe over the past 7 days, the highest weekly increase since the pandemic began. India contributed north of 1.4mn cases to this increase which is also its largest weekly gain and continues to remain the current epicenter of the virus. Elsewhere both Osaka and Tokyo may go into a fresh state of emergency conduction as soon as today. On a more positive note, Fauci said that he expects a decision on how to resume vaccinating Americans with the J&J COVID-19 vaccine will probably come by Friday and added that “I doubt very seriously if they just cancel” the J&J vaccine. We wonder if the people who chose the J&J vaccine will fly to their vaccination spot using a 737 MAX.

From central banks, this week’s highlight will be the latest ECB decision on Thursday, along with President Lagarde’s subsequent press conference. In their preview, Deutsche Bank's European economists write that a change in the policy stance is unlikely and that a decision on whether or not to maintain the new faster pace of PEPP purchases will be made after a joint assessment of financing conditions and the inflation outlook at the Governing Council’s next monetary policy meeting in June. However, at this point, it’s unclear whether they will maintain that higher pace beyond June. Although a latent recovery is building and ‘net-net’ issuance (net issuance, net of ECB purchases) ought to turn favorable for rates markets following the Q1 spike, the ECB consensus is cautious and determined to avoid a premature tightening in financing conditions.

Staying on Europe, another important event will take place in Germany today, as the Green party present their first chancellor candidate in the 41-year history of their party. This is an important one to look out for, as the CDU/CSU’s slump in the polls has put them only a few points ahead of the second-place Greens, so it’s no longer implausible that the next German chancellor could come from the Greens following September’s federal election. DB's view is that the odds appear slightly tilted towards co-leader Annalena Baerbock being selected, which proved to be the case. In terms of the election result, a CDU-CSU/Green coalition is still seen as the baseline scenario, with Conservatives expected to regain polling momentum. Talking of which, it’s also possible that the CDU/CSU will agree on who will be their candidate over the next day as Armin Laschet and Markus Soeder have been having behind-closed-door discussions since Friday to hammer out which of them will be on the ticket come September. Overnight, the headlines have leaned more favorably towards Markus Soeder with CDU lawmaker Christian von Stetten suggesting in an interview yesterday that Laschet’s leadership bid would be rejected by the CDU/CSU caucus in a vote on Tuesday if the issue isn’t resolved before then.

On the data front, it’s a lighter week ahead, with the main highlight likely to be at the end of the week with the flash PMIs for April. This will give us an initial indication of how global economic performance has fared at the start of Q2, and there’ll be particular attention on the price gauges as well as investors stay attuned to any signs of growing inflationary pressures. In terms of central banks, there are a few other decisions alongside the ECB, with Canada, Russia, and Indonesia all deciding on rates. However, there won’t be any Fed speakers as they’re now in a blackout period ahead of their own meeting the week after.

Earnings season kicks up another gear this week, as 80 companies from the S&P 500 report along with a further 54 from the STOXX 600. Among the highlights include Coca-Cola and IBM today, before tomorrow sees reports from Johnson & Johnson, Procter & Gamble, Netflix, Abbott Laboratories, Philip Morris International, and Lockheed Martin. Then on Wednesday, we’ll hear from ASML, Verizon, NextEra Energy, and Thursday sees releases from Intel, AT&T, Danaher, Union Pacific, and Credit Suisse. Finally, on Friday, there’s Honeywell International, American Express, and Daimler.

Courtesy of Deutsche Bank here is a day by day preview of the week ahead

Monday, April 19

- Data: Japan March trade balance, final February industrial production

- Earnings: Coca-Cola, IBM

Tuesday, April 20

- Data: Japan February tertiary industry index, UK February unemployment, Germany March PPI

- Central Banks: Bank Indonesia monetary policy decision

- Earnings: Johnson & Johnson, Procter & Gamble, Netflix, Abbott Laboratories, Philip Morris International, Lockheed Martin

Wednesday, April 21

- Data: UK March CPI, Canada March CPI

- Central Banks: Bank of Canada monetary policy decision

- Earnings: ASML, Verizon, NextEra Energy

Thursday, April 22

- Data: US weekly initial jobless claims, March existing home sales, leading index, Chicago Fed national activity index, April Kansas City Fed manufacturing activity, Euro Area advance April consumer confidence

- Central Banks: ECB monetary policy decision

- Earnings: Intel, AT&T, Danaher, Union Pacific, Credit Suisse

Friday, April 23

- Data: Flash April manufacturing, services, and composite PMIs from Australia, Japan, France, Germany, Euro Area, UK and US, UK April GfK consumer confidence, March retail sales, public sector net borrowing, Japan March nationwide CPI, US March new home sales

- Central Banks: Central Bank of Russia monetary policy decision

- Earnings: Honeywell International, American Express, Daimler

* * *

Finally, focusing on just the US, it's a quiet week on the data front with Goldman writing that the key economic data release this week is the jobless claims report on Thursday. There are no speaking engagements from Fed officials this week..

Monday, April 19

- There are no major economic data releases.

Tuesday, April 20

- There are no major economic data releases.

Wednesday, April 21

- There are no major economic data releases.

Thursday, April 22

- 08:30 AM Initial jobless claims, the week ended April 17 (GS 610k, consensus 625k, last 576k); Continuing jobless claims, the week ended April 10 (consensus 3,700k, last 3,731k): We estimate initial jobless claims increased to 610k in the week ended April 17.

- 10:00 AM Existing home sales, March (GS -4.5%, consensus -1.1%, last -6.6%): We estimate that existing home sales declined by 4.5% in March after falling by 6.6% in February. Existing home sales are an input into the brokers' commissions component of residential investment in the GDP report.

Friday, April 23

- 09:45 AM Markit Flash US Manufacturing PMI, April preliminary (consensus 60.5, last 59.1)

- 09:45 AM Markit Flash US services PMI, April preliminary (consensus 61.5, last 60.4)

- 10:00 AM New home sales, March (GS +11.5%, consensus +14.2%, last -18.2%): We estimate that new home sales rose by 11.5% in March, reflecting a sequential improvement after February’s 18.2% decline due to winter storms.

Source: Deutsche Bank, BofA, Goldman

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more