Key Events In EMEA Next Week - Saturday, Sept. 18

Hungary's central bank is set to continue its hawkish tone after the reopening boom pushed inflation higher, whereas Turkey is maintaining a more dovish stance. In Poland, the recovery in industry has been solid, but retail sales figures may disappoint as consumer demand has shifted towards services.

Hungary: Hawkish tone remains, and current account deficit expected to continue

As the Hungarian economy reopened, consumption and investment activity boomed. This generated a significant import flow, while on the export side, supply chain issues provided some bottlenecks. Income balances also turned more negative, resulting in a current account deficit in 2Q21. We see this deficit remaining with us in 2021 as a whole. We also see the National Bank of Hungary continuing its rate hike cycle, moving to a more conformist pace of 25bp. The tone should remain hawkish as we see the central bank reviewing its GDP and CPI forecasts upward for at least 2021, and probably in 2022 as well. When it comes to the inflation outlook risk assessment, we see the same outcome as before: upside risks remaining, which will indicate further tightening steps in the months ahead and probably point to a further cut in the size of the QE programme.

Turkey: Still too early for a policy rate easing

While August inflation exceeded the key rate, the Central Bank of Turkey has signalled a change to its earlier guidance to keep the policy rate “at a level above inflation”. It plans to switch its target to core inflation, given the growing divergence between the headline rate and non-food inflation due to ongoing pressure in food prices. Despite increasing market concerns for an early easing this month after these comments from the CBT, we are sticking to the view that the first easing will occur in November or December when “the significant fall in the Inflation Report’s forecast path is achieved”, as promised by the Bank earlier.

Poland: Industry recovering but retail sales expected to be lower than consensus

Industry in Poland is doing quite well, despite supply side constraints. A diversified structure of production is helping, and August should add a favourable calendar. Hence our forecast is a little higher than anticipated by the market consensus. The outlook for retail sales may be less positive. Although consumer demand rebounded strongly in 2Q21, with no signs of cooling down, we think that it shifted towards services, which finally became available after the easing of restrictions. Those services, unfortunately, are not part of retail sales, results of which will be published by the Central Statistical Office on Tuesday.

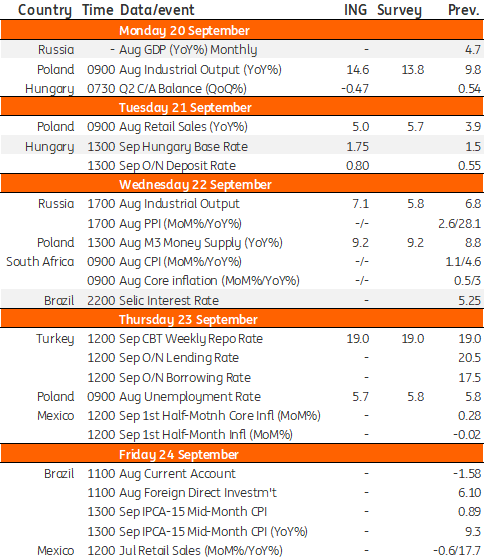

EMEA Economic Calendar

Refinitiv, ING, *GMT

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more