Key Events In EMEA And Latam Next Week - Saturday, Sept. 19

Turkey, Hungary and the Czech Republic are all set to keep rates on hold next week, however, we may see a 25 basis point rate cut in Mexico. Most central banks appear to be in wait-and-see mode going into autumn, as the need for further stimulus remains uncertain.

Turkey: Widening in the corridor structure possible

The Central Bank of Turkey has started gradually hiking the effective cost of funding - up by 300bp since mid-July to 10.3% now - by changing the composition of funding. In the current scheme, the CBT could push the effective cost of funding up to the late liquidity window rate of 11.25%, implying relatively lower flexibility in comparison to the latest inflation number of close to 12%. So given the CBT's stance of not changing the policy rate due to Covid-19 related uncertainties, we could see an adjustment and widening in the corridor structure at the September MPC meeting through changes in the late liquidity window and overnight lending rates.

Hungary: Rates to remain unchanged but with a hawkish tone

We see a significant deterioration in the Hungarian current account balance in the second quarter of 2020. The collapse of international travel and trade left a huge mark on the data, in our view. Other than this, the calendar will be light on data, so all eyes will be on the National Bank of Hungary on Tuesday. Inflation surprised on the upside recently, while growth surprised on the downside. We think the NBH will focus on the inflation story, but just by using words rather than action. Rates and unconventional tools should remain unchanged, but the press conference's tone could be a bit more hawkish than it used to be. The central bank will also reveal its main forecast figures before it releases its full Inflation Report on Thursday. We expect a major downgrade in GDP growth (from 0.3–2.0% growth to a 5–7% decline) with the inflation forecast to remain broadly unchanged.

Czech Republic: CNB set to keep rates on hold

The Czech National Bank is set to stay on hold next Wednesday as the current monetary setting seems to be optimal from the perspective of the CNB's Board. The latest economic data was slightly better than the CNB expected, though the recent sharp surge in COVID cases is a clear downside risk.

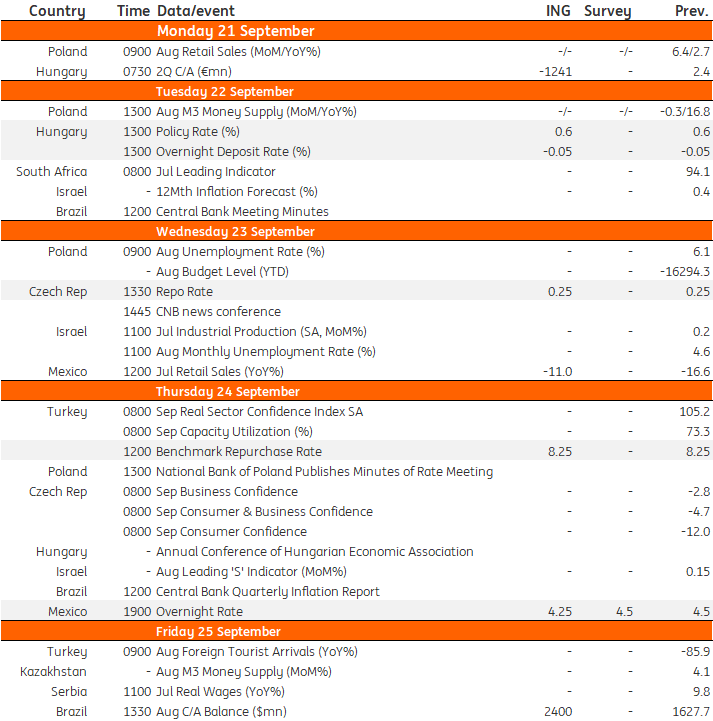

EMEA Latam Economic Calendar

ING, Bloomberg

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more