Key Events In EMEA And Latam Next Week - Saturday, Feb. 8

A busy week ahead in EMEA and Latam with two central bank meetings and lots of inflation numbers which seem to be creeping up everywhere.

Czech Republic: Uncertain January inflation

January inflation is usually difficult to estimate as many prices change at the beginning of the year. The uncertainty is even higher this year due to relatively more volatile food prices developing against traditional seasonality and tax changes, which might transmit into the final prices gradually. Still, some preliminary data suggests that fuel prices continued growing in MoM terms around 1%, as well as food prices.

Prices of cigarettes also started to grow gradually, though the tax effect will culminate most likely in March. We assume a 3% MoM increase in January suggested by some data. Together with other prices related to housing, we expect January inflation to increase by 1.2% MoM, reaching 3.4% YoY. On the other hand, 4Q19 GDP growth is expected to slow down to just 0.2 QoQ due to the delay effect of weaker foreign demand, reaching 1.9% YoY GDP dynamics after 2.5% in the previous quarter.

Hungary: Inflation's reality check

The reality check regarding Hungarian inflation will show a significant jump in prices. We see headline CPI moving to 4.5% YoY, mainly on the back of significant fuel price increase combined with an unfavourable base effect. Other than that, price changes in postal services, lottery and tobacco products (due to excise duty hike) will also add to the increasing inflation pressure along with the rising prices of food products.

However, core inflation is expected to come in at 4.0%, while the core ex-tax reading will be at 3.6%. This would also mean, that the upside surprise in headline inflation is mainly a result of temporary and not persistent factors. GDP growth is expected to slow markedly after a really weak Q4 in industry. We see a 4.0% YoY performance, which might still be enough to keep Hungary among the growth leaders in Europe.

Poland: CPI to push higher

CPI should increase further in January towards 4.2%YoY, due to the hike of energy tariffs and statistical effects on food & fuels. Simultaneously, core inflation is expected to accelerate by 0.1pp to 3.2%YoY. We forecast inflation should come in around 1Q at 4.5%YoY. Minimal wage hike should affect prices of services, also hike of excise tax for alcohol and tobacco would add some 0.2pp.

Simultaneously, first reading should confirm that GDP decelerated towards 3%YoY in 4Q. Annual 2019 GDP reading implies deceleration of private consumption and strong negative drag from inventories. On the other hand, it also presents a puzzling rise in investments.

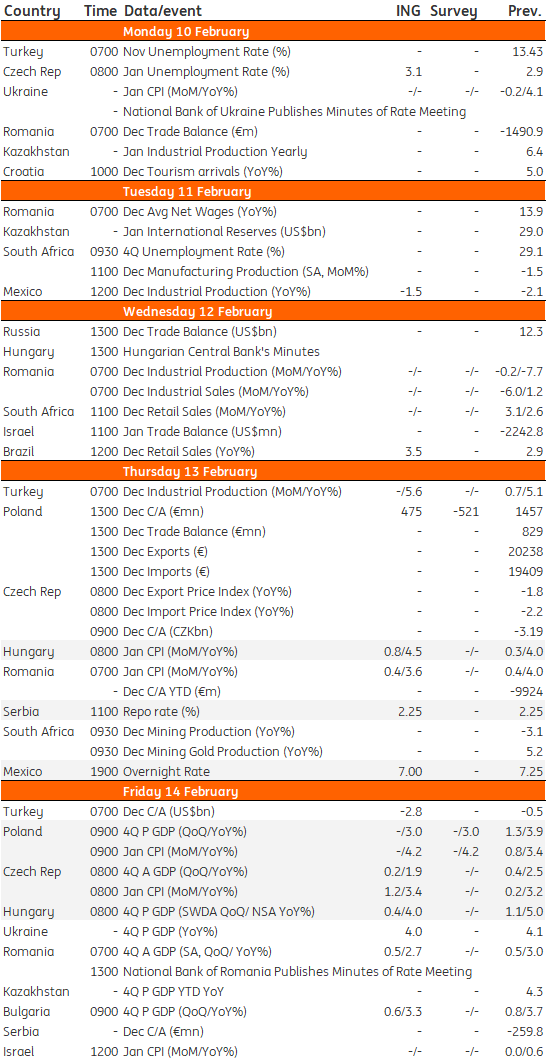

EMEA and Latam Economic Calendar

(Click on image to enlarge)

Source: ING, Bloomberg

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more