Key Events In Developed Markets Next Week - Sunday, May 2

Dat.a from the US continues to show a strong recovery is under way amid a successful vaccine rollout. Asset purchase tapering from the Bank of England is on the cards and the Scottish Independence debate will be in the limelight.

source: Shutterstock

US: From strength to even more strength

After another very strong GDP print, attention switches to the jobs story in the coming week. With 142 million Americans having received at least one dose of the Covid vaccine, the economy continues to reopen and consumers have more opportunities to spend their money – remember that household cash, checking and savings deposits have increased by $3tn since late 2019. The jobs report data is collected the week of the 12th of each month and between March 12 and April 12 we have seen a massive uptick in restaurant diners, a surge in airport travellers and very strong daily credit and debit card transaction numbers, which point to large increases in employment in the leisure and hospitality industries, retail and travel and logistics. Rising industrial output and a red-hot property market also point to good gains in manufacturing and construction employment meaning that in total, we expect to see total US employment rise by more than one million. We will get more data during the week to help us firm up our forecasts, including the ISM manufacturing and service reports along with the ADP’s survey of private payrolls.

In addition to highlighting strong order books, the ISM reports are also likely to indicate ongoing rapid increases in prices, which means we have a combination of strong growth, a vibrant jobs market and the prospect of more elevated and sustained inflation pressures in the US economy. As such, we suspect the Federal Reserve will be forced into an earlier policy tightening than the 2024 date for the first interest rate hike they are currently signalling, particularly with another $4tn of fiscal support set to hit the economy in addition to the $5tn already spent to support the economy through the pandemic.

Expect cautious optimism from the Bank of England – and some tapering?

We expect a series of upgrades to the Bank of England’s forecasts, including a bigger rebound in 2Q and a lower peak in unemployment. This encouraging outlook potentially means the Bank will take the opportunity next week to taper the pace of its asset purchases. At face value, this should come as no surprise – the BoE has already told us it will be doing this at some point. Policymakers expect to wrap up the remaining amount of gilt purchases around the end of the year, but at the current £4.4bn weekly pace, it will get there months earlier. A cut in the weekly buying pace to roughly £3bn/week from now onwards would allow the Bank to reach its target holdings of £875bn worth of government bonds around the end of the year.

Scottish Independence debate in focus as UK voters go to the polls

There are various UK votes next week, including Scottish Parliamentary elections. These come following a period of renewed focus on the question of Scottish Independence, though voters are now more 50:50 on the issue, erasing a previous lead for ‘Yes’ that had built up through the pandemic. The main question next week is whether the Scottish National Party (SNP) manages to gain an outright majority in the Scottish parliament, though there is a possibility of a coalition with the pro-independence Green party if they don’t.

The upshot is a formal request for a second independence referendum is likely over the next few years. And while London, which ultimately holds the power to allow one, will likely continue to reject such calls, the question is unlikely to go away. Indeed, if a referendum hasn’t been granted by 2024, the issue will likely play a key role in the next general election scheduled for that year.

Norges Bank – the hawkish outlier

As this is an ‘in-between’ meeting, we don’t expect much news from the Norges Bank next week. The Norwegian central bank looks on track to hike rates in December barring a negative economic surprise, and in fact, a move in September can’t be ruled out if the recovery in Europe is faster than expected over the summer.

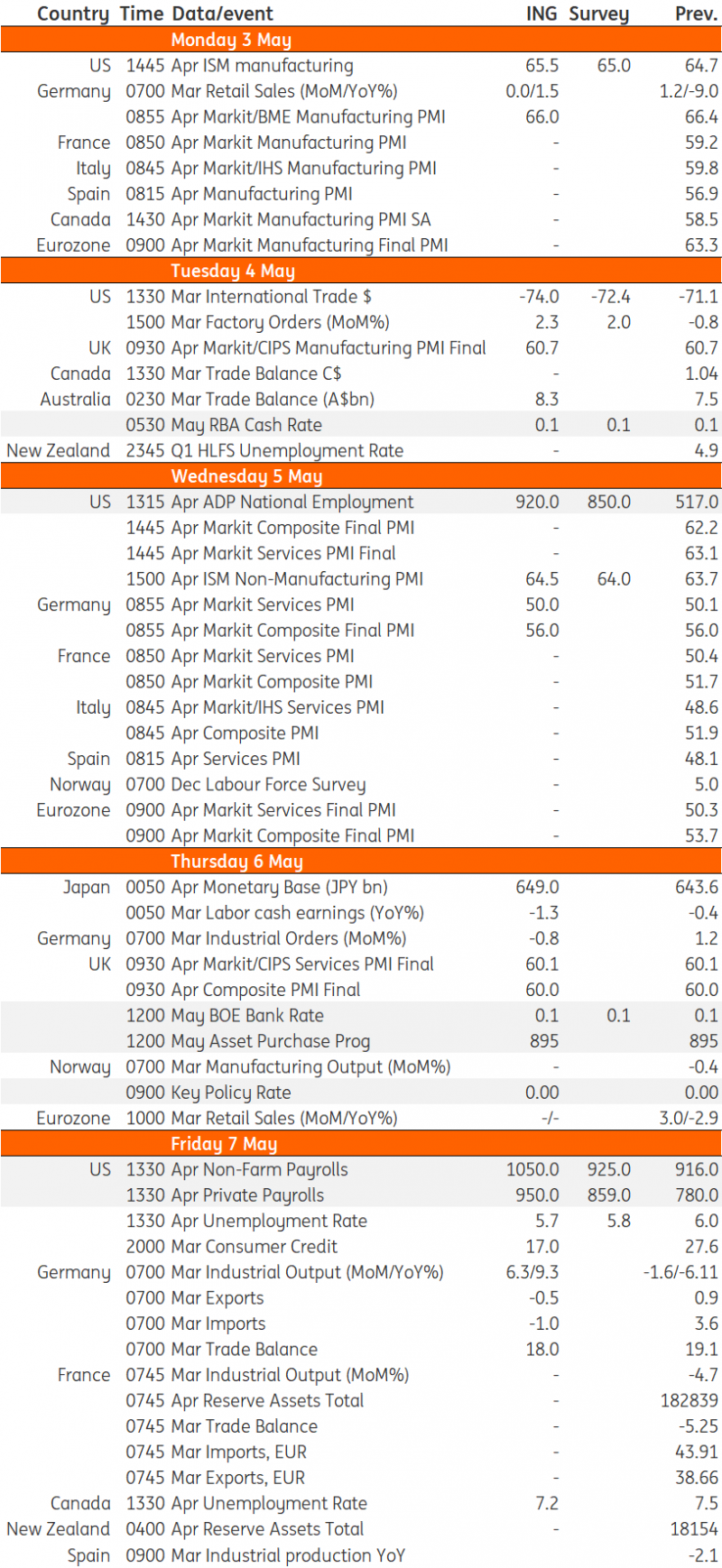

Developed Markets Economic Calendar

Source ING, Refinitiv

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more