Key Events In Developed Markets Next Week - Saturday, June 19

US: Three rate hikes in 2023 expected in Fed’s hawkish shift

The Fed’s hawkish shift continues to reverberate around markets.

Seven out of 18 Fed officials now expect a rate rise in 2022, with 13 out of 18 favouring 2023 for the start point. Previously it was four and seven members respectively for 2022 and 2023. The result is the Fed is now signalling 50 basis points of rate rises by the end of 2023, which is in line with the pricing on Fed funds futures contracts. Over the coming week we will get updates from eight individual Fed members, including Chair Jerome Powell. They could provide some nuance with hints on where they each see the balance of risks surrounding the outlook for monetary policy.

There is a combination of housing numbers, durable goods orders and personal incomes, spending and inflation data in terms of the economic releases. Housing figures have softened of late, but this reflects the lack of supply on the market, which has bid prices sharply higher. Actual demand remains strong but is unfilled. Durable goods orders should remain on a strong path, but again the issue is being able to meet that demand.

The ISM has reported a record order backlog with supplier delivery times continuing to lengthen. Consequently, we expect this to prompt more business capital expenditure in the quarters ahead. Rounding out the reports we may see a slight fall in income growth in a lagged response the stimulus payment in March not being repeated. However, income from private sources continues to improve, and spending should continue to expand. The focus, though, will be the core personal consumer expenditure deflator, the Fed’s favoured measure of inflation. It should post another sizeable gain as strong demand come up again, supply frictions in the economy.

Don’t expect many new rate hike clues from the Bank of England just yet

Will the Bank of England join the likes of the Bank of Canada in hinting at a possible rate hike in 2022?

Markets certainly are beginning to think this way and now have two hikes priced in by mid-2023 (albeit one of those is a ‘partial’ one from 0.1% to 0.25%). And we’ve also had Gertjan Vlieghe, a typically dovish committee member (though one that will shortly leave his post), floating the possibility of a hike later into 2022.

The reality is that the central bank is unlikely to say anything new on this next week, and indeed it has recently shied away from saying anything particularly concrete on the timing of a first move. Instead, UK policymakers have taken a leaf out of the Fed’s book by signalling it wants ‘significant’ progress on spare capacity before thinking about hiking. Having said that, the last set of forecasts from May (which won’t be updated next week) effectively endorsed the market’s then-view of 20bp of tightening by 2Q23. Forecasts based on that interest rate profile yielded no excess supply by the tail-end of its policy horizon and kept inflation roughly at 2%.

For the time being, we’ve pencilled in the first move for 1Q23, though we wouldn’t rule out an earlier move. Possible triggers include a more rapid unwinding of household savings or a more permanent-looking increase in wage growth. When discussing future rate rises, it’s worth remembering that the Bank of England under Governor Andrew Bailey seems fairly keen that shrinking the balance sheet should also do some of the heavy lifting.

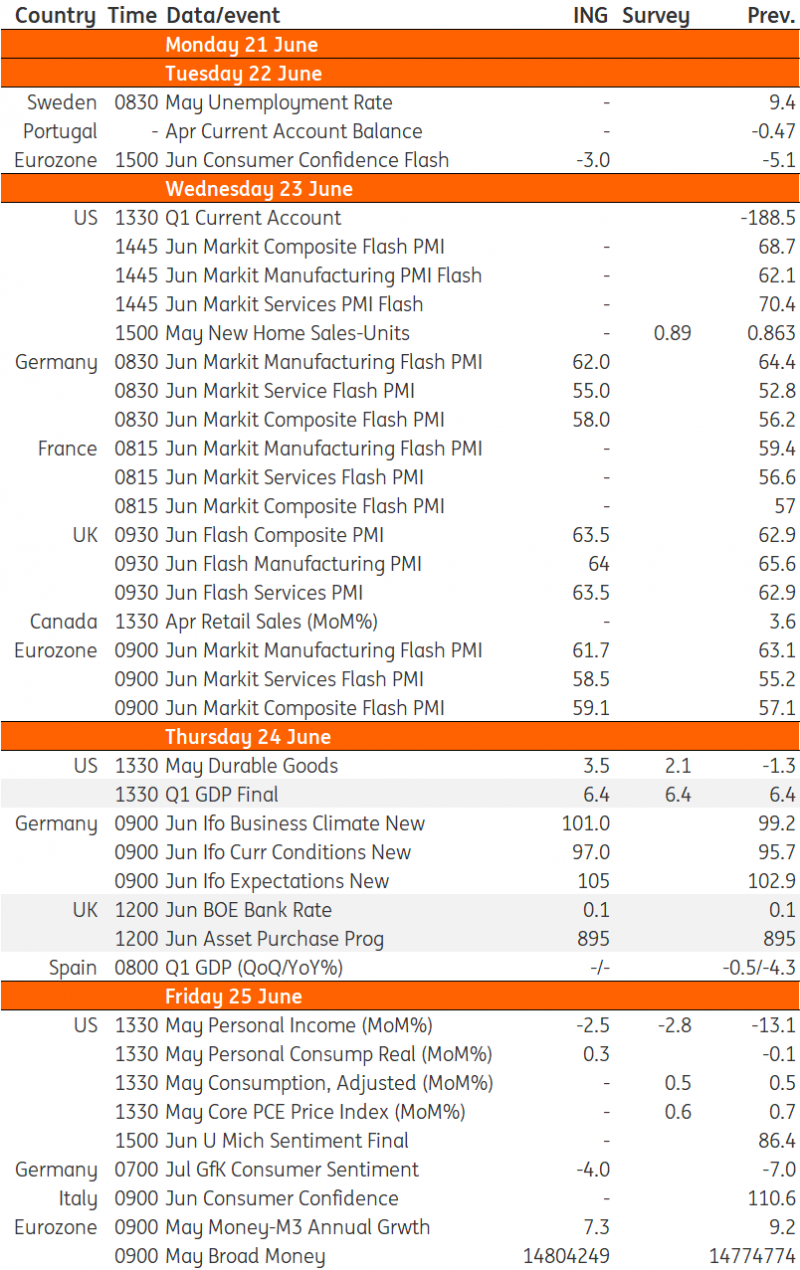

Developed Markets Economic Calendar

Source: ING, Refinitiv

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more