Image Source: Pixabay

US: No Change from the Fed but GDP Figures to Reflect Vaccine Optimism

It is looking to be a jam-packed calendar next week, with the Federal Reserve monetary policy decision and the Q1 GDP report on the horizon. The Fed is set to leave monetary policy unchanged – rates remaining in the 0-0.25% range and QE monthly asset purchases at $120 billion – with policymakers set to re-affirm there will be no shift in stance until “substantial further progress” on the recovery front.

Recent comments suggest that officials continue to think this is some way off, with the March forecast update suggesting that most members still think 2024 will be the starting point for lift-off in interest rates. However, the Q1 GDP report is likely to show another fantastic growth figure, led by stimulus-fueled consumer spending.

We are expecting annualized growth of 7.4%, and with the vaccination program's success meaning more than 135 million Americans have had at least one dose and the economy opening up more and more each day, we expect to see more than a million jobs created in April - with GDP growth likely to be in double figures for the second quarter.

With inflation likely to hit close to 4% and prove to be somewhat stickier than the Fed is publicly acknowledging – largely due to house price developments and ongoing supply capacity issues – we continue to think that the Fed could start tapering asset purchases before the end of the year. We are looking for the first-rate hike to come in 1H 2023, but the odds are increasingly moving in the direction of a possible December 2022 rate hike.

Eurozone: A Technical Recession Alongside Energy Price Fueled Inflation

The eurozone is set for another technical recession, with numbers on Q1 coming out on Friday that will likely show another decline. Extended lockdowns have pushed the economy in the red, even though underlying activity in sectors less hindered by restrictions seem to be performing well at the moment.

Also interesting will be Friday’s inflation data, which is set to soar further on the back of increasing energy prices. But we're not concerned, as all factors seem to be temporary, confirming the ECB's view. Also important is how unemployment performs; further falls will indicate a quick rebound upon reopening.

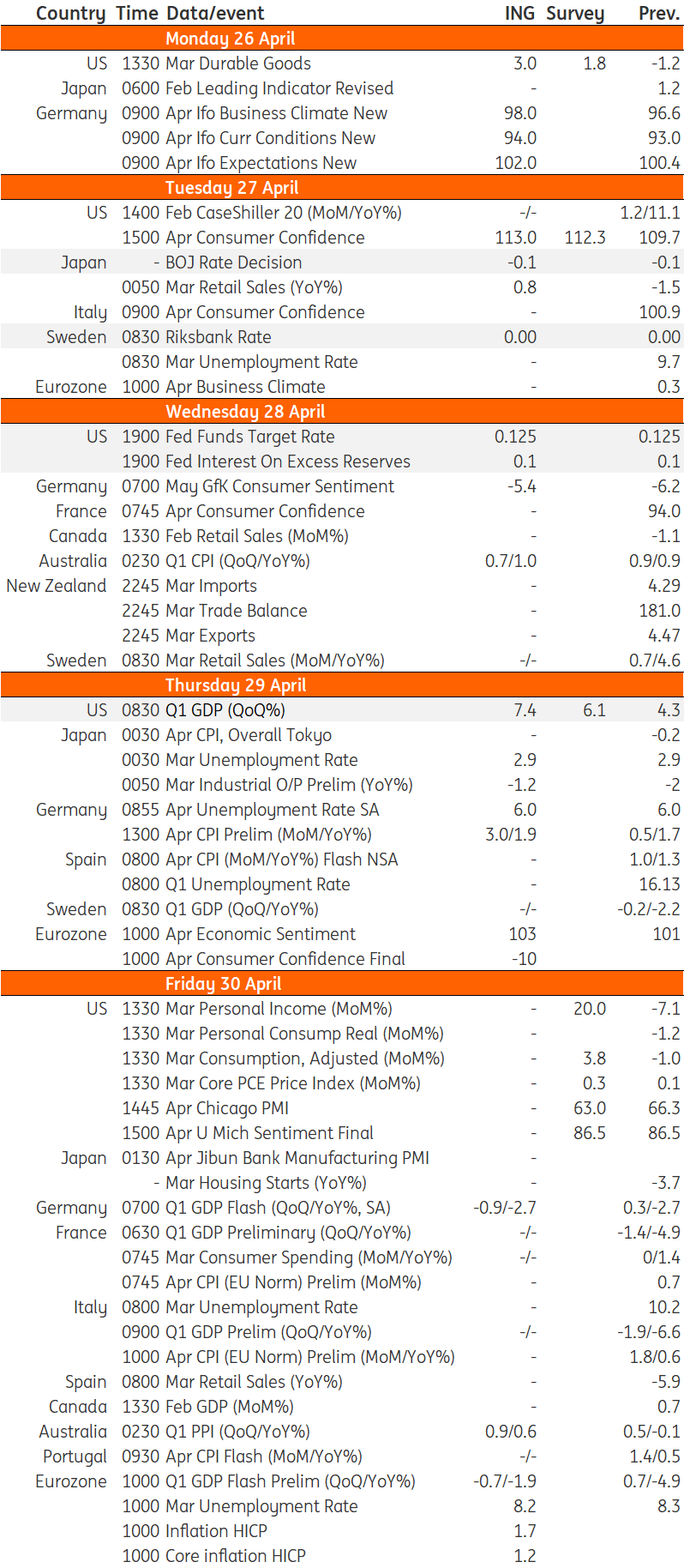

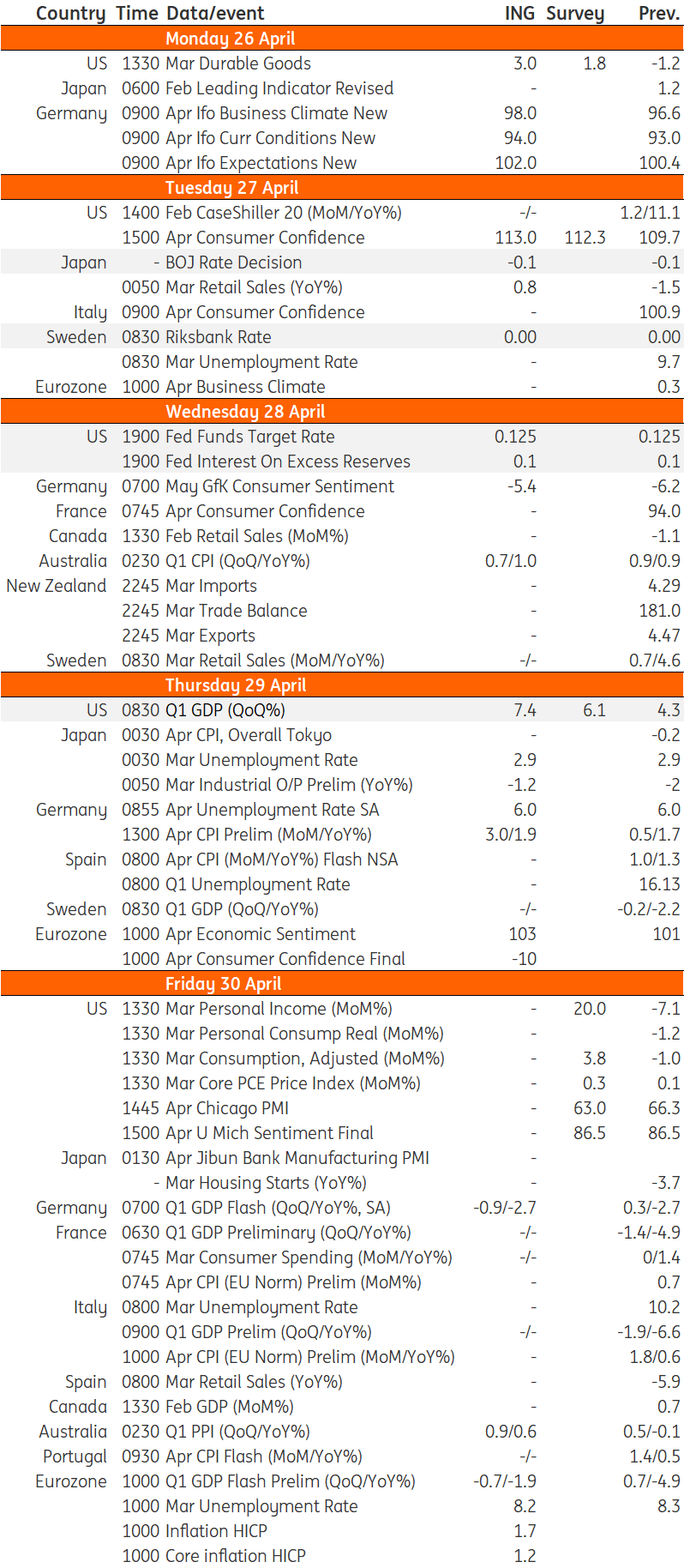

Developed Markets Economic Calendar

Source: ING, Refinitiv

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.