Key Events In Developed Markets For Week Of June 27

Image Source: Pixabay

The risk of a US hard landing is increasing, and while the consumer numbers still look solid, cracks are appearing in the manufacturing sector. Eurozone inflation is set to go another leg higher on rising energy prices, while Sweden's Riksbank looks set to join the 50bp club as policymakers try to get ahead of ECB rate hikes.

Increasing risk of a hard landing as the Fed is determined to get inflation under control

In the near term, the US activity story is holding up with consumers still willing to use savings accumulated through the pandemic to finance spending on leisure and “experiences”. This means we expect expenditures related to services to outperform spending on goods through the summer. However, with the Federal Reserve raising interest rates more aggressively, moving monetary policy harder and faster into restrictive territory as it tries to get a grip on inflation, there is a growing fear of a US recession later this year and into 2023.

Household finances are being squeezed by inflation while higher mortgage rates are already prompting a deceleration in housing activity and the Capex outlook is deteriorating as corporate managers fret about falling stock market prices and the potential for weaker demand. We expect to see durable goods orders fall, consumer confidence remains weak, and manufacturing surveys come under more pressure this week, which would add to a sense of impending gloom.

Inflationary pressure persists as consumers get the short end of the straw

The eurozone will focus on inflation figures that come out on Friday. There are no signs that inflationary pressures have abated in the meantime, with energy inflation set to trend higher again on squeezed gas supply and the oil embargo, which have both caused market prices to increase again. Core inflation is set to see another leg up as input price pressures are being priced through to consumers. While there are now more signs emerging that pipeline pressures are peaking, the question is when this will feed through to the end consumer. This can be a volatile process with further increases in energy prices not excluded given the unpredictability of geopolitics.

Riksbank set to join the 50bp club

The Riksbank looks set to join the ever-increasing band of central banks hiking by half-point increments, for two key reasons. Firstly, the Riksbank holds fewer meetings each year than other central banks and it has only two further scheduled opportunities to change policy after next week. Thursday’s meeting is an opportunity to get out in front of the ECB, which is poised to hike twice before the Riksbank meets again. Secondly, the Riksbank laid out a few scenarios in April, and core CPIF is so far tracking its ‘higher inflation’ path which policymakers indicated at the time would require an accelerated pace of tightening. Wage pressures are also building ahead of important negotiations later in the year.

A 50bp hike at this meeting, and probably another in September, therefore, look likely. Recent SEK depreciation will be an area of nervousness, though the Riksbank will need to weigh this against early signs of a weakening in the housing market, where a little under half of the new loans are on floating rates.

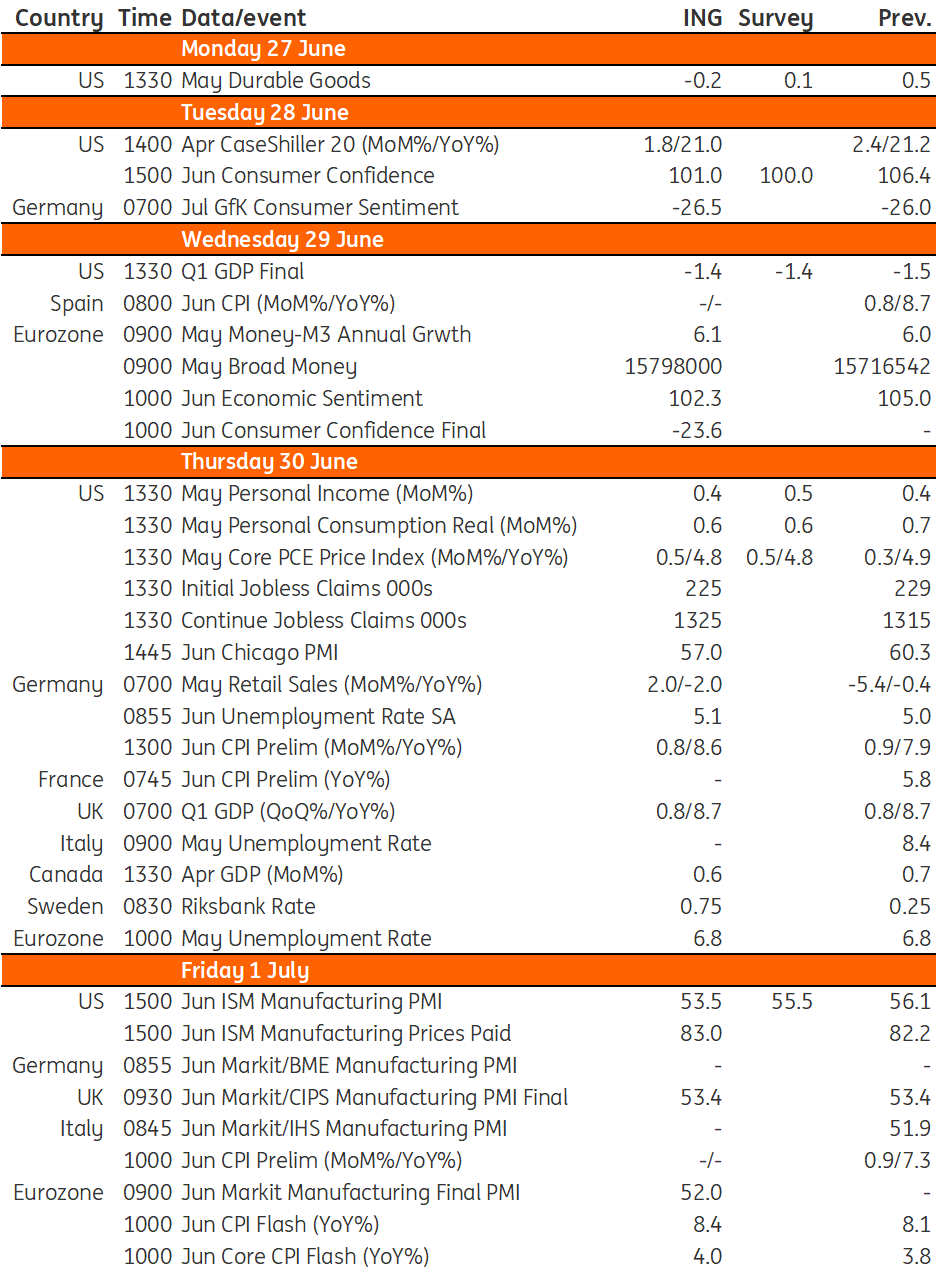

Developed Markets Economic Calendar

Image Source: Refinitiv, ING

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more