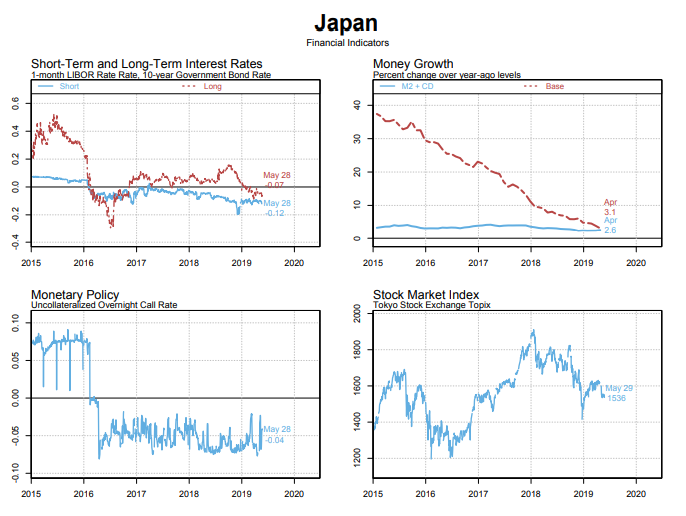

Japan’s Economy Is In A Negative Interest Rate Environment

“The Bank of Japan left its key short-term interest rate unchanged at -0.1 percent at its April meeting and kept the target for the 10-year government bond yield at around zero percent, as widely expected. The Committee said it intends to keep the current extremely low levels of short-term and long-term interest rates for an extended period of time, at least through around Spring 2020, taking into account uncertainties regarding economic activity and prices including developments in overseas economies and the effects of the scheduled consumption tax hike.” (Trading Economics, May 2019)

“Globally, there is more than $8 trillion in government bonds trading at negative rates. While this is great news for indebted governments, it does little to make businesses more productive or to help low-income households afford more goods and services. Super-low interest rates do not improve the capital stock or improve education and training for labor. Negative interest rates might incentivize banks to withdraw reserve deposits, but they do not create any more creditworthy borrowers or attractive business investments” (Sean Ross, Why Negative Interest Rates Are Still Not Working in Japan, Oct 12, 2018)

A negative interest rate policy (or NIRP) is an unconventional monetary policy tool whereby the central bank sets its nominal policy interest rates at a negative value, i.e. below the theoretical lower bound of zero percent.

The intention is to overcome a deflationary environment, where households and firms hoard money instead of spending and investing. The deflationary environment could cause a collapse in aggregate demand, which leads to a vicious circle of prices falling even further.

When a central bank adopts a negative interest rate policy, it charges its depositors to hold their reserves at the central bank. This is intended to incentivize the private banks to lend money more freely and businesses and individuals to invest, lend, and spend money rather than pay a fee to keep their funds safe.

The Bank of Japan introduced its negative interest rate policy in January 2016 when it announced that it would charge banks 0.1% for parking additional reserves with the BOJ. The intention was to encourage banks to lend and prompt businesses and savers to spend and invest. In other words, the Bank of Japan deliberately pushed interest rates below zero after years of keeping the rates very low.

The original announcement briefly drove down the yen and buoyed Japanese share prices, and markets quickly went into reverse. Japan’s 10-year government bond yield quickly fell below zero and actually stayed above zero for most of 2017 and 2018, only to decline again into negative territory this year.

There are two reasons why central banks impose artificially low interest rates. The first reason is to stimulate the economy into faster growth by encouraging spending and investment. Lower interest rates are thought to overcome the paradox of thrift, which slows an economy down. Negative interest rates are simply a more aggressive form of this tool to generate spending, investment, and higher inflation.

The second reason for adopting low interest rates is less obvious. When governments are highly indebted, low interest rates make it easier for them to afford the interest payments. When interest rates are negative, the depositor pays the government to run a budget deficit.

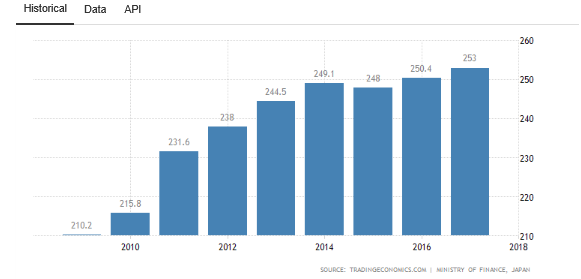

When the BOJ announced its negative interest rate policy in 2016, government debt was well over 200% of GDP. Recently the debt to GDP ratio exceeded 250% of GDP.

Japan’s experience with extremely low and then negative interest rates has not been too successful, but at least the economy has been growing grudgingly over the last few years, and inflation, albeit still too low, is at least positive.

Japan’s Gross Debt To GDP Ratio

(Click on image to enlarge)

(Click on image to enlarge)