Japan’s Economic Bounceback Continues

4Q20 GDP was surprisingly good

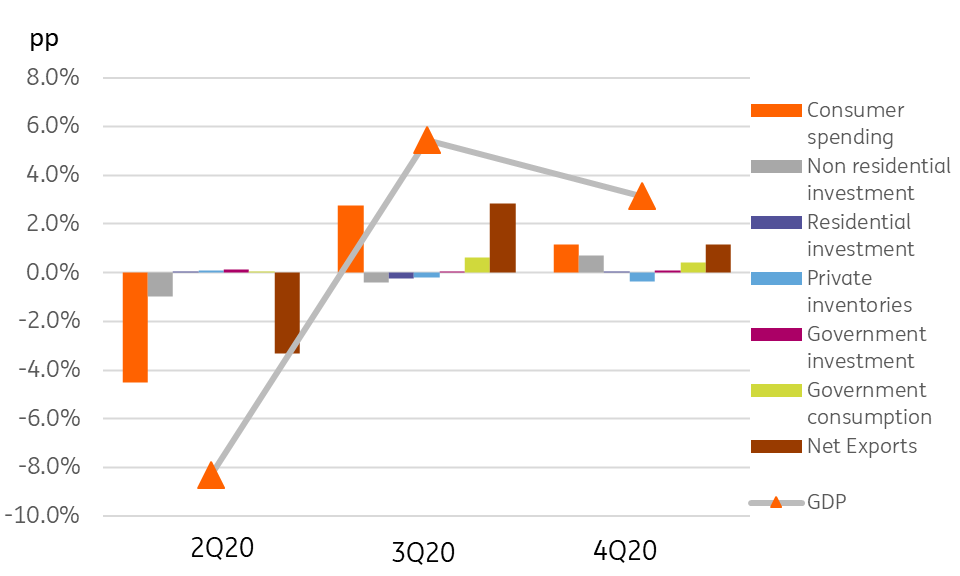

We hadn't been expecting a figure this strong in 4Q20. At 3.0% quarter-on-quarter or 12.7% when annualising the number, this means that Japan only shrank 4.9% in 2020. And although this isn't far off the -5.4% we had been forecasting for that period, that comparison misses the main impact of this stronger end-of-year figure, which is the boost it provides to next year's growth numbers.

Now admittedly, the end of December 2020 (and by extension, 4Q20 as a whole) probably marked the local high point in the recent recovery from the pandemic-induced slump in 2Q 2020. Covid-19 numbers climbed steadily in Japan through December, rising to more than 8000 a day at one point. States of emergency in Tokyo and many other prefectures were implemented towards the end of this period. These restrictions are less draconian than lockdowns implemented elsewhere in the world, but they will still likely crimp consumer spending to an extent, as well as some other discretionary expenditures. Most of these emergency measures remain in place today and face extension as Japan's death rates from Covid remain stubbornly high even as daily case-loads fall and new variants spring up. Consequently, the first quarter of 2021 will probably look considerably less good.

We are penciling in a very slight contraction in consumer spending in 1Q21, though government consumption (mainly public sector salaries) will remain supportive. We may also see private non-residential investment slow in 1Q21, though slower growth in both of these components may be offset by weaker imports and a larger contribution to growth from net exports.

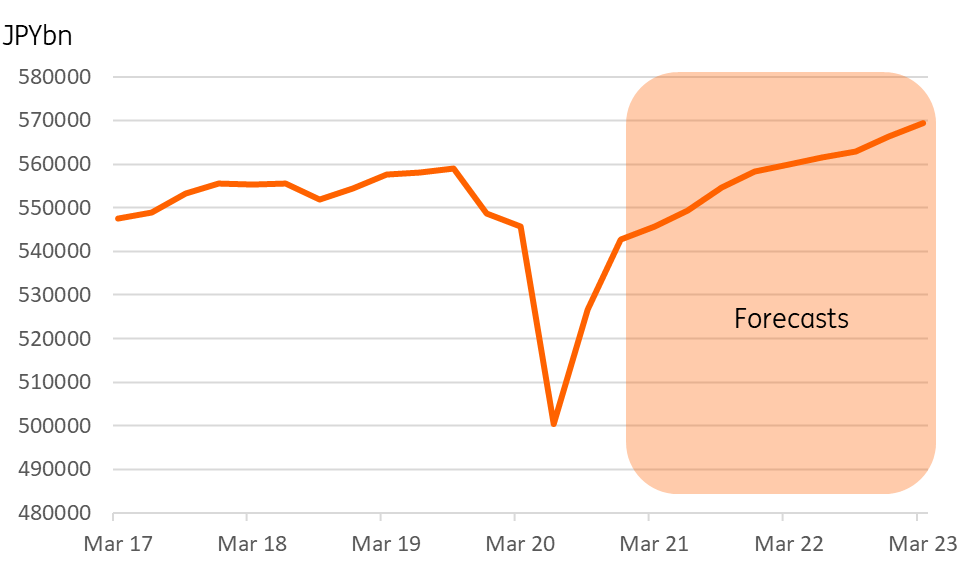

Japanese real GDP (JPYbn)

CEIC, ING

Second half could see a second pick up

After a slightly shaky start to 2021, we would anticipate that the global rollout of vaccines and the local rollout in Japan will coincide with lower daily cases and death rates, and a further relaxation of social distancing measures and restrictions on gathering. This should see a second pick up in economic activity moving from 2Q21 to 3Q21, which will take Japan close to its pre-Covid GDP level. Following this, we would imagine further growth will be more difficult to engineer, and Japan will begin to revert to its previous uninspiring underlying rates of growth.

That could still be enough for Japan to notch up growth of 4.5% in 2021, which would be a remarkably strong performance for an economy that often struggles to grow 1%. With inflation also picking up 2021, recent talk of the Bank of Japan looking for more ways to signal that it can move its policy into a new, more accommodative stance should come to nothing.

Contribution to quarterly (QoQ%) GDP growth

(Click on image to enlarge)

CEIC, ING

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more