Ituran Is Set To Recover

- The company was buffeted by the pandemic, a dividend cut, a car market growth decline, and negative currency effects but all of these seem to be disappearing.

- Currencies remain a considerable risk though, with the company mostly operating in Israel and Latin America.

- The company produces strong cash flow and has resumed dividend payments, the shares are cheap.

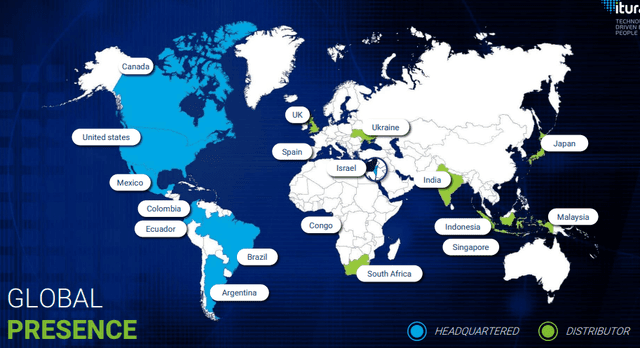

Ituran (ITRN) is an Israel-based telematics service provider with markets mostly in Israel and the Americas. They offer asset location, theft recovery service, and several value-added services with Israel and Brazil (their two largest markets and countries with a very high car theft incidence) and other markets in the Americas (including the US).

Source: FinViz

The technology was originally developed to locate military pilots in distress which was later converted to civilian use.

We like the business model as it is mostly a highly scalable platform that is easily expandable with new services and customers, runs on high gross margins, and produces recurring monthly subscription fees.

The company's devices and sensors that go into cars and other assets are produced by contract manufacturers in Israel and China, these produce lower gross margins but these are still pretty good, in the low to mid-20s.

Growth

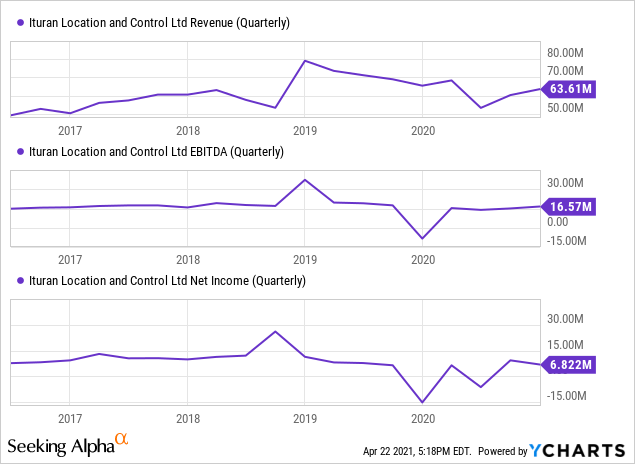

The impact of the pandemic was notable:

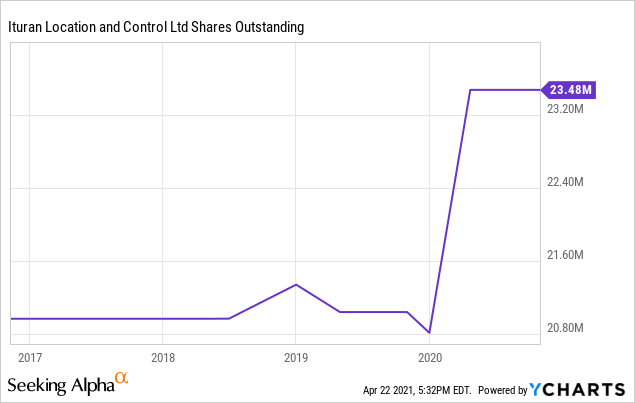

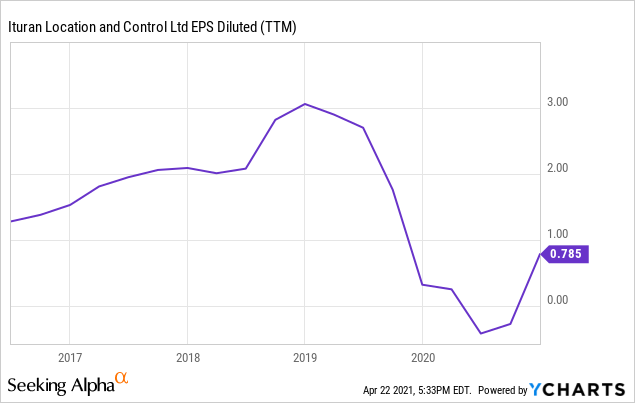

Data by YCharts

But 2020 was, of course, a singularly bad year and even then the company managed to produce $60M in free cash flow and where others struggled during the pandemic installing the devices in cars, Ituran kept things going by installing them in people's homes, a pretty creative solution.

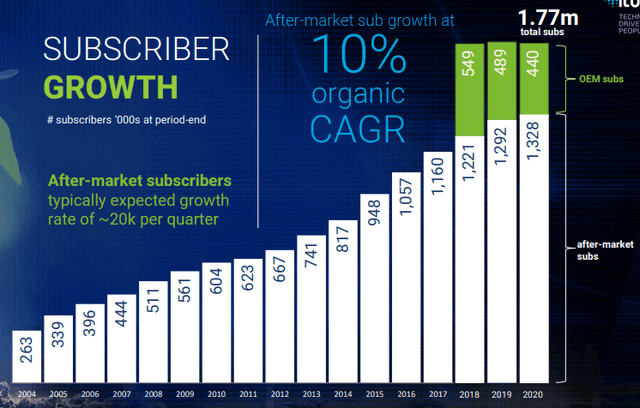

The number of subscribers has risen steadily and the company now has 1.77M subscribers:

Source: March 2021 IR presentation

Recurring subscription revenue is more than 70% of revenue. They sell to OEMs (car manufacturers) and the aftermarket and partner with insurance companies.

Source: March 2021 IR presentation

The company uses terrestrial network triangulation and GPRS for their main SVR service as terrestrial triangulation doesn't suffer from some of the disadvantages of other network technologies like GPS and cellular networks.

For instance, their terrestrial network doesn't suffer in dense urban situations, it's difficult to jam, short bursts of data are sufficient for tracking which is also why the network of base stations doesn't have to be dense but it requires the build-out and maintenance of proprietary infrastructure (a network of base stations).

However, the company is increasingly using other network technology (SMART and GPS/GPRS) as GPS, in combination with their own improvements is overcoming most of its disadvantages. So when entering a new market they don't have to build out the infrastructure first, which is important to keep in mind.

Products

Theft protection comes in two forms, one for cars where insurance companies require it and SAVE, a simpler form where this isn't required and these are systems that make unauthorized use of a car very difficult. Their ICS (Ituran Com Seguro) product is very successful in Brazil

Stolen vehicle recovery or SVR is doing just that, recovering stolen vehicles with the help of devices in cars, a network of base stations, and a 24H manned control center which receives an indication of unauthorized entry, determining whether this is real or a false alarm. In the latter case, law enforcement is notified of the location and in several countries, the company maintains private enforcement units to assist the former. Vehicles can also be remotely immobilized.

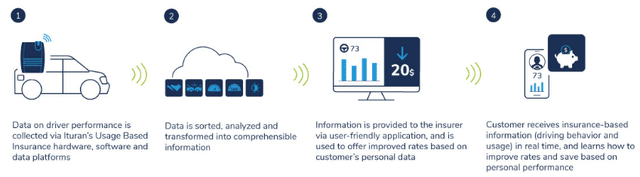

User-based insurance where a combined hardware and software solution monitors the driving behavior which is then used by insurance companies to tailor insurance offerings individually. At present this is only offered in Israel (and a 20K pilot in Argentina), but it has good expansion potential especially as the activation can be done remotely.

Fleet management allows operators of fleets the ability to locate, monitor (speed, distance driven, direction, diagnostics, driver behavior etc.), record, and schedule in order to manage and control their fleet, reducing operating cost, optimizing work hours and appointment scheduling, improving services and operations and the like.

Value-added services consist of locator services (equipment, merchandise), concierge services (24h navigation guidance, phone assistance, traffic reports, directions, etc.), and connected car services.

Connected car provides car service and other info on an app and the company's infotainment system and it provides pre-emptive car maintenance alerts for mechanical failures and operational issues like low tire pressure.

White label provides products and solutions for third-party operators which market it under their own brand, the company is working with distributors in 20 countries.

Bull case

While the stock has had some headwinds coming from auto sales, the pandemic, dividend cut, and misbehaving Latin American currencies, it looks like most if not all of these are moving to the rearview mirror so we see a pretty solid bull case consisting of the following elements:

- Telematics market

- Digitalization of insurance

- New markets

- New customers

- New services

- Cash flow, dividend

Telematics market

The company has a secular tailwind from the telematics market growth (from Research and Markets):

The telematics market is expected to register a CAGR of 20.7% over the forecast period from 2021 to 2026. By enabling the capabilities of telecommunication and information technology, telematics is now being used across various industries for adequate transportation and logistics purposes. Recently, the application's focus has shifted from vehicle location and routing to solutions focused on drivers and their safety. By monitoring the driving behavior, vehicle health and maintenance intervals, telematics solutions help minimize accidental incidents, speeding tickets, and downtime.

Insurance

The company partners with insurance companies in order to sell a package deal as their telematics services reduce risk, they reduce insurance premiums and the benefits can be split three ways.

But there is a lot of resistance in the insurance market, especially in emerging markets where insurance companies are afraid of cannibalization and/or hang on to conservative ways of doing business through brokers and agencies.

What markets are finding out is that the advent of online insurance companies breaks this deadlock. This happened in Israel and Brazil, the company's biggest two markets, and management is counting on this happening again in Mexico (where they already have a pilot program) and the rest of Latin America.

And the company has introduced innovative solutions like User-Based Insurance (see below).

New markets

The company operates in the following markets:

Source: March 2021 IR presentation

The company has big plans for the aftermarket in Mexico, partnering with insurers in a similar way they did like Brazil as noted above.

There is a slide in the March 2021 IR presentation deck that says "Venturing into new areas, India with 250M vehicles" (and not much more) but the company's entry in the Indian market dates from 2017 when they entered into a joint-venture to sell telematics products in India (PR):

The new JV company will be called Lumax Ituran Telematics Pvt Ltd. According to the agreement, Lumax Auto Technologies will own 50% of the joint venture, with Ituran owning the remaining 50%. The JV will tap into this large market, which currently has low penetration of advanced telematics technology. The JV will sell Ituran's telematics products and services, adapted to the Indian automotive industry.

They are only just starting here and success will not come overnight. Needless to say, this is a big market opportunity, and having a big partner like Lumax provides a good entry point.

New services

The last couple of years saw the company introduce new services like UBI and Connected Car. UBI can be rolled out over the air on existing installations as it makes use of the same sensors for Connected Car so once insurance companies are on board and customers sign up this is easy to expand.

The bottleneck here is insurance acceptance, this is a long slug but management believes that companies will see the benefits, which can be split three ways so everybody wins. UBI comes in two flavors:

- PAYD; Pay As You Drive - Based on the vehicle usage

- PHYD; Pay How You Drive - Based on a customer driving behavior

The latter is of course pretty interesting with PHYD software monitoring driving behavior like speeding, sudden braking and acceleration, sharp turns, dangerous overtaking, and the like.

Source: company website

Participations

Given the solid financial position of Ituran, the company is actively seeking out equity participations in promising new tech companies in the field of managing mobility.

There is DRIVE, the company's mobility innovation center in cooperation with the likes of Mayer Cars and Trucks, Hertz (HTZ), Honda (HMC), and Volvo Cars. This isn't a new service but an incubator for new technology companies. Here is what Ituran's CEO argued at its launch in 2017

Our goal is to assist local entrepreneurs in our field by providing them with our experience and tools, and bring future DRIVE nurtured solutions into the use of our customers around the world. For Ituran and its partners, we will gain early access some of these most advanced ideas and technology that are born within these companies

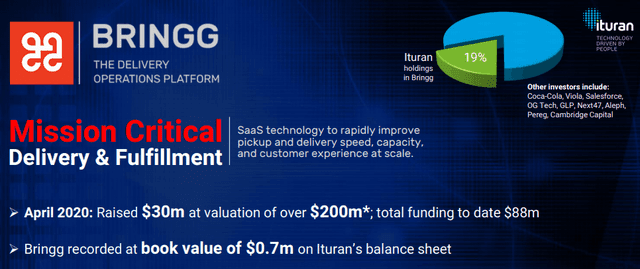

Investing in promising tech startups can be rewarding, there is for instance Ituran's participation in BRINGG, in which they have a minority stake:

Source: March 2021 IR presentation

What does BRINGG do, well, from their linked website:

Our cloud platform connects, automates and orchestrates supply chain technology, people and providers, making innovative delivery and fulfillment models accessible and valuable to everyone.

This has already been catching on (PR)

Bringg, is a fast growing customer-centric Software As A Service delivery logistics platform for enterprises. Bringg's platform is used by some of the world's best-known brands such as Coca-Cola, Kimberly Clark and Panera Bread, recently adding Walmart and McDonalds' largest global franchisee, Arcos Dorados, to its customer roster.

This is already bringing in financial gains (from the same PR):

Ituran Location and Control Ltd. (NASDAQ: ITRN), today announced that following a third investment round in one of its increasingly successful early-stage mobility technology holdings, Bringg, Ituran will realize a non-cash capital gain of approximately $5 million, the majority of which will be recognized in the fourth quarter of 2018. Including this capital gain, Ituran will have recognized total capital gains to-date from Bringg of approximately $11 million.

And that PR came from January 2019. Given the number of marquee customers we think this nearly 20% participation has the potential to be valued as a couple of hundred million in the not too distant future, should it choose to go public.

Another participation was that in SaverOne, which produces systems that take over people's mobile phones and prevent drivers to be distracted from them.

Mobile phones account for up to a quarter of road accidents in the US, accounting for more casualties than the pandemic, according to SaverOne management.

SaverOne was listed on the market in Israel last year and could greatly benefit from government regulation, given the casualty numbers involved this sounds a reasonable prospect and it's the only technology that fulfills the three criteria that the US has defined for such a system.

There is a draft EU regulation that could set things in motion from next year onwards. The technology involved is pretty neat, here is CEO Gilboa:

"The company was founded with the vision of providing a life-saving technological product to deal with the number one problem in traffic accidents: distractions caused by mobile phone usage. This is a very complex technological problem," Gilboa continues. "First, SaverOne actually recognizes phone signals from inside the vehicle space. Next, the system’s hardware and software are able to distinguish between a phone located in the driver's area and phones in the passenger area. The wavelength is 20 centimeters, and to the best of our knowledge there is no other technological solution in the world or any other way to identify which phone is the driver's." Once the phone in the driver's environment is detected, the system prevents certain applications from working, with no need for the driver to take action.

Ituran has an 11% stake in SaverOne, as a result of the IPO of the latter, valuation is now taken at the end of the quarter and in Q3 this resulted in a non-cash gain of $3.3M, although this gain wasn't repeated in Q4 as the shares retreated slightly in the quarter.

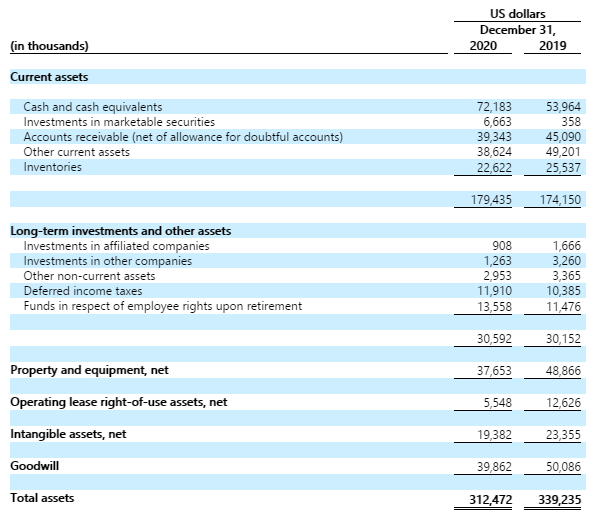

These participations have a surprisingly low value on the company's balance sheet:

Source: 6K

So there is potential for substantial revaluation should these companies be listed and/or Itauran sell its participations.

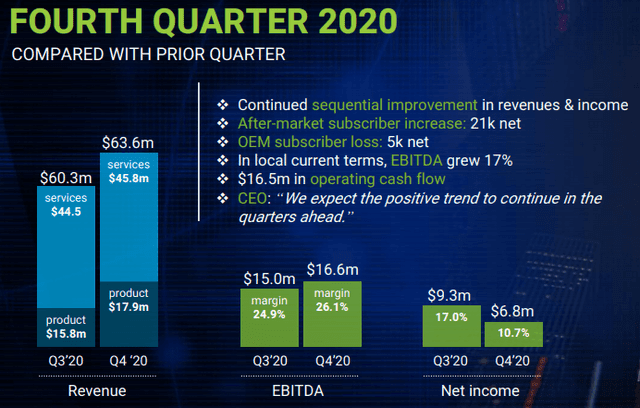

Q4 figures

Source: March 2021 IR presentation

There are a few highlights:

- Sequential improvement

- Aftermarket subscriber growth back to normal

- Currency effects decreasing

It's no surprise that Isreal and the US were their main performing markets in Q4 given that much of Latin America remains mired in the pandemic. In Israel, new car sales in January were the strongest in history, up 16% y/y, for instance.

There was no growth in Latin America, but at least the company was able to maintain its profitability and the situation wasn't as bad as feared, from the Q4CC:

the decline is lower than we were expected. It’s not 20%, 25%, 30% less. It’s going to be, we believe, 10%, 12% less than before the pandemic.

The decline in OEM subscribers tapered off from 27K in Q2 to 12K in Q3 to just 5K in Q4 and the loss was more than compensated by the subscriber gain of 21K in the aftermarket in Q4 for a net sequential gain of 16K.

The aftermarket growth comes down to some markets (US, Israel) going back to more normal circumstances and the investments in UBI (user-based insurance). Subscription fees were flat in local currency terms in Q4

Product revenues are also recovering with a 13% improvement y/y to $17.9M. In local currency terms, revenue was up 3% y/y in Q4

The two Roadtrack OEM customers have divergent developments already for some time. The one serving Brazil and Argentina stopped buying hardware from the company two years ago and the company is now only a service provider.

This has led to a sharp decline in revenue, but this is compensated by the other OEM customer in Mexico which just installed the highest number of units ever and is keen to expand.

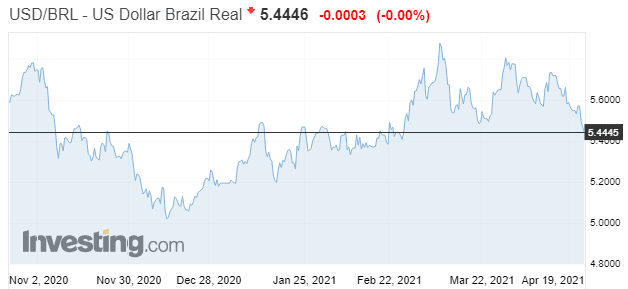

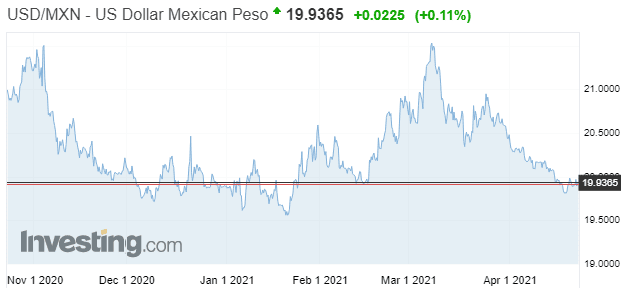

Currencies

The company is liable to substantial currency risk with nearly half the revenue coming from Israel and much of the rest coming from Latin America. A strengthening of the dollar has a negative effect on earnings. Here is the last 12 months of the Brazilian Real:

And the Israeli Shekel:

And the USD against the Mexican Peso:

The Shekel and the Mexican Peso have strengthened, the Real hasn't really moved all that much.

In Q4 revenue decreased 3% in UDS but in local currency terms, it actually increased 3% so there was a substantial currency tailwind from a weakening USD against emerging market currencies like the Shekel, the Mexican Peso, and the Brazilian Real but currencies remain a considerable risk going forward, in our view.

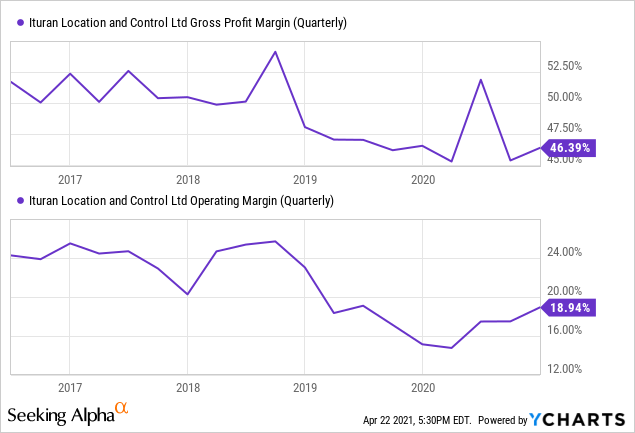

Margins

Data by YCharts

Margins have suffered but this isn't a big surprise given the macroeconomic circumstances.

Gross margin on subscription fees was 54.5% in Q4 versus 54.4% last year. Gross margin on products was 25.6% a 340bp increase from Q4 2019 but this is due to inventory building by OEM clients in Mexico and Brazil which management doesn't expect to continue so the gross margin on product sales is likely to fall back to its normal level.

The company did some cost-cutting (mostly compensation, but also travel), but the compensation part will mostly revert back to normal.

For the year as a whole, operating profits increased by 23% to $27.8M or 11.3% of revenue (up from 8.1% in 2019) but if one strips out impairments in both years operating income decreased by 7%.

Q4 2019 operating expenses included an impairment loss of $26.2M related to the acquisition of Road Track Holdings.

EBITDA in local currency terms (excluding the impairments) rose 7% in 2020 versus 2019.

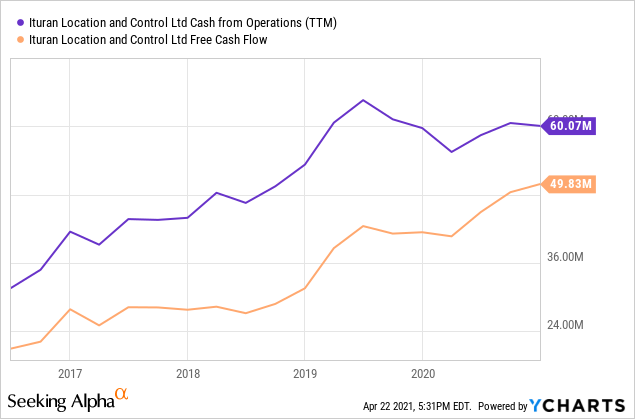

Cash

Cash flow dipped in Q1 but it has remained well in the black during the pandemic:

Data by YCharts

Cash flow from operations was a record $60.1M in 2020 despite the pandemic. At the end of the year, the company had $78.8M in cash and equivalents and $54.5M in debt.

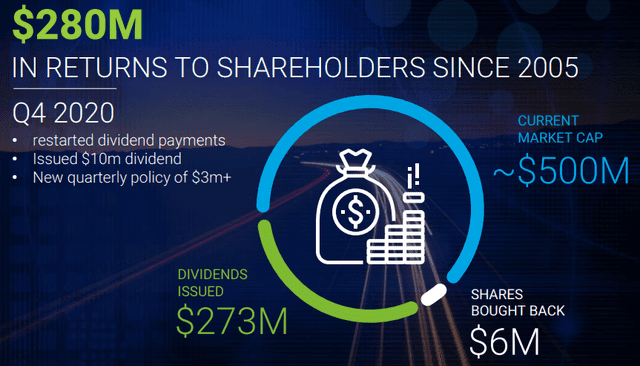

Management feels confident enough to restore dividends and offered a $10M payout (rather than the usual $3M) for a couple of missed quarters during the pandemic in early April 2021. This amounted to $0.48 per share. The company has quite a history here:

Source: March 2021 IR presentation

They will resume the quarterly dividend payout of at least $3M a quarter going forward.

Data by YCharts

Valuation

Gaap net income in 2020 was $16.1M (6.6% of revenues) or fully diluted earnings per share of $0.77, compared with GAAP net income of $6.9 million (2.5% of revenues) or fully diluted earnings per share of $0.33 in 2019.

Data by YCharts

The EPS figure above is in GAAP. Non-GAAP EPS was $1.42 in 2020 (versus $1.58 in 2019 and $2.45 in 2018).

Analysts expect (non-GAAP) EPS to come in at $1.67 this year and growing $1.96 next year, for a company with the balance sheet and especially cash flow and dividend this seems rather cheap to us.

Conclusion

We see multiple reasons to be optimistic about the shares:

- There is a secular tailwind from the telematics market and subscriber growth has returned.

- The company has embarked on new growth initiatives like UBI that can drive growth further, most notably in Mexico where the digitalization of insurance is in the early innings.

- Participations in a number of tech startups can significantly appreciate in value, especially given their low valuation on the company's balance sheet.

- The company has a solid balance sheet and produces really substantial amounts of cash which can easily finance the dividend.

- The shares are cheap.

- The main risk seems to come from the forex markets.

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their ...

more

Going to pick up some shares of $ITRN, thanks.

$ITRN looks promising.

Yes, I was actually surprised how modestly priced the stock is, to be honest. Management is innovative and these applications tend to be quite sticky.

Very impressive. It's hard to find such detailed information about this company.

My pleasure Dick, appreciated.

Who are the competitors to this company?

There quite a few in the telematics space, they are mentioned in the 20-F, a few I covered are INSG and MiX Telematics. The market is growing and there Is quite a bit of segmentation in the market (by application, geography, technology, etc.) so it's not hypercompetitive.

@[Vivian Lewis](user:4662), don't you cover Israeli companies? What's your take on #Ituran? Worth buying $ITRN?

I hadn't heard of this company, but $ITRN sounds worthwhile to me. I think I'll pick up some shares.