Italy’s Policy Conundrum: Growth Is Too Slow, Legacy Indebtedness Is Too High

“The fate of the euro was always going to depend on Italy. With annual GDP of more than €1.6trn ($1.9trn), about 15% of euro-area output and debt of nearly €2.3trn, it poses a challenge to the single currency that Europe seems unable to manage but cannot avoid.”

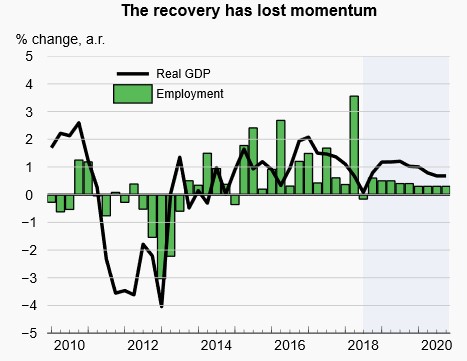

“Real incomes in Italy have fallen since joining the euro area; inequality and poverty have risen. Economic growth briefly rose to almost 2% in mid-2017 but has since slipped back to close to zero. At 10.1%, the unemployment rate is well above the pre-crisis low of 5.8%. Economic weakness is re-emerging even as the European Central Bank reduces its stimulative asset purchases and prepares for eventual interest-rate rises.”(Economist web site, Nov. 12, 2019)

Italy possesses the 3rd-largest economy in the Euro Zone, and in terms of real GDP comparisons, has the 9th-largest economy in the world.

Italy also has recently elected a populist government which promises to end austerity and spend money on popular themes. However, Italy’s recent national budget is in the defiance of EU guidelines, since the budget targets a fiscal deficit which would amount to 2.4% of GDP. On October 23rd the European Commission rejected Italy's 2019 budget and vowed to ask Rome to present a new document within three weeks.

It must be recognized that over the past 10 years the number of Italians living in absolute poverty has nearly tripled. And contrary to widespread prejudice, Italy has been a frugal country, and its debt overhang is mostly a legacy problem created before Italy entered the Euro Zone.

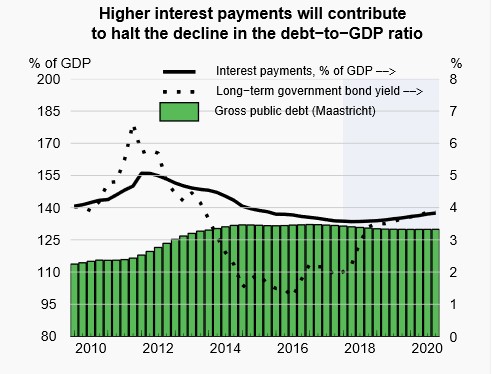

Indeed, Italy has been able to achieve a primary budget surplus (the excess of revenue over non-interest spending) in every year since 2010. As a recent Financial Times article points out, in comparison, all other Euro Zone countries, except for Germany, have racked up cumulative primary deficits.

Italy’s debt incurred since 2000 has been primarily used to pay interest; it has not financed spending. Moreover, Italy has also achieved a current account surplus in recent years.

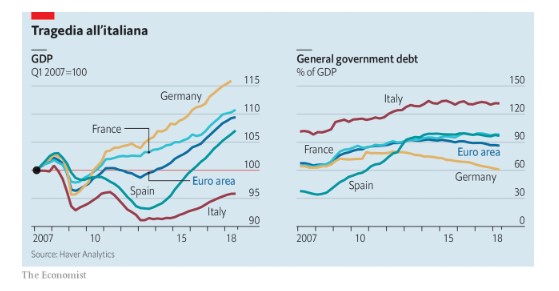

The policy of reducing its debt through restrictive fiscal measures while simultaneously implementing painful structural reforms has failed. Italy’s economy is stagnating, as its real GDP has grown only 7% over the past two decades, compared with 40% in Spain and 30% in France and Germany.

Officials in Brussels say Italy is deliberately defying European fiscal rules and recklessly spending. The EU cannot veto Italy’s plans, but in recent weeks the organization has applied considerable pressure, including threatening financial sanctions.

According to the OECD, economic growth in Italy is projected to be only 0.9% in 2019 and 2020, though the current account surplus is projected to remain at around 2.5% of GDP.

Fiscal policy is projected to turn expansionary over the next two years, widening the budget deficit to 2.5% of GDP in 2019 and 2.8% in 2020.

Public debt, which has been gradually declining relative to GDP, is expected to stabilize at a high level.

While Italy’s banks are well capitalized, and the stock of non-performing loans is declining, nonetheless the country’s banks are vulnerable to further increases in sovereign bond yields.

Disclosure: None.

Arthur Donner does a great summary analysis of Italian fiscal issues. It provides a wake-up call for investors to re-evaluate their Bank stock positions in this market.