Italian Industrial Production Had A Soft Rebound In October

The small rebound in production and the upcoming negative impact of the November soft lockdown is likely to prevent industry from providing a positive contribution to 4Q20 GDP growth. The almost inevitable drag coming from services is thus set to pull 4Q20 GDP back into negative growth territory.

After a volatile summer, industrial production was up a modest 1.3% MoM in October

When commenting on the extremely volatile industrial production data for August and September, we warned about the risk of over-interpreting their directional signals and advised on waiting for the October release to get a better sense of the underlying direction. This has now been published and depicts a stabilizing production framework.

Italian industrial production increased by 1.3% month-on-month in October, after contracting 5.7% MoM in September and a surprisingly strong expansion in August. In working days adjusted terms, industrial production was down 2.1% year-on-year. Browsing the seasonally adjusted big aggregates breakdown, we note that the production of investment goods led the way (+2.6% MoM), followed by intermediate goods (+1.3% MoM) and consumer goods (+0.7% MoM), with energy production alone in negative territory (-3% MoM).

Not enough to envisage an industrial compensation to the service sector drag in 4Q20...

The October release leaves a flat statistical carryover to 4Q20 industrial production. As November marked the start of the soft lockdown Italy (and other Eurozone trading partners) is still partially in, we expect November industrial production to have contracted again. We would need an unlikely strong rebound in December to make industry a positive contributor to 4Q20 GDP growth. Even if that was the case, the polarization of the current lockdown measures on consumption-related service sectors (hospitality, bars and restaurant, leisure) will almost inevitably make services a clear negative contributor to 4Q20 GDP. Details from Istat confidence surveys for November point in that direction. Confidence was down, driven by increasing worries about future unemployment and by worsened expectations about developments in the Italian economic situation, creating the conditions for more precautionary savings. Not the most favorable environment for a consumption boon.

...which would have been worse without labor market public safety nets

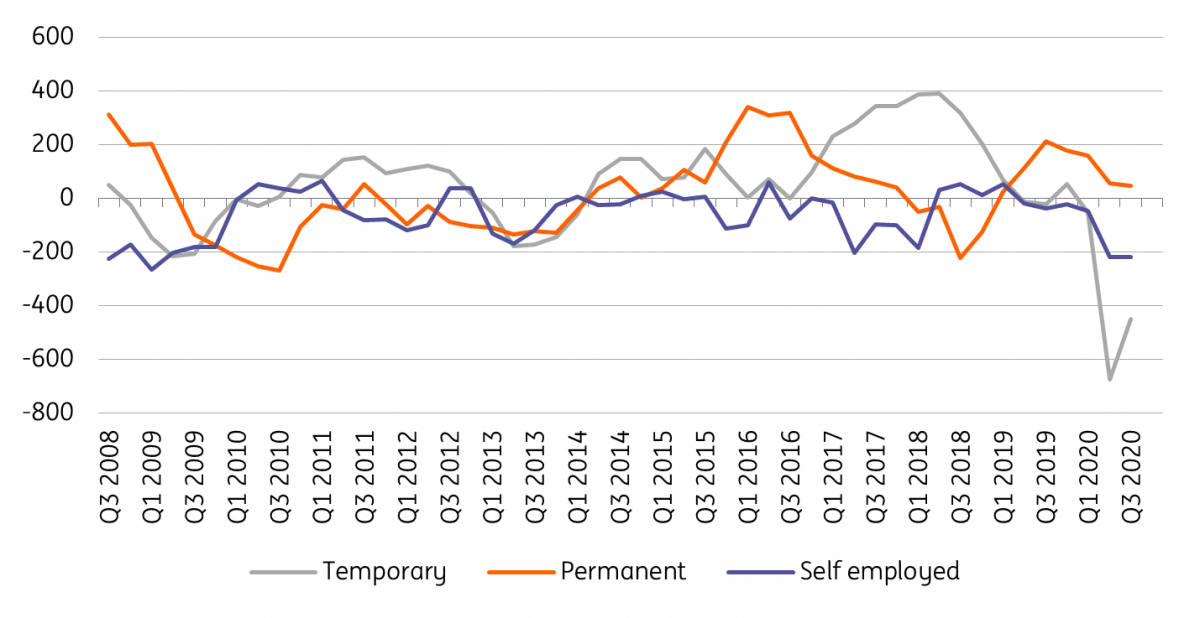

And this happened notwithstanding the safety net deployed to prevent a massive job hemorrhage. Istat published earlier today labor market data for 3Q20, which confirmed that the combination of the short work scheme (COVID CIG in the Italian version) and the reiterated redundancy ban managed to limit the employment loss from 3Q19 to 622K headcounts, most of whom are among the unprotected temporary (-449K headcounts) and self-employed (-218K headcounts) pools, while permanent workers, the category protected by the ban, even posting a small increase (+60K headcounts).

Employment change over one year earlier by employment type

(Click on image to enlarge)

Source: Refinitiv Datastream, ING

All in all, October industrial production data do not look strong enough to justify any upward revision to our current GDP forecast. We expect Italian GDP to contract by 2.5% QoQ in 4Q20 and by an average 8.9% for 2020 as a whole.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more