Italian Bonds Slide As Conte Said To Consider New Elections

Italian bonds dropped on Friday, continuing their Thursday selloff after Corriere della Sera reported that Italian Prime Minister Giuseppe Conte could seek new elections, as he is increasingly tempted by early voting due to the current state of polls.

According to Bloomberg, Conte, who lost a key ally in parliament last week, is having a tougher-than-expected time rebuilding his majority, and his camp is trying to win over lawmakers by using the threat of snap elections, even though this is widely considered an unlikely option, according to officials who asked not to be named discussing confidential talks.

The 56-year-old Conte, who has no party of his own and was plucked from obscurity to become premier in 2018, does see elections as a possibility, buoyed by opinion polls that suggest he could win 15% or more of the vote, Bloomberg reported citing according to an official familiar with his thinking. But Conte’s allies within the coalition are saying privately they’ll refuse to follow him down that path, and if he persists he could end up returning to his past career as a professor of law, the official said.

Coalition members also fear that a vote would usher in the center-right opposition led by Matteo Salvini, and in any new vote many would lose their seats since the parliament has been downsized following reforms, lawmakers said, asking not to be named discussing confidential deliberations.

Conte, who won confidence votes in both houses of parliament earlier this week but fell short of an outright majority in the Senate, is targeting senators from Silvio Berlusconi’s Forza Italia, centrists, unaffiliated lawmakers and even members of Matteo Renzi’s Italy Alive party, which ditched the coalition last week.

Officials in the two main coalition forces, the Five Star Movement and the center-left Democratic Party, are seeking to persuade lawmakers that refusing to back Conte now would lead to early elections. But senators being targeted by the Conte camp have yet to publicly announce their support, amid reports of haggling over favors including government jobs.

President Sergio Mattarella, who would oversee any attempt to form a new government, has pressured Conte to resolve the impasse quickly and ensure a stable majority. Possible scenarios if the prime minister fails in his quest include a new Conte government, a similar alliance under a different premier, or a broader coalition.

The news was seen unfavorably by markets as new elections would delay crucial reforms for the country and timely access to the EU’s package, and add to investors’ uncertainty over some government-backed deals including the sale of lender Monte Paschi di Siena SpA, according to two people familiar with the matter.

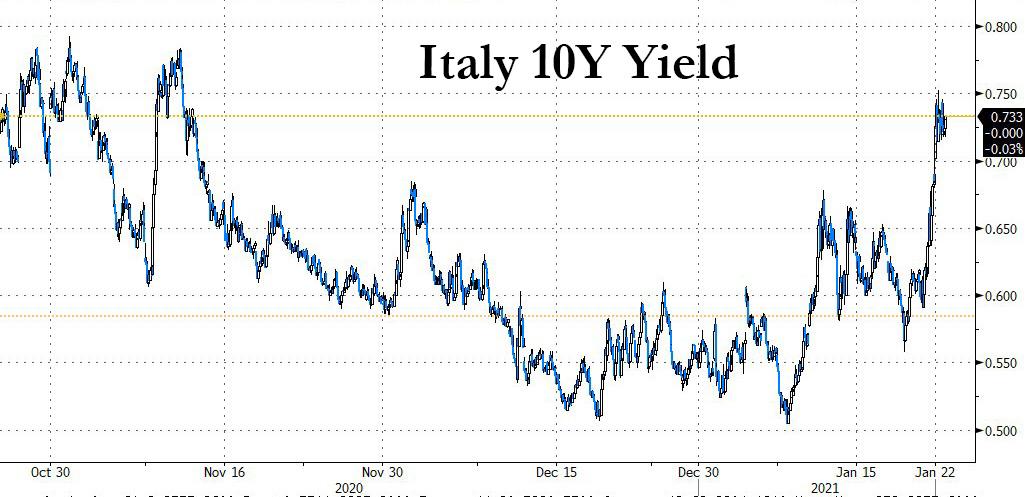

The report added to a bond selloff sparked Thursday by concerns over the pace of ECB bond-buying when the central bank said it may not use up all of its QE "envelope." Italian yield curve bear flattens, with Commerzbank noting that markets are highly sensitive to ECB flow expectations: "We still believe that the ECB will continue to implement its soft spread cap,” write strategists, Michael Leister and Marco Stoeckle. “Ironically, the emphasized language of potentially not using the envelope in full may lead to the ECB having to buy more."

The Italian 10Y yield was last trading at 0.73%, the highest level since early November, the slide put Italy's 10-year yields on course for a weekly rise of 12 basis, their biggest jump since April. The premium over German bonds, a key gauge of risk in the region was at 124 basis points, the highest level since November.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more