Is The Mexico ETF Worth The Risk?

The iShares MSCI Mexico ETF (EWW) has been available for 23 years. EWW has spent most of that time outperforming US Large Cap Blend equities, but currently trails the S&P 500 by 0.79% CAGR.

The Mexican economy is the 15th largest by GDP and Mexico is the 10th largest country by population. So, is EWW worth considering as a component of a worldwide equity portfolio?

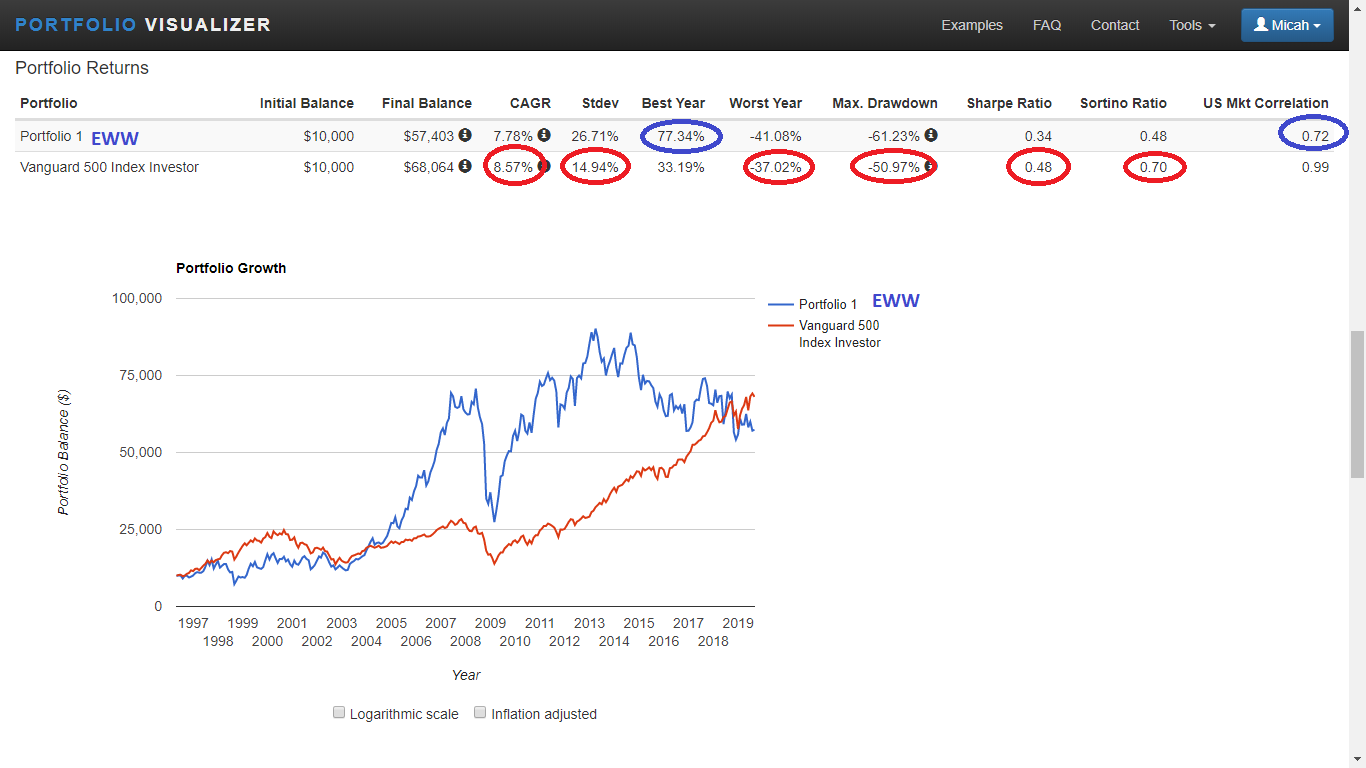

EWW vs S&P 500 Index Fund: May 1996 – August 2019

Source: https://www.portfoliovisualizer.com/

EWW vs SPY: March 18, 1996 – September 13, 2019

Source: https://www.koyfin.com/home

With the onslaught of negative news about the Mexican economy flirting with a recession, worldwide trade wars and heated debates about immigration with the United States, investors are understandably cautious about allocating their capital to the oldest and largest Mexico equity ETF (EWW). But there are some bright spots worth considering:

- Mexico is considered an Emerging Market economy. Emerging Markets tend to have more frequent recessions than Developed Markets. Mexico has been teetering in and out of recession over the last few years, but things do seem to be improving.

- The economy of Mexico is the 15th largest in the world by GDP. That is a lot of goods and services being produced and worth considering when constructing a worldwide equity portfolio.

- The population of Mexico is the 10th largest in the world. There are over 125 million people living and working and pursuing their own personal happiness. They buy cars, food, clothes, electronics and other products; they build houses, grow food, produce products, create businesses and provide services for others every day.

- The USMCA, United States Mexico Canada Agreement, has not been enacted yet, but it is expected to be a done deal soon.

It can be difficult to find positive news on the Mexican economy, but some reporters are starting to take notice of some potentially positive developments.

- Mexico may be an unexpected winner of the US-China trade war - Published SEP 12, 2019 by Grace Shao – CNBC

- Mexican economic plan aims to cut migration to the US - By Ann Deslandes Business reporter, Tijuana, Mexico – BBC

- Mexico Says It Has Cut the Number of Migrants Heading to U.S. - By Azam Ahmed Sept. 6, 2019 – The New York Times

- Boosting Mexico’s Border Economy - MARCH 15, 2019 by Kassandra Lau – Arizona Public Media

- 'I've got other numbers!' Debate rages over recession in Mexico - JULY 22, 2019 Anthony Esposito, Abraham Gonzalez – Reuters

As with any other investment decision, there are pros and cons to making an investment in EWW. Investors should weigh the risks vs the potential rewards. EWW has had a good long-term track record and the current downturn in its’ price could make it a great investment. If you are considering investing the iShares MSCI Mexico ETF (EWW), you should consider how the portfolio is constructed, what kind of equities are in the portfolio and some of the key facts and characteristics of this ETF. Below are some of those key facts about EWW:

- Investment objective: The iShares MSCI Mexico ETF seeks to track the investment results of a broad-based index composed of Mexican equities. Exposure to a broad range of companies in Mexico. Targeted access to Mexican stocks. Use to express a single country view.

- Net Assets: $761M

- Average Volume (20 day): 3M shares/day

- Inception Date: March 12, 1996

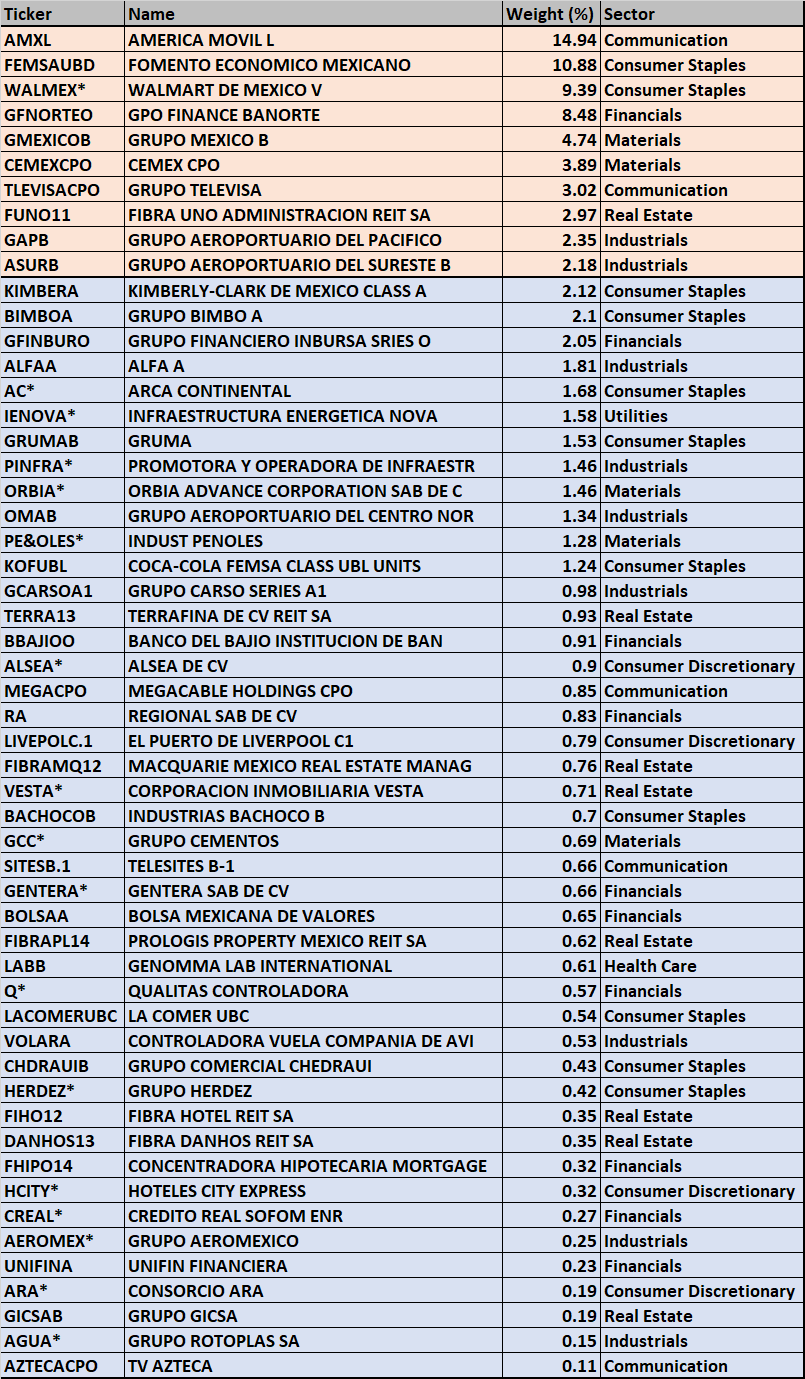

- Number of Holdings: 54

- P/E Ratio: 14.7

- P/B Ratio: 1.80

- 12m Trailing Yield: 3.00%

- Expense Ratio: 0.50%

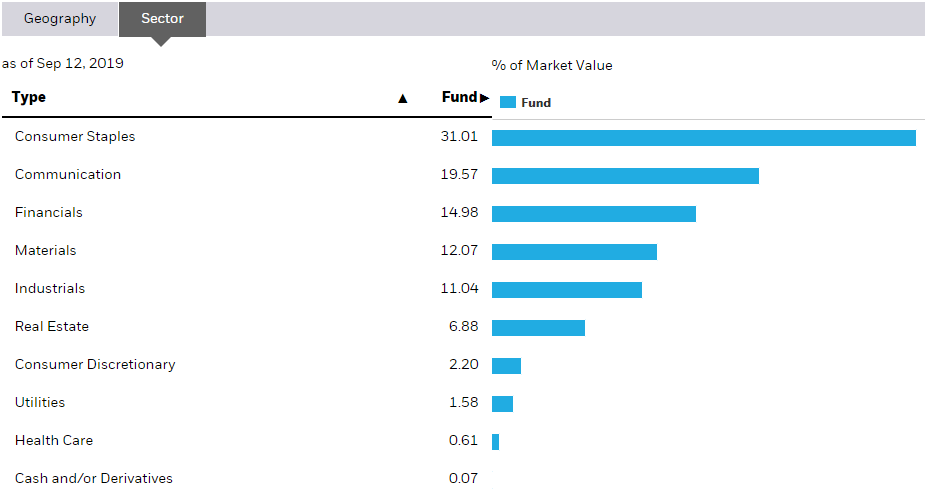

Sector Breakdown:

Holdings:

Source: https://www.ishares.com/us/products/239670/ishares-msci-mexico-capped-etf

Why the Deep Value ETF Accumulator invests in EWW:

- Diversification from U.S. Equities (correlation 0.72)

- Reasonable dividends while awaiting capital appreciation (3.00%)

- Emerging Markets have a great long-term track record. EWW provides more direct ownership of emerging market equities in Mexico

- High volatility (26.71% standard deviation). Nearly double the volatility of an S&P 500 index fund (14.94%). Higher volatility typically provides more opportunities to buy at lower prices.

- Good long-term performance history. Reasonable risk/reward prospects

Disclosure:

We currently own shares of EWW and we intend to buy more shares in the future. I am not a professional investment advisor. Please perform you own due diligence or seek the advice of ...

more