Is Economic Policy Uncertainty Really This Low In Hong Kong?

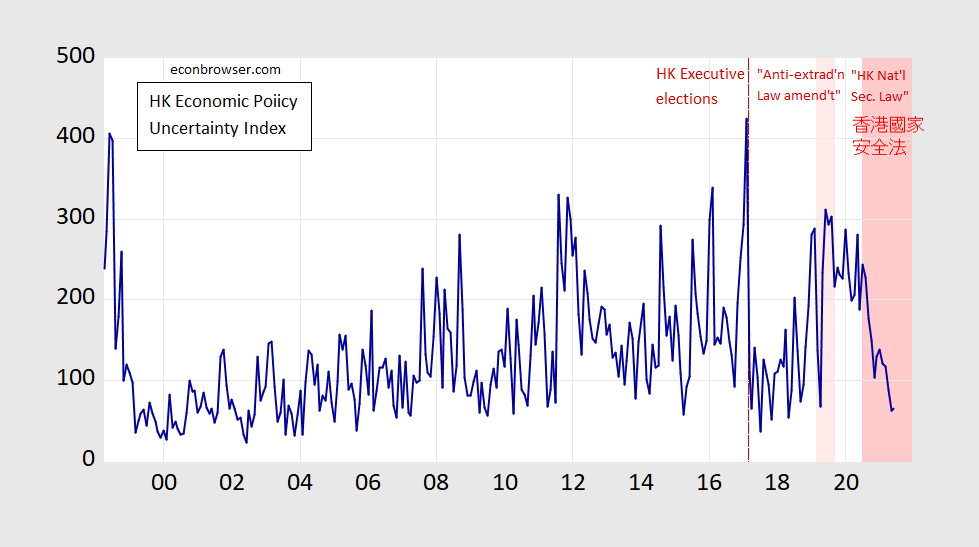

The Economic Policy Uncertainty index, calculated using the Baker, Bloom and Davis methodology:

Figure 1: Hong Kong Economic Policy Uncertainty index (blue). Source: Luk et al. via policyuncertainty.com.

The recent downward movement seems odd to me, given the high uncertainty regarding the direction of political control in Hong Kong. On the other hand, perhaps economic policy is perceived to now be set in stone (in Beijing) so that there is little uncertainty regarding the direction of economic regulation and environment. Or economic policy uncertainty is highly correlated with economic uncertainty, which has declined as economic conditions and business conditions have improved. (A nice primer on the correlations between economic policy uncertainty and economic uncertainty indices is Ferrara, Lhuissier and Tripien (2017).)

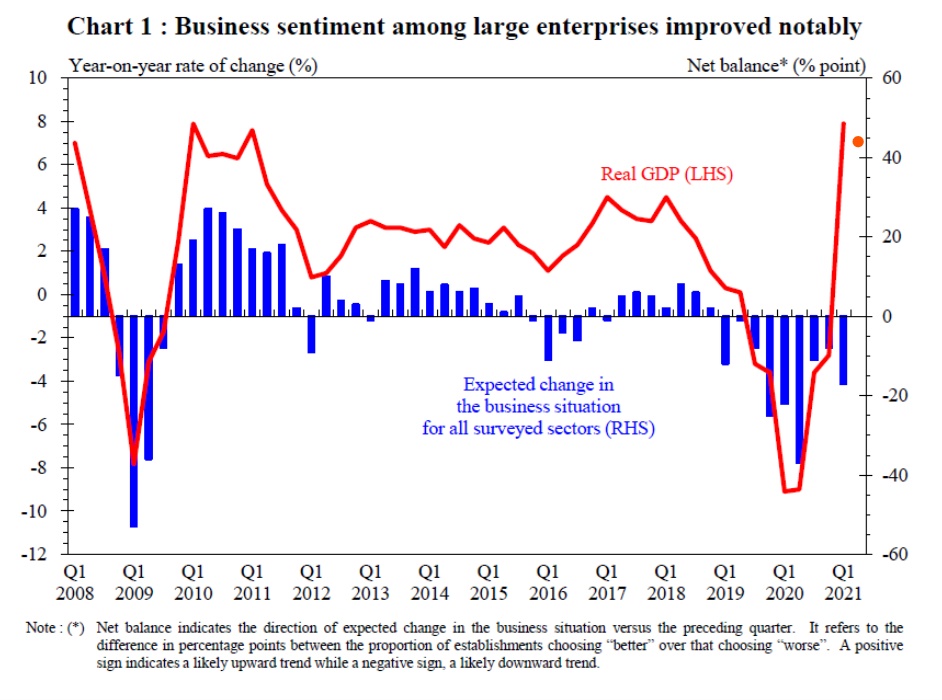

Figure 2: Hong Kong GDP (Ch.2019$) growth, y/y, % (red, left scale), and expected change in business conditions (blue bar, right scale), from Chart 1 from Government of Hong Kong SAR. Orange dot at 2021Q2 is advance estimate of 7.5% y/y, as reported by HK Monetary Authority (on 8/2/2021).

An alternative interpretation is that as the sample of newspapers shrinks (the now Apple Daily was one of the source papers) has shrunk, and likely reporting behavior at the remaining papers has changed. The original set was: Wen Wei Po, Sing Pao, Ming Pao, Oriental Daily, Hong Kong Economic Journal, Sing Tao Daily, Hong Kong Economic Times, Apple Daily, Hong Kong Commercial Daily, and Tai Kung Pao.

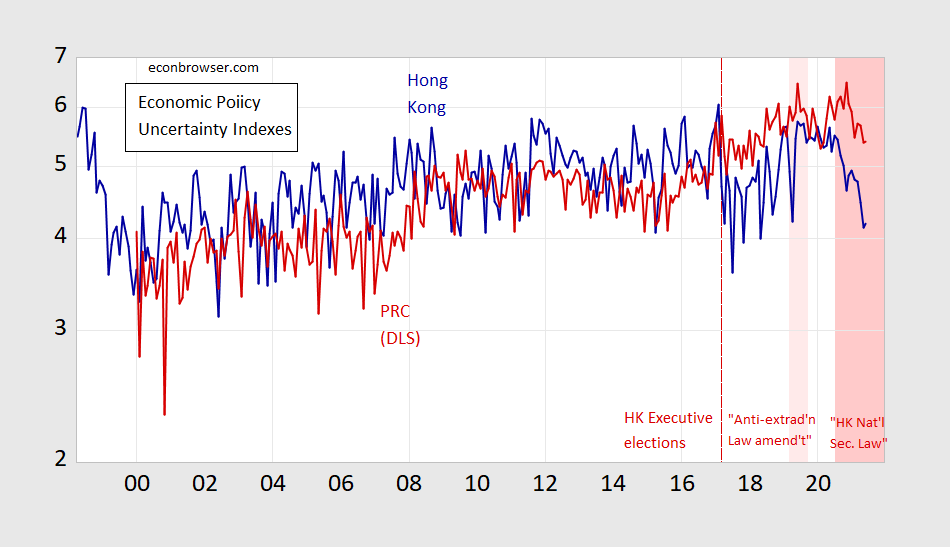

There’s no real way to test any of these hypotheses easily, and with data available to me. What I can answer is whether the relationship between mainland China and Hong Kong uncertainty indices has changed, and when.

Figure 3: Hong Kong Economic Policy Uncertainty index (blue), China Economic Policy Uncertainty index, from Davis, Liu and Sheng (red), both on log scale. Source: Luk et al. via policyuncertainty.com, and Davis et al. via policyuncertainty.com.

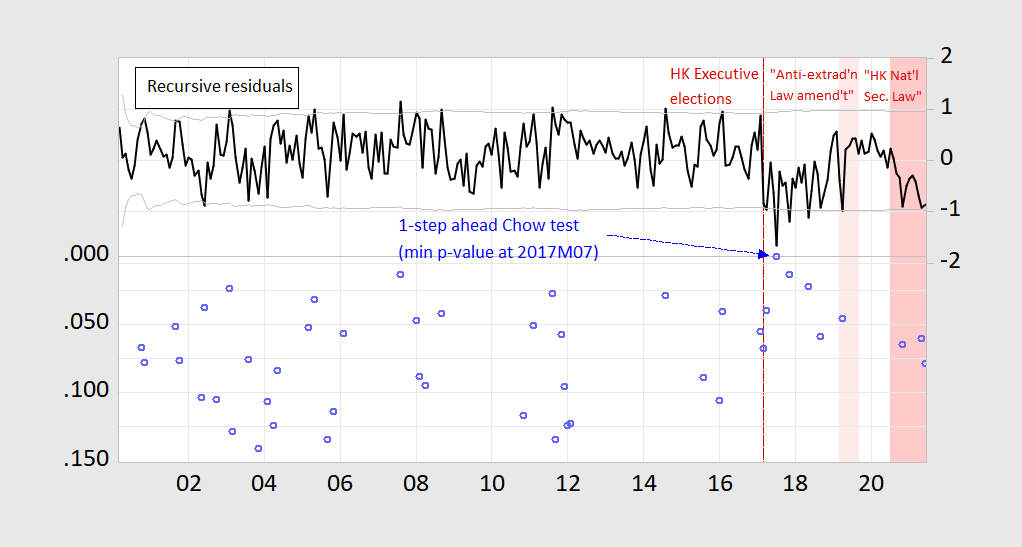

To this end, I estimate a regression of log HK EPU on log China EPU, and check for structural breaks usingone-step-ahead Chow tests on recursive residuals. This approach uses the regression up to period YYYY.MM, then examines whether the forecast error for YYYY.MM+1 is likely to have occurred by random chance or not (loosely speaking). The results show a structural break at 2017M07 (at significance level of 0.0135). This is slightly after the HK Executive election which took place in 2017M03.

Figure 3: Recursive residuals (black), and marginal probabilities for one-step-ahead Chow tests (blue circles). Residuals from linear regression of log HK EPU on log China EPU. Source: Author’s calculations.

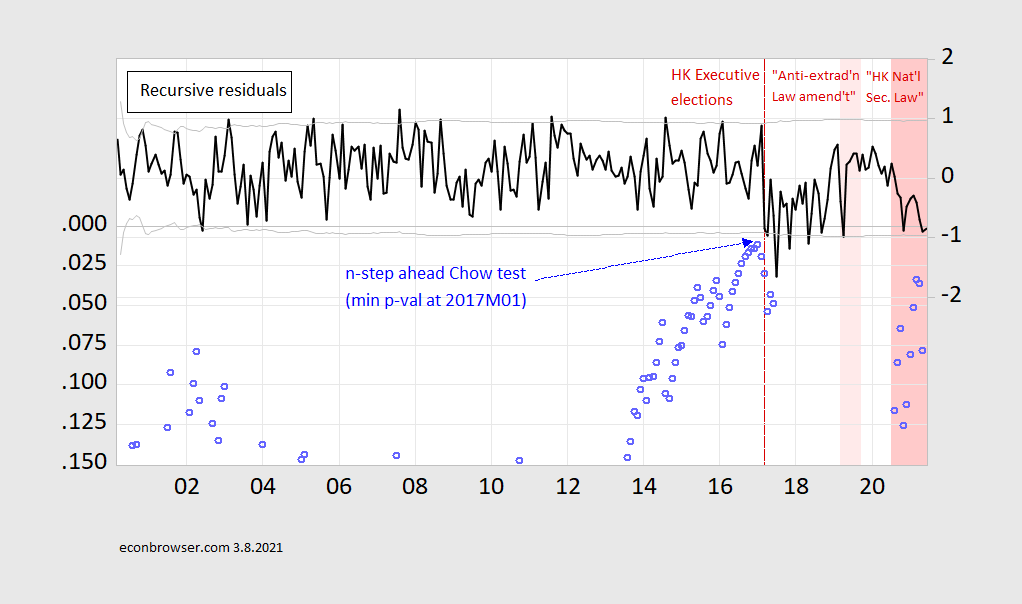

Alternatively, one can look at n-step ahead Chow test, to see where the likely structural break is. This is the case where a series of Chow tests are done for all the possible break points in the sample.

Figure 4: Recursive residuals (black), and marginal probabilities for n-step Chow tests (blue circles). Residuals from linear regression of log HK EPU on log China EPU. Source: Author’s calculations.

These results show a structural break at 2017M01 (at significance level of 0.0116). This is slightly before the HK Executive election which took place in 2017M03.

The data are consistent with a break in the correlation between Chinese and Hong Kong series, with that break occurring around the HK Executive elections or at the time of the implementation of the “HK National Security Law”. One can also see that — using correlations between the Chinese and HK uncertainty indices — the reported HK EPU has been particularly low in the last couple months (although only significantly so at less than the 5% significance level.

Obviously, all the preceding is informal analysis. An alternative approach would be to link HK EPU to some macro and/or financial variables, and test to see for structural breaks in those relationships.

Disclosure: None.