India’s “Trump” Card: Tax Cuts

The International Monetary Fund (IMF) has been predicting India to grow solidly above 7% for the foreseeable future. Despite some recent transient weakness, we think India is very well positioned to continue its impressive growth.

Several recent measures to boost the economy point to a political willingness to support India’s growth. After an unprecedented rate cut, India’s government, in a big boost to “India Inc.,” just announced corporate tax cuts of 8% to 15%.1 My analysis below breaks down what this tax cut means for different sectors and how investorsmight benefit.

Scale of Tax Cuts and the Reasoning Behind Them

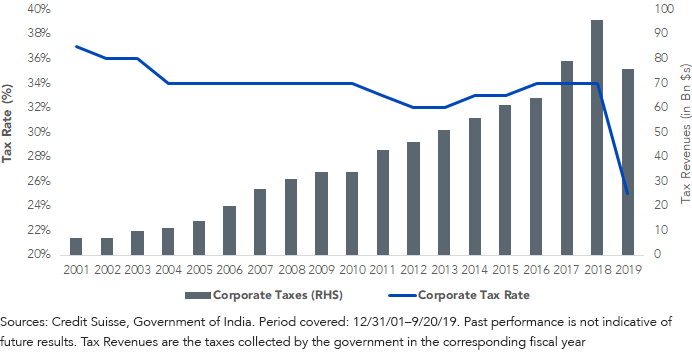

On September 20, the finance minister of India announced an unprecedented cut in corporate taxes, bringing them down from 35% to 25% in most cases and from 30% to 22% in some cases.1 With an approximate total tax revenue of around $100 billion, that’s a drop in government revenue of about $20.5 billion.

Corporate Taxes

Reason 1: Domestic Growth

This step reflects policy making in India that responds fast to changing domestic and international environments. Back-to-back reforms that were focused on streamlining taxes caused stress for manufacturers and distributors, and weakening credit growth has affected consumer spending. This has been reflected in weakening sales of automobiles and consumer goods. Thus, it was necessary for government to provide a fiscal boost in addition to the monetary boost provided by the Reserve Bank of India (RBI) in August.

Reason 2: Trade Competitiveness

Beyond domestic reasons, the tax cut? was made to help incentivize global manufacturing companies to hedge against the effects of the volatile U.S.-China trade dispute. Early this year, Apple2 announced that it was shifting some of its manufacturing from China to India, and other companies are also shopping around.

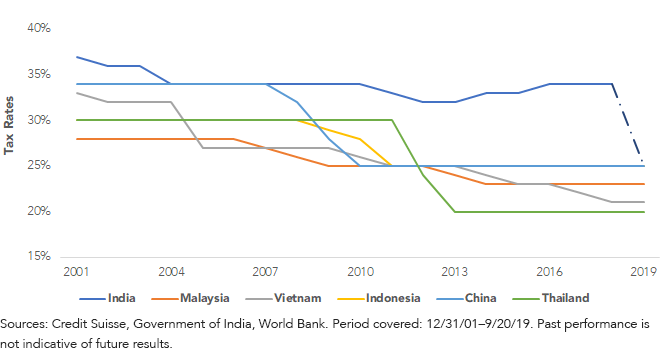

The figure below shows that over the last two decades India has had higher tax rates when compared with China, Malaysia, Vietnam, Thailand and other potential manufacturing hubs in Asia. This put India at a relative disadvantage for companies that were considering moving out of China because of the recent U.S.-China trade war. Thus, current cuts by India are much welcome and, in my opinion, aimed at giving companies an incentive to move to India.

Corporate Tax Rates

(Asian Manufacturing Countries)

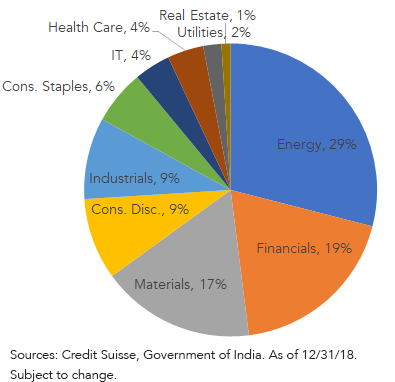

What Sectors Might Benefit Most?

Breaking down India’s tax collection by sector, the Energy and Financials sectors are among the larger tax-paying sectors, and therefore companies in those sectors stand to benefit the most.

This is a shot in the arm for public sector banks that have been reeling from nonperforming assets. This may also help the Energy sector, leading to potentially higher industrial utilization and increased investment activity. Extra cash can help corporate companies deleverage and improve their profitability, margins and return on assets (ROA).

Tax Collection Per Sector

(% of Total Taxes)

Tapping into India’s Growth

The WisdomTree India Earnings Fund (EPI) screens for profitable companies and then weights by net earnings. This market cap-agnostic weighting methodology leads to a diversified exposure across large-, mid- and small-cap companies with relatively inexpensive valuations. Relative to the MSCI India Index, this leads to the following:

- Roughly 25% over-weight in mid- and small-cap (but profitable) companies. These firms tend to have a stronger connection to local economy and reflect India’s growth more closely than large caps.

- An approximate price-to-earnings (P/E) ratio of 13.6, compared with about 19.6 for the MSCI India Index; thus, a discount of >30% for the same market.

- About 4% over-weight in the Energy sector, which is the biggest beneficiary of the current fiscal boost.

For standardized performance of EPI, please click here.

Recently, we also launched the WisdomTree India ex-State-Owned Enterprises Fund (IXSE), a continuation of our very successful ex-state-owned product family. This methodology screens and selects only companies with less than 20% ownership by the government. Relative to MSCI India Index, this leads to the following:

- Lean and efficiently run companies led by managers whose objectives are streamlined with those of shareholders.

- No exposure to state-owned banks, financials, etc., which are often unprofitable.

- Basket with overall improved profitability (>30% improvement in ROA).

- Better corporate governance, thus focusing on the G in ESG.

We believe that in this challenging investment landscape filled with geopolitical tensions, India could be an oasis of growth. It went through its election cycle, with the government led by Prime Minister Narendra Modi coming back to power for another five years in May 2019. This removed much of the political instability, which combined with the resolve that the Modi government showed in listening to industry in its first term indicates a period of decisive policy making ahead. The current fiscal boost is another shot in a series of measures fired by policy makers in India to help ensure its solid growth.

We believe reforms and growth are going to be the story ahead. Trumping most other markets, India is well positioned to outshine.

1Companies in different sectors fall in different tax brackets in India. The tax structure of a firm in the Financials sector is very different from a firm in the Technology sector. With the new cuts depending on which sector a firm falls in and what existing cess (levy) /rebates were already applied to the firm, tax rates can fall from 35% to 25% or from 30% to 22%.

2Neither IXSE or EPI hold Apple.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more