IBEX 35, DAX 30 Forecasts: Bears Take Control As COVID-19 Fights Back

Key Talking Points:

- Brexit and COVID-19 remain at the forefront of market concerns

- IAG falls more than 11% and drags the IBEX 35 lower

- DAX 30 reverses last week’s gains and corrects overbought conditions

Risk-off To Start The Week As COVID-19 Fights Back

A new strain of COVID-19 detected in the UK has forced many countries to stop flights to and from the country, meaning airlines are taking a big hit this morning. Brexit is also on everyone’s minds, as we see increased calls for talks to be postponed past the Dec 31st deadline given the health crisis unfolding, which will only drag on uncertainty for longer.

As many parts in the UK are placed into tier 4 restrictions, many countries in mainland Europe are also struggling to keep a lid on the spread of COVID-19, with Germany reporting its highest number of daily deaths last week. This has increased concern and caution amongst investors, and given that equity markets were already pushing the overbought limit, it is not surprising that stock indices are taking a hit this morning.

IBEX 35 Slides As Airline Stocks Take A Hit

At the head of this risk-off move is the Spanish stock index, as the IBEX 35 is down 2.95% at the time of writing. We must remember that the tourism industry, which is taking a bit hit on the back of worsening COVID-19 conditions, is a big part of the index. The biggest losers of the day so far are IAG, the airline conglomerate that owns Iberia and British Airways (IAG), which is down 11.25%, followed by Melia Hotels International SA (SMIZF), down 6.5% so far.

From a technical standpoint, the IBEX has given in a big part of last month’s merits by falling below the 8,000 mark, a highly important psychological area that had halted any attempt at a bullish run throughout the summer. The current price is hovering just above the 50-day simple moving average, so we may expect to see further losses throughout the day, as the next support area is likely to be around the 7,640 horizontal line.

Fibonacci levels continue to be of key importance to measure the progress of the recovery from coronavirus lows, so further pullbacks towards the 38.2% % Fibonacci (7,442) may take place before we see bullish momentum take over again. On the upside, the 8,000 is likely to have turned back into key resistance, followed by the 20-day moving average at 8,155.

IBEX 35 Daily chart

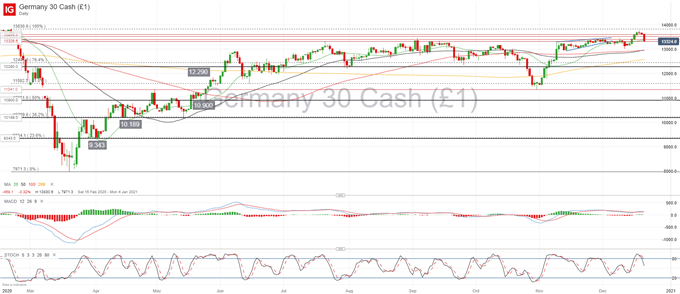

DAX 30 Technical Outlook

Following the IBEX 35 closely are German equities, as the DAX 30 is down around 2.3% so far today. Last week I mentioned that the DAX was in a risky position as it had become massively overbought, and the index was ignoring the grim picture at home where coronavirus infections are getting out of hand.

Today’s reversal is getting the index closer to its true value, but I suspect we still have further corrections to come before we can consider the DAX 30 t be fairly valued. For now, the index seems to have found short-term support at the 13,315 area, although the true test of support for me will be at the 13,000 mark. A fall below this area is likely to bring further corrective pressure, possibly testing the 12,290 area, whilst firm support could see the index bounce back into the new year.

DAX 30 Daily Chart

Disclosure: See the full disclosure for DailyFX here.