Hungarian Labour Market Metrics Improve Even More

Even though the March unemployment rate decreased in Hungary despite the new lockdown measures, we believe we're going to see a negative impact from the labour market on GDP growth in 1Q21.

The February labour market data for Hungary caused an upside surprise. Despite our expectation of a deterioration in March on the back of new lockdown measures, almost all labour market metrics improved.

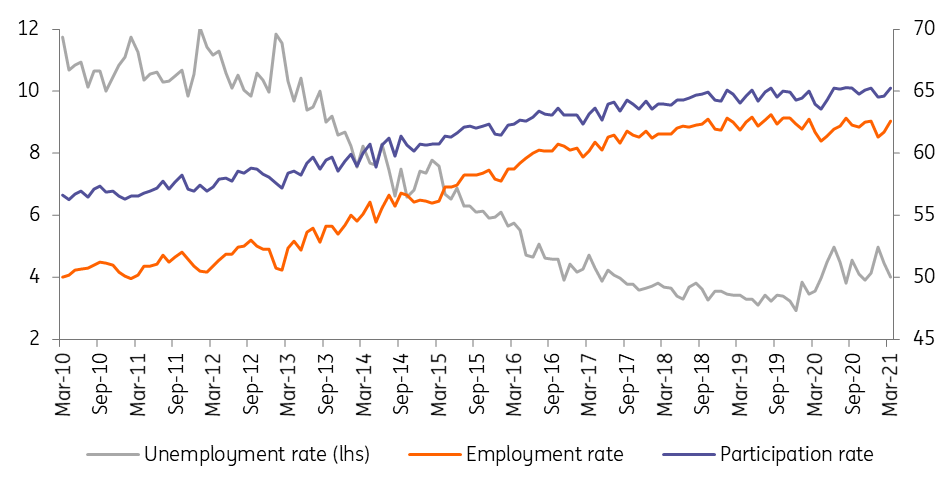

The unemployment rate came in at 4% in March, 0.4 percentage points lower than a month ago, but still 0.5ppt higher than in March 2020. During the first quarter of 2021, the official unemployment rate was 4.5% on average, increasing compared to 4Q20.

The latest lockdowns haven’t shown up (fully) in the unemployment numbers, but there is usually a two-month lag in the data. Our hunch is strengthened by the fact that based on the National Employment Service data; the number of registered jobseekers increased by 0.5% MoM to 304,000.

Labour market trends (%)

Source: HCSO, ING

The government has started to gradually reopen the economy in April, translating into a further improvement in employment statistics, covering the impact of the third wave lockdowns. However, new lay-offs will not necessarily appear in the official unemployment statistics, neither do the increased workload.

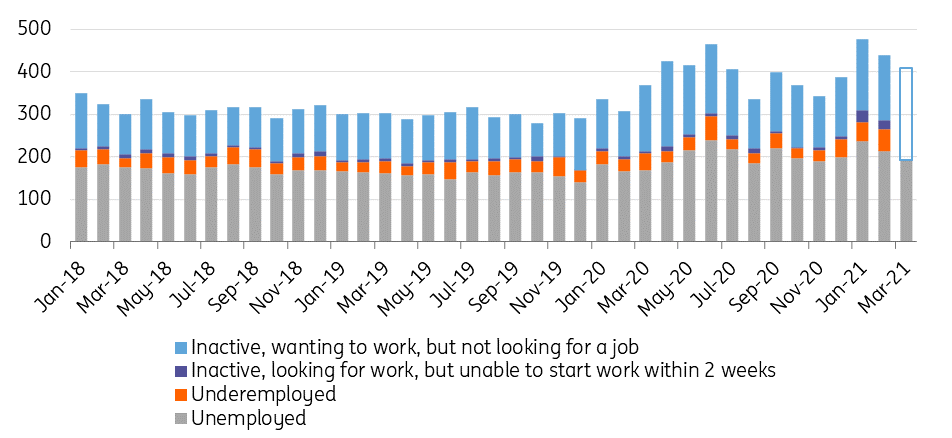

The reason is simple: the majority of workers in the services sector were underemployed. This means that this type of labour force was already counted in the employment statistics. Moreover, there could be many workers who were inactive wanting to work but unable to start work within two weeks.

People in these categories are seen as inactive, and if they join the labour force, it will increase the number of employed people but won’t improve the unemployment statistics.

Potential labour reserves within the 15-74 age group ('000)

Source: HCSO, ING

March 2021 data is ING estimation, as the HCSO hasn't disclosed the detailed data.

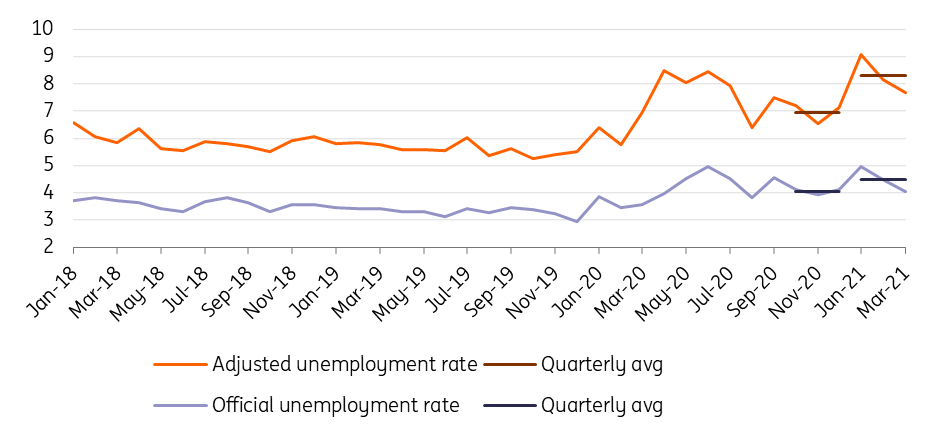

In addition to the unemployed, the underemployed and the inactive labour force are also counted as the potential labour reserve. Due to statistical methodology issues, the potential labour reserve could better explain the labour market situation. Based on this calculation, the adjusted unemployment rate could be around 7.7%.

This ratio is coming from the number of the unemployed plus inactive labour force who want work or unable to start immediately compared to the number of labour market participants. In March, the adjusted unemployment rate was still 0.75ppt higher than a year ago and 2.4ppt higher than the all-time low reading recorded in late 2019.

The official and adjusted unemployment rates (%)

Source: HCSO, ING

The number of employed increased by 65.8k MoM, while the number of unemployed reduced by 19.4k. This means the Hungarian labour market gained roughly 46k participants, in just one month, again depicting the flaws of the official unemployment statistics.

Regarding the big picture, despite the upside surprises in February and March, we still believe that labour market developments will impact consumption and GDP growth in a negative manner in the first quarter.

The reason is simple: the official unemployment rate stagnated in 1Q21 compared to the last quarter of 2020, while the adjusted unemployment rate increased. The number of employed decreased on a quarterly basis and wage growth also slowed down.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more