How To Protect Your Portfolio From A Weak Euro

The Euro has had a tremendous comeback from the dark days of 2012. Back then fears of Greece leaving the European Union were recurring catalyst for downward moves in the Euro's value. Since then, debt levels and secession from the Union are no longer major concerns. These days, the greatest factor affecting the Euro exchange rate is the European central bank.

The old Wall Street adage "don't fight the fed" is relevant to other central banks. When a central bank wants something, it usually happens. Right now, the European Central Bank has voiced its concerns over the low-deflation levels in Europe.

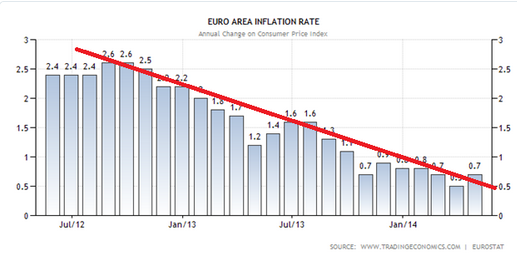

As you can see from the graph above, from tradingeconomics.com, Euro area inflation has been consistently decreasing. Fears of deflation have caused the ECB to begin discussing quantitative easing measures. In a nutshell, if the central bank wants more inflation, they will print money. When a central bank prints money, everything else held constant, that country's currency will depreciate.

Since the easing plans were announced by the ECB, the Euro has depreciated significantly relative to the U.S. Dollar. Until the Euro-zone's inflation levels start picking up, we should see more easing and hence more weakness in the Euro relative to the dollar. Now, if the Federal Reserve was also easing, the two monetary policies of the central banks may cancel each other out. However, the Federal Reserve's Chairman, Janet Yellen has made it clear that the Fed will continue shrinking its easing activity.

Bottom line, the ECB wants a weak Euro and the Federal Reserve wants a strong Dollar. Don't fight the fed!

How a depreciating Euro may affect your portfolio

If you own stocks of companies who do business in Europe, your portfolio has some exposure to the Euro: the companies you own likely receive Euros as payment for products or services in Europe and converts the Euros back to its domestic currency. A depreciating Euro will negatively affect the value of the company's converted currencyhttp://www.investopedia.com/articles/basics/12/portfolio-currency-exposure.asp. In a nutshell, a depreciating Euro could mean lowered profits for the Euro-exposed companies you own shares of.

What you can do to protect your investments from a depreciating Euro

To offset the negative affects of a depreciating Euro on your portfolio, an investor has many choices. You can directly short-sell the Euro/U.S. Dollar pair, enter a forward contract to purchase Euros by selling U.S. Dollars at a future date, purchase a currency put option -- the list goes on. However, these types of dealings can be complicated, and most require special brokerage accounts. If you're not a seasoned financial professional, you may prefer the simpler route: exchange traded fund investing. Two great ETF's you can use to protect your portfolio from a weakening Euro are the ProShares UltraShort Euro (NYSEMKT: EUO) or Guggenheim CurrencyShares Euro Trust (NYSE: FXE).

Description of EUO:

This fund reacts to fluctuations in the Euro by inversely increasing or decreasing twice as much as the Euro relative to the U.S. Dollar. For example, if the Euro depreciates by 1% against the Dollar over the course of one week, EUO will increase by 2% in that same week. If the reverse happens and the Euro appreciates against the U.S. Dollar by 1% over the course of a week, EUO will decrease in value by 2% in that same week.

Description of FXE:

This is a grantor trust. Meaning the trust issues shares in exchange for deposits of Euros. The investment objective of the fund is to mimic the price of the Euro plus accrued interest. Since the interest rates of the Euro and U.S. Dollar currently identical at .25%, the fund moves in lockstep with the Euro.

How to use these funds:

If you believe the Euro will depreciate against the U.S. dollar and you own stocks with Euro-exposure or you're simply trying to make a profit from the currency movement, purchasing some shares of EUO or short-selling shares of FXE may help you offset the negative effects of a depreciating Euro, and/or serve as a way to create capital gains for your account.

Of course, like any investment, there are risks: if you purchase shares of EUO or short-sell shares of FXE and the Euro appreciates relative to the Dollar, this will create capital losses on your account. Also, currency speculation is one of the most difficult investment endeavors. Unlike the U.S. stock market which has trended upward over the long-run, the currency markets have had no definite pattern to follow. So, unless you are very confident that the Euro will depreciate against the Dollar, this fund may not be right for you.

Beat the S&P 500 recommends shorting the Euro