How The Emerging Markets Troubles Are Transmitted Around The World

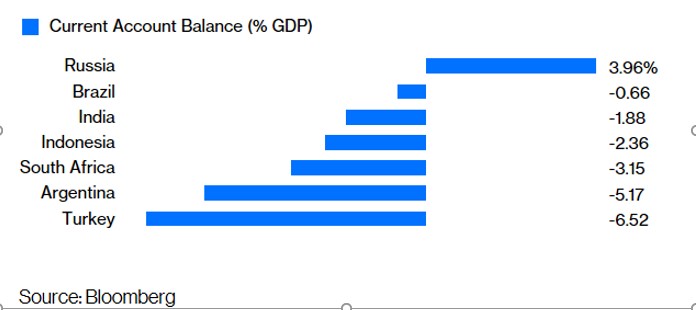

The IMF’s Managing Director, Christine Lagarde stated that “some emerging economies find themselves in precarious situations”, citing current account imbalances and a rising US dollar as the principal causes[1]. The trade imbalances are growing in significance, ranging from just under 2% of GDP ( India) to 6.5% (Turkey). Moreover, the intensifying trade war between China and the United States threatens to have a negative impact on China’s growth which, in turn, will be felt throughout other Asian economies, given the extensive supply chains that exist throughout the region.

Figure 1 Emerging Markets Trade Deficits

But when economists speak of “contagion” they are more focussed on the capital flows involving the highly integrated financial links between the emerging markets and the developed economies. Trade adjustments are relatively slow compared to the speed with which financial capital can move across borders. It is estimated that since 2009, foreign capital flows into emerging market financial assets--- debt and equity--- have averaged around $1 trillion annually. It is widely agreed that the main source of these inflows has been accommodative monetary policy of developed-world central banks and the attraction of higher returns. It is further estimated that cross-border lending constitutes around half of the exposure of the U.K., European, Japanese and Chinese banks.

At the time when emerging markets are most in need of foreign capital, creditors curtail lending to both emerging markets and advanced economies as they seek to rebuild capital and realign risk. In other words, risk, regardless of its regional location, is curtailed ---- such is the nature of contagion. As concern worsens, creditors force investors to liquidate and repay debt, depressing asset prices and weakening emerging market currencies----both resulting in further contagion.

The risk-off nature in the emerging markets is clearly evident when one compares the behavior of their equity markets ( Figure 2). Since May these equity markets have been on a steady downward trajectory, as investors exit in response to the currency devaluations and poor returns. Asian equity markets are down for the last 10 consecutive days, marking the longest selloff in 15 years.

Figure 2 Emerging Market Equity Index

So far, the realignment of risk has been very orderly in the emerging markets and has not spilled over into the financial markets in the advanced countries. However, international trade is threatened by US protectionism, especially with respect to China; the Federal Reserve is determined to raise short-term rates and to withdraw liquidity as it tapers its balance sheet.; and, the US dollar remains very strong. Investors will be high alert for any signs, should trade and financial conditions worsen in the emerging markets.

[1] Trade And Capital Flows In The Emerging Markets Spell Trouble

Investors In Emerging Markets Worry As The Contagion Spreads

The issue is it's good to look at emerging markets because they are the first to respond to global downturns. Thus, I think it's hard to determine how much emerging market problems affect the rest of the world because the rest of the world usually is a big factor for the emerging market meltdowns in the first place.