How Long Can The Bank Of Canada Resist A Rate Cut?

When the Bank of Canada governing council meets next week, it will be greeted with a very uneven economic report, one in which the past may not necessarily be prologue. The GDP results for the second quarter is really a look through a rear-view mirror. The results are sufficiently cloudy to give policymakers concern regarding the outlook over the next twelve months. Setting monetary policy in the current environment is unenviable task.

(Click on image to enlarge)

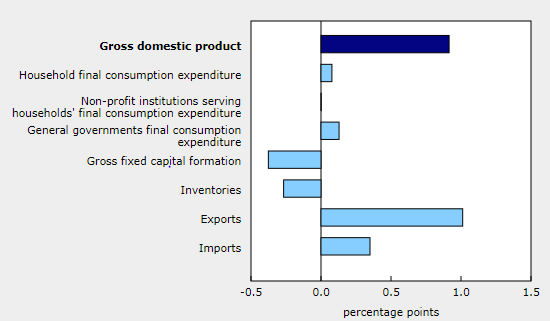

Figure 1 Contribution to GDP by Sector, 2019 Q2

To begin with, the overall the economy expanded at an annual rate of 3.7% for the last quarter, an impressive result on the top line. Drilling down into the individual major segments reveals several underlying results that cast doubt on whether the Canadian economy can continue to grow without a change in monetary policy. Consider these results from the second quarter:

- Consumer spending barely recorded any growth, as household spending slowed to just 0.1% and durable goods purchases actually fell by 0.3%; final demand, which excludes inventory changes and exports, declined by 0.2% in the last quarter; given the current levels of household debt, we should not count on the consumer to drive the economy forward;

- The biggest disappointment was in the business sector, as business capital formation declined by 1.6%, detracting heavily from overall economic expansion; the Bank of Canada has stated that its surveys indicated that the private sector would grow and be one of the drivers of economic expansion ; also, business investment in non-residential buildings and in engineering structures continues their more than year-long decline;

- Inflation was very tame; a more reliable measure of inflation is the GDP implicit price index which increased by merely 1.1% annually, a reflection of the underlying weakness in the economy; and, finally

- Exports stand out as the biggest contributor to the GDP; export volumes were broadly-based throughout the energy, non-metallic and agricultural sectors; however, these results were recorded prior to the greatly deteriorating international trading environment that occurred this summer; exporters continue to be nervous as the US takes on China and the EU as part of global trade war, in which no nation will go untouched.

The Bank of Canada currently maintains a neutral position, arguing that there the risks to the economy are roughly evenly balanced. This quarterly result will probably keep that neutral position alive for a little longer, as it represents, at best, a mixed bag. The big question is: how long can the Bank resist the forces that are causing some central bankers to adopt rate cuts? The longer the Bank’s wait, the more urgent will be the need to cut.