How Are Those China Crash Predictions Working Out For You?

Back in 2010, I did a blog post expressing skepticism about theories that China was in a bubble. I quoted this statement:

Faber joins hedge fund manager Jim Chanos and Harvard University’s Kenneth Rogoff in warning of a crash in China.

China is “on a treadmill to hell” because it’s hooked on property development for driving growth, Chanos said in an interview last month. As much as 60 percent of the country’s gross domestic product relies on construction, he said. Rogoff said in February a debt-fueled bubble in China may trigger a regional recession within a decade.

So how does that prediction look 11 years later? The Economist has a new article on China property. In the print edition, it is titled:

The Great Escape

Long seen as a bubble, China’s housing market now looks stable. Can that hold?

The online addition has a scarier sounding title:

Can China’s long property boom hold?The country is building five times as many houses as America and Europe combined

(I prefer their print editor.)

Both editions point to past predictions that have not panned out:

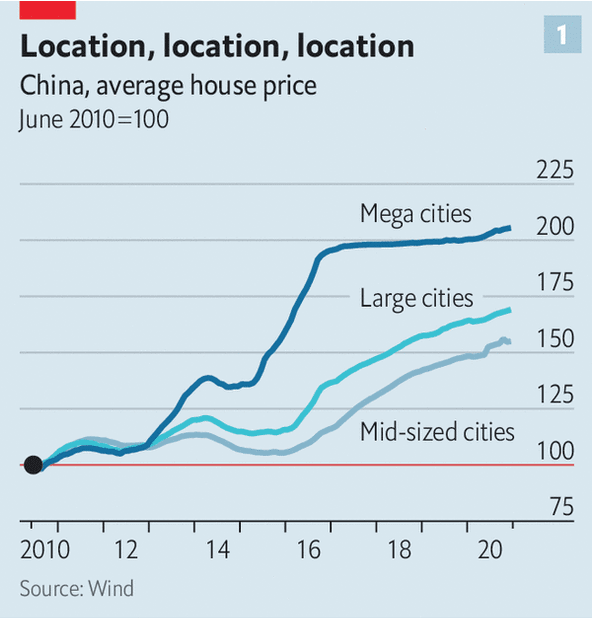

As far back as 2009 Jim Chanos, a hedge-fund manager, said China was “Dubai on steroids”, predicting that its property sector would implode spectacularly. Since then prices have doubled, and enough homes have been built for 250m people. The longevity of the boom suggests that the market is more complex than its depictions as a bubble suggest.

And they provide this useful this graph:

Are you people getting tired of me pointing out, over and over again, how bubble theories are useless? How past bubble predictions for everything from China to Bitcoin to NASDAQ to US real estate are not helpful to investors?

Then stop talking about bubbles.

The beatings will continue until the bubble talk stops.

PS. In a 2016 post I made the following prediction:

If I’d had to guess, I’d estimate that China will have one Korea-1998 type disaster in the next 30 years, but I have no idea when. It will be impossible to predict. That’s because if it could be predicted three years ahead, then the date of the crash would immediately move up by three years!

So don’t hold your breath for a China crash. It will probably happen at some point, but no one will be able to predict it. Nonetheless, you can be sure that Jim Chanos and other China bears will take credit for predicting it, even though they were wrong many times before being right.

P.S. In a 30 year window, I think the second most likely number of 1998-type disasters for China is zero. Two is third most likely.

PPS. In the same issue of The Economist, I saw this claim:

If low real rates are the main prop for share prices, then any attempt to time the stockmarket is in essence a bet on the bond market—and, in turn, on how inflation evolves, and how central banks react to it. Good luck with getting those calls right.

OK, I’ll take the dare. I’ll predict 2% inflation during the 2020s. Wish me luck. If I’m right I’ll remind you all in 2030.

(If I’m still alive. I’m more confident about inflation averaging 1.6% to 2.4% during the 2020s than I am about living to 75.)